Region:Middle East

Author(s):Rebecca

Product Code:KRAD6221

Pages:81

Published On:December 2025

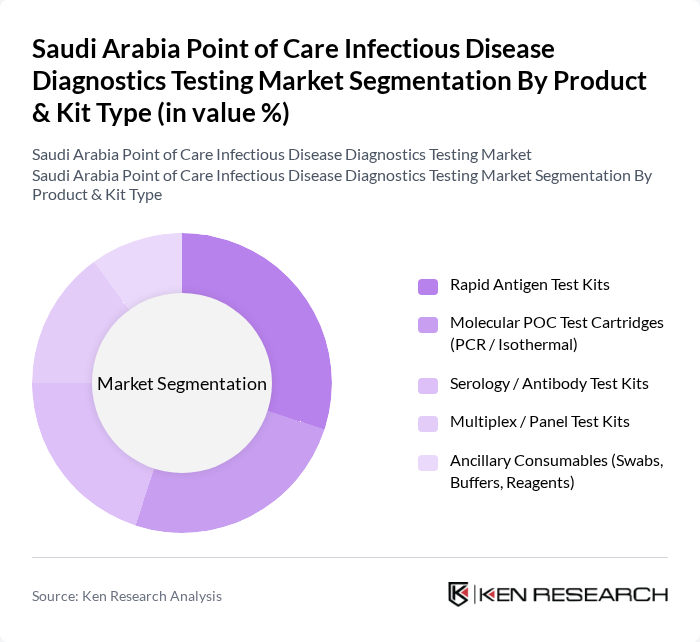

By Product & Kit Type:The product and kit type segmentation includes various diagnostic tools essential for point-of-care testing. The subsegments are as follows:

The Rapid Antigen Test Kits segment is currently dominating the market due to their ease of use, quick results, and cost-effectiveness, making them highly preferred in both clinical and near?patient community settings such as pharmacies and screening camps. The COVID?19 pandemic significantly boosted the demand for these kits, leading to widespread adoption for respiratory infection screening and occupational health programs. Additionally, the growing awareness of infectious diseases, expansion of respiratory, influenza, and flu?like illness testing, and the need for rapid diagnosis in emergency and primary care situations have further solidified their market position. As a result, this segment is expected to maintain its leadership in the coming years, while molecular POC cartridges and multiplex panels gain share in high?acuity and complex infection settings.

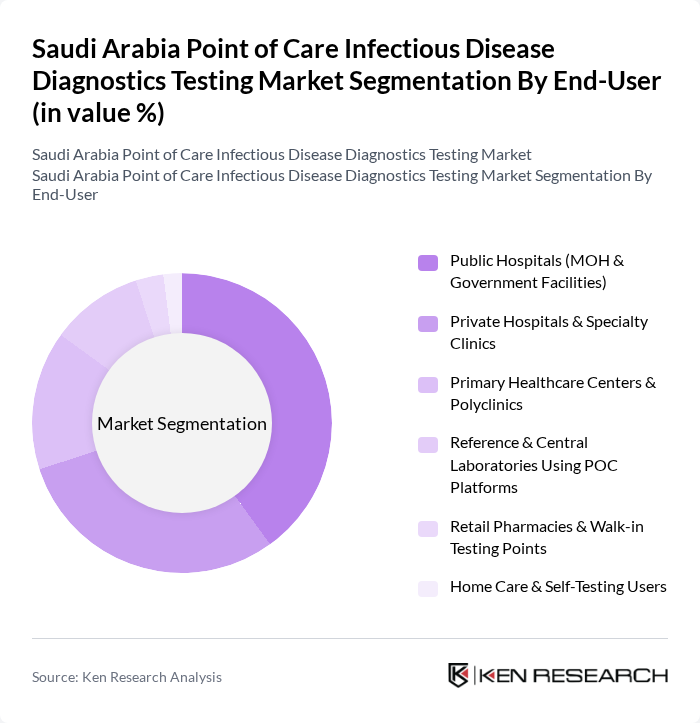

By End-User:The end-user segmentation highlights the various healthcare settings utilizing point-of-care testing. The subsegments are as follows:

Public Hospitals, particularly those under the Ministry of Health, are the leading end-users of point-of-care testing solutions, reflecting their role as high?volume hubs for emergency and inpatient care. This dominance is attributed to the high patient volume, growing burden of respiratory and other infectious diseases, and the urgent need for rapid diagnostic capabilities to support antimicrobial stewardship and isolation decisions. The integration of point-of-care testing into routine clinical workflows has been accelerated by Vision 2030 healthcare transformation initiatives, which promote decentralization of diagnostics, digital connectivity of devices, and improved access in emergency, critical care, and primary healthcare settings. Additionally, the increasing focus on patient-centered care, expansion of virtual care and telehealth programs, and the need for timely diagnosis in remote and out?of?hospital environments further enhance the role of public hospitals while driving uptake in pharmacies, primary care centers, and home/self?testing channels.

The Saudi Arabia Point of Care Infectious Disease Diagnostics Testing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abbott Laboratories (Abbott Rapid Diagnostics, i?STAT), Roche Diagnostics (cobas Liat, Accu?Chek), Siemens Healthineers (epoc, RAPIDPoint), Becton, Dickinson and Company (BD Veritor, BD MAX POC), QuidelOrtho Corporation (QuickVue, Sofia), Cepheid (GeneXpert & Xpert Xpress Assays), bioMérieux (BIOFIRE FilmArray, VIKIA, VIDAS POC), Thermo Fisher Scientific (POC Molecular & Rapid Test Portfolio), Danaher Corporation – Beckman Coulter / Cepheid Group, Nova Biomedical (Nova StatStrip & POC Analyzers), SD Biosensor, Inc. (STANDARD Q & STANDARD F Rapid Tests), Bio-Rad Laboratories (POC Infectious Disease Controls & Kits), Trivitron Healthcare (POC Infectious Disease & Rapid Test Kits), Mylab Discovery Solutions Pvt. Ltd., DnaNudge Ltd., Al Borg Diagnostics (Regional Reference Lab & POC Deployment Partner), National Unified Procurement Company (NUPCO) – Centralized Procurement Body contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia point of care infectious disease diagnostics testing market appears promising, driven by technological advancements and increasing healthcare investments. The integration of artificial intelligence in diagnostic processes is expected to enhance accuracy and efficiency. Additionally, the expansion of telemedicine and remote diagnostics will likely facilitate greater access to testing, particularly in underserved areas, thereby improving overall healthcare delivery and patient outcomes in the region.

| Segment | Sub-Segments |

|---|---|

| By Product & Kit Type | Rapid Antigen Test Kits Molecular POC Test Cartridges (PCR / Isothermal) Serology / Antibody Test Kits Multiplex / Panel Test Kits Ancillary Consumables (Swabs, Buffers, Reagents) |

| By End-User | Public Hospitals (MOH & Government Facilities) Private Hospitals & Specialty Clinics Primary Healthcare Centers & Polyclinics Reference & Central Laboratories Using POC Platforms Retail Pharmacies & Walk?in Testing Points Home Care & Self?Testing Users |

| By Infectious Disease Type | Respiratory Infections (Influenza, RSV, COVID?19, Others) Sexually Transmitted Infections (HIV, Syphilis, CT/NG, Others) Hepatitis (HBV, HCV) Tuberculosis & Other Mycobacterial Infections Vector?Borne & Emerging Infections (Dengue, MERS?CoV, Others) Hospital?Acquired & Sepsis?Related Infections |

| By Distribution Channel | Direct Sales to Hospitals & Government Tenders Local Distributors / Importers Retail & Chain Pharmacies E?commerce & Online B2B Platforms NGO, Institutional & Bulk Procurement |

| By Region | Central Region (Riyadh & Surrounding Provinces) Western Region (Makkah, Madinah & Jeddah Corridor) Eastern Region (Dammam, Al?Khobar, Jubail) Southern Region Northern Region |

| By Technology Platform | Lateral Flow Immunoassays Point?of?Care PCR & Isothermal Amplification Microfluidics?Based POC Systems Immunochromatographic & Fluorescent Assays Others (Biosensors, Smartphone?Enabled Readers) |

| By Clinical Use Case | Screening & Surveillance Programs Confirmatory Diagnosis at Point of Care Treatment Monitoring & Test?of?Cure Outbreak & Emergency Response Testing Pre?admission / Pre?procedural Testing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Laboratories | 100 | Lab Managers, Pathologists |

| Private Clinics | 80 | General Practitioners, Clinic Owners |

| Public Health Officials | 60 | Health Policy Makers, Epidemiologists |

| Diagnostic Equipment Suppliers | 70 | Sales Managers, Product Specialists |

| Research Institutions | 50 | Research Scientists, Academic Professors |

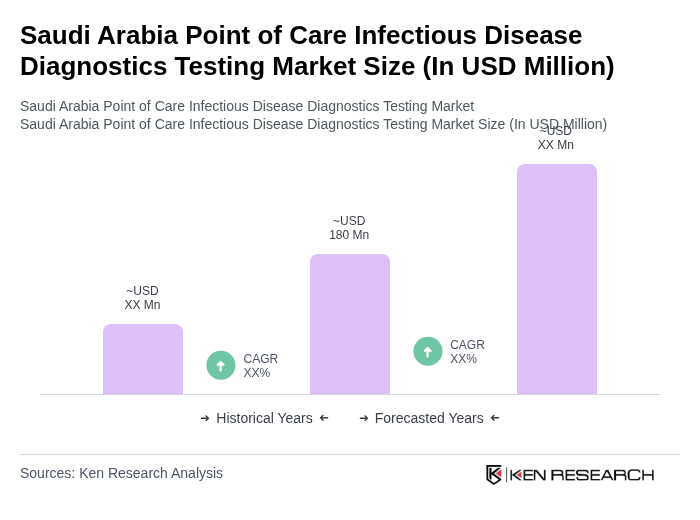

The Saudi Arabia Point of Care Infectious Disease Diagnostics Testing Market is valued at approximately USD 180 million, reflecting a significant growth driven by the increasing prevalence of infectious diseases and the demand for rapid diagnostic solutions.