Region:Middle East

Author(s):Rebecca

Product Code:KRAD4317

Pages:92

Published On:December 2025

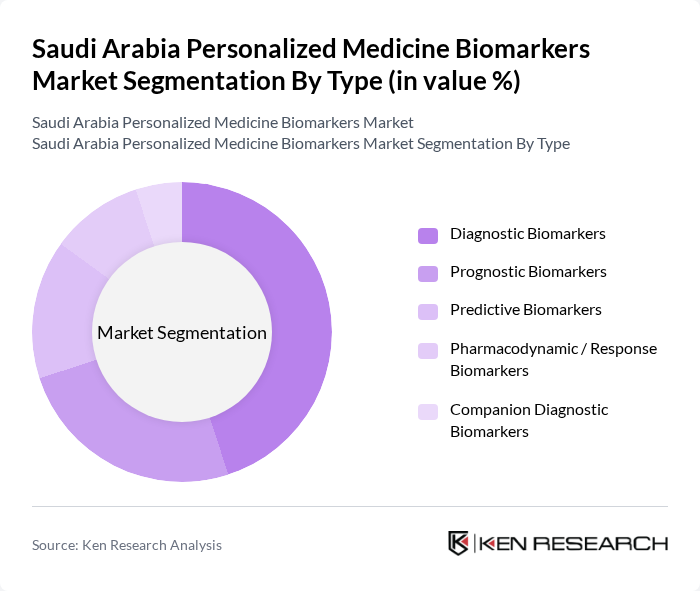

By Type:The market is segmented into various types of biomarkers, including diagnostic, prognostic, predictive, pharmacodynamic, and companion diagnostic biomarkers. Among these, diagnostic biomarkers are currently leading the market due to their critical role in early disease detection and management. The increasing focus on precision medicine and the growing prevalence of diseases such as cancer and diabetes are driving the demand for these biomarkers. Prognostic biomarkers are also gaining traction as they provide insights into disease progression and treatment response, further enhancing personalized treatment strategies.

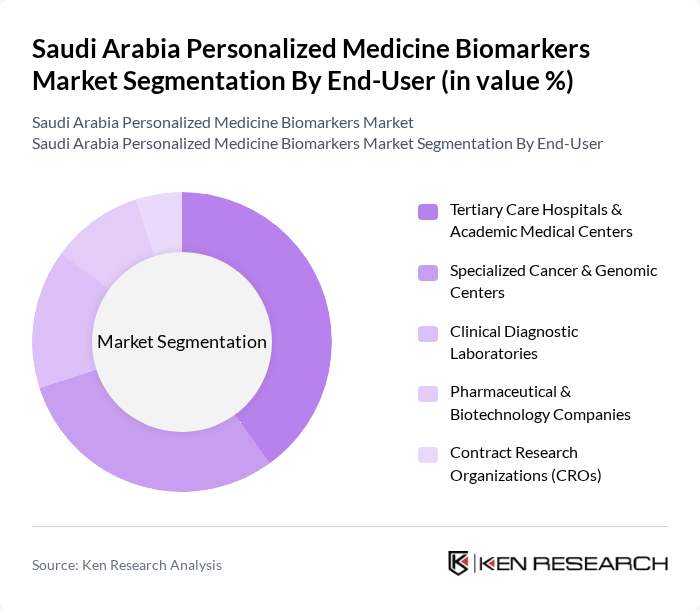

By End-User:The end-user segmentation includes tertiary care hospitals, specialized cancer and genomic centers, clinical diagnostic laboratories, pharmaceutical and biotechnology companies, and contract research organizations (CROs). Tertiary care hospitals and academic medical centers are the dominant end-users, as they are equipped with advanced diagnostic technologies and have a high patient volume. The increasing collaboration between hospitals and biotech firms for research and development is also contributing to the growth of this segment. Specialized cancer and genomic centers are emerging as significant players due to the rising incidence of cancer and the need for targeted therapies.

The Saudi Arabia Personalized Medicine Biomarkers Market is characterized by a dynamic mix of regional and international players. Leading participants such as King Faisal Specialist Hospital & Research Centre (KFSH&RC), King Abdulaziz Medical City – Ministry of National Guard Health Affairs, King Fahad Medical City (KFMC), Saudi German Health (Saudi German Hospital Group), Dr. Sulaiman Al Habib Medical Group, King Saud University Medical City / College of Medicine – Genomics & Precision Medicine Programs, Saudi Food and Drug Authority (SFDA) – Center for Medical Devices & In Vitro Diagnostics, National Unified Procurement Company for Medical Supplies (NUPCO), National Guard Health Affairs Genomics & Biomarker Laboratories, Ministry of Health – National Genomics and Precision Medicine Initiatives, Al Borg Diagnostics, Al-Mokhtabar / Specialized Molecular & Genetics Laboratories in KSA, Regional Operations of Thermo Fisher Scientific Inc. in Saudi Arabia, Regional Operations of Roche Diagnostics Middle East in Saudi Arabia, Regional Operations of Illumina Inc. / Authorized Distributors in Saudi Arabia contribute to innovation, geographic expansion, and service delivery in this space.

The future of the personalized medicine biomarkers market in Saudi Arabia appears promising, driven by technological advancements and increasing healthcare investments. As genomic technologies continue to evolve, the integration of artificial intelligence in biomarker discovery is expected to enhance diagnostic accuracy. Furthermore, the growing emphasis on preventive healthcare will likely lead to more personalized treatment plans, improving patient outcomes. These trends indicate a robust market trajectory, fostering innovation and collaboration within the healthcare ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Diagnostic Biomarkers Prognostic Biomarkers Predictive Biomarkers Pharmacodynamic / Response Biomarkers Companion Diagnostic Biomarkers |

| By End-User | Tertiary Care Hospitals & Academic Medical Centers Specialized Cancer & Genomic Centers Clinical Diagnostic Laboratories Pharmaceutical & Biotechnology Companies Contract Research Organizations (CROs) |

| By Application | Oncology (Solid Tumors & Hematological Malignancies) Cardiovascular & Metabolic Diseases Neurological & Psychiatric Disorders Infectious & Rare Genetic Diseases Early Detection / Screening & Risk Stratification |

| By Technology | Next-Generation Sequencing (NGS) & Whole-Genome / Exome Sequencing PCR & qPCR-based Assays Immunoassays & Multiplex Protein Arrays Mass Spectrometry & Metabolomics Platforms Liquid Biopsy & Circulating Biomarker Platforms |

| By Biomarker Type | Circulating Tumor DNA (ctDNA) & Circulating Tumor Cells (CTCs) Genomic & Transcriptomic Biomarkers (DNA / RNA) Protein & Immunologic Biomarkers Metabolite & Microbiome Biomarkers Digital & Imaging-derived Biomarkers |

| By Region | Central Region (including Riyadh) Western Region (including Jeddah, Makkah, Madinah) Eastern Region (including Dammam, Al Khobar) Southern & Northern Regions |

| By Investment Source | Government & Public Sector Funding Private Hospitals & Healthcare Groups Local & International Pharmaceutical / Biotech Investments Venture Capital & Innovation Funds Academic–Industry & International Research Collaborations |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncology Biomarkers | 100 | Oncologists, Pathologists |

| Genetic Testing Services | 90 | Genetic Counselors, Laboratory Directors |

| Pharmaceutical Applications | 80 | Pharmaceutical Researchers, Clinical Trial Managers |

| Patient Awareness Programs | 70 | Healthcare Educators, Patient Advocacy Leaders |

| Regulatory Framework Insights | 60 | Regulatory Affairs Specialists, Policy Makers |

The Saudi Arabia Personalized Medicine Biomarkers Market is valued at approximately USD 4.6 billion, driven by advancements in genomic technologies, the rising prevalence of chronic diseases, and an increasing demand for personalized healthcare solutions.