Region:Middle East

Author(s):Shubham

Product Code:KRAC4349

Pages:86

Published On:October 2025

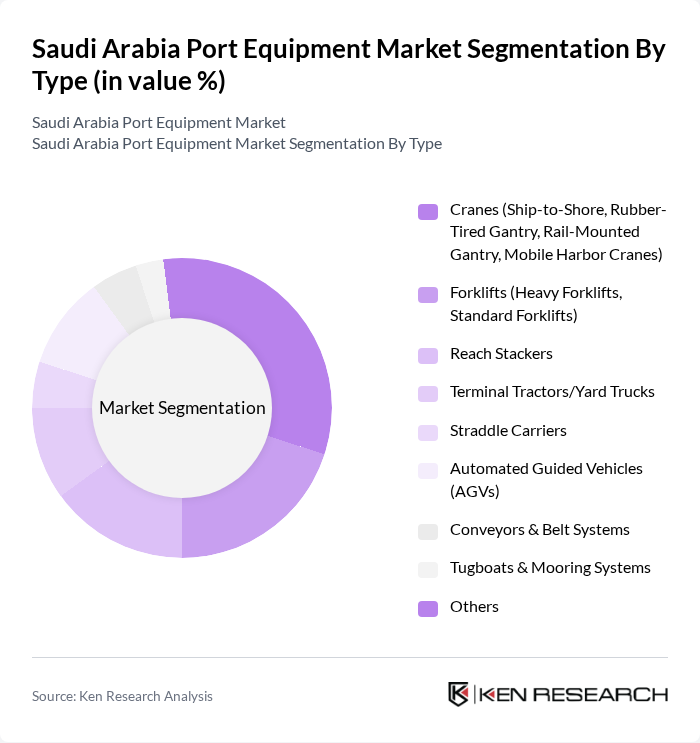

By Type:The market is segmented into various types of port equipment, including cranes, forklifts, reach stackers, terminal tractors, straddle carriers, automated guided vehicles, conveyors, tugboats, and others. Each sub-segment plays a crucial role in enhancing operational efficiency and meeting the growing demands of port operations. Recent trends indicate thatreach stackersandheavy forkliftsare among the fastest-growing segments, reflecting the need for flexible and high-capacity cargo handling solutions .

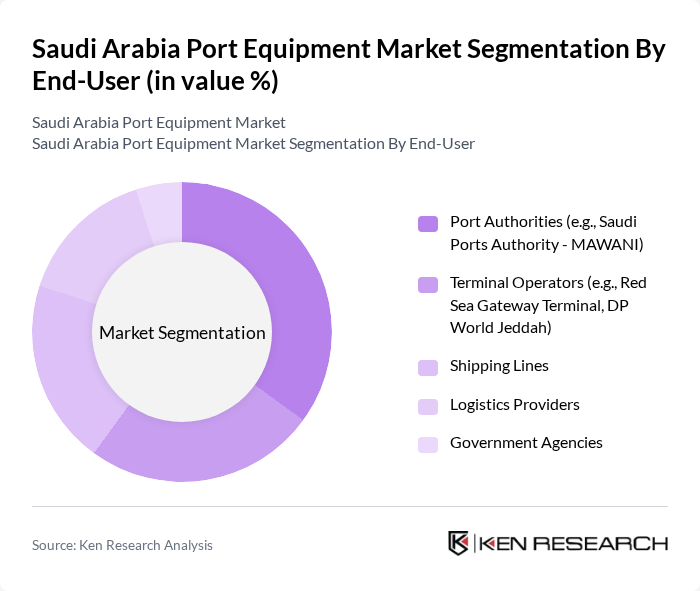

By End-User:The end-user segmentation includes port authorities, terminal operators, shipping lines, logistics providers, and government agencies. Each of these segments has unique requirements and contributes to the overall demand for port equipment. Port authorities and terminal operators remain the largest buyers, driven by ongoing modernization and capacity expansion projects .

The Saudi Arabia Port Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Konecranes, Liebherr Group, Kalmar (Cargotec Corporation), ZPMC (Shanghai Zhenhua Heavy Industries Co., Ltd.), SANY Group, Hyster-Yale Materials Handling, Inc., Mitsubishi Logisnext Co., Ltd., Toyota Industries Corporation, Doosan Industrial Vehicle Co., Ltd., Crown Equipment Corporation, Manitou Group, JCB, Hyundai Heavy Industries Co., Ltd., Terex Corporation, Aljomaih Equipment Co. (Saudi Arabia), Arabian Machinery & Heavy Equipment Co. (Saudi Arabia), Red Sea Gateway Terminal (Saudi Arabia, as operator/end-user), DP World Jeddah (Saudi Arabia, as operator/end-user) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia port equipment market appears promising, driven by ongoing investments in infrastructure and technology. As the government continues to prioritize modernization, the demand for advanced port equipment is expected to rise significantly. Additionally, the integration of smart technologies will enhance operational efficiency, positioning Saudi ports as key players in global trade. The focus on sustainability will also shape future developments, ensuring that environmental considerations are integrated into port operations.

| Segment | Sub-Segments |

|---|---|

| By Type | Cranes (Ship-to-Shore, Rubber-Tired Gantry, Rail-Mounted Gantry, Mobile Harbor Cranes) Forklifts (Heavy Forklifts, Standard Forklifts) Reach Stackers Terminal Tractors/Yard Trucks Straddle Carriers Automated Guided Vehicles (AGVs) Conveyors & Belt Systems Tugboats & Mooring Systems Others |

| By End-User | Port Authorities (e.g., Saudi Ports Authority - MAWANI) Terminal Operators (e.g., Red Sea Gateway Terminal, DP World Jeddah) Shipping Lines Logistics Providers Government Agencies |

| By Application | Container Handling Bulk Cargo Handling Ro-Ro Operations General Cargo Handling Ship Handling |

| By Distribution Mode | Direct Sales Distributors Online Sales |

| By Component | Equipment Spare Parts Maintenance Services |

| By Price Range | Low-End Equipment Mid-Range Equipment High-End Equipment |

| By Technology | Manual Equipment Semi-Automated Equipment Fully Automated Equipment |

| By Power Source | Diesel Electric Hybrid LPG/LNG Hydrogen Fuel Cell |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Container Handling Equipment | 60 | Port Equipment Managers, Operations Directors |

| Bulk Cargo Handling Solutions | 50 | Logistics Managers, Supply Chain Analysts |

| Maintenance and Repair Services | 40 | Maintenance Supervisors, Equipment Technicians |

| Port Infrastructure Development | 45 | Project Managers, Civil Engineers |

| Automated Port Systems | 55 | IT Managers, Automation Specialists |

The Saudi Arabia Port Equipment Market is valued at approximately USD 300 million, reflecting significant growth driven by the expansion of logistics, transportation sectors, and investments in port infrastructure aimed at enhancing operational efficiency and capacity.