Region:Middle East

Author(s):Geetanshi

Product Code:KRAC0127

Pages:98

Published On:August 2025

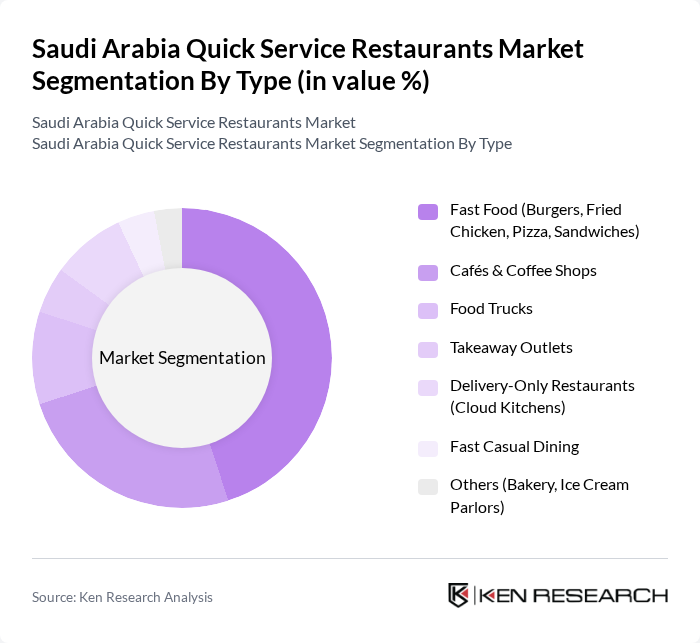

By Type:The Quick Service Restaurants market is segmented into various types, including Fast Food, Cafés & Coffee Shops, Food Trucks, Takeaway Outlets, Delivery-Only Restaurants, Fast Casual Dining, and Others. Among these, Fast Food is the leading segment due to its widespread popularity and convenience, catering to the fast-paced lifestyle of consumers. Cafés & Coffee Shops also hold a significant share, driven by the growing coffee culture and social dining trends. Food Trucks and Delivery-Only Restaurants (Cloud Kitchens) are witnessing increased traction, supported by changing consumer habits and the proliferation of online food delivery platforms .

By End-User:The market is segmented by end-users, including Families, Young Professionals, Students, and Tourists. Families represent the largest segment, as they often seek convenient dining options that cater to all age groups. Young Professionals are also a significant demographic, favoring quick meals during their busy workdays. Students and Tourists contribute to the market by seeking affordable and accessible dining experiences. The growing influx of tourists, supported by government initiatives to boost tourism, is further expanding the end-user base for QSRs .

The Saudi Arabia Quick Service Restaurants Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Baik, KFC, McDonald's, Subway, Domino's Pizza, Hardee's, Burger King, Pizza Hut, Shawarmer, Taco Bell, Dunkin' Donuts, Baskin-Robbins, Tim Hortons, Starbucks, Piatto, Herfy, Maestro Pizza, Shawarma House, Krispy Kreme, and Five Guys contribute to innovation, geographic expansion, and service delivery in this space.

The future of the quick service restaurant market in Saudi Arabia appears promising, driven by evolving consumer preferences and technological advancements. As the population continues to urbanize and disposable incomes rise, QSRs are expected to adapt by offering diverse menu options, including healthier choices. Furthermore, the integration of technology in ordering and delivery processes will enhance customer experiences, making dining more convenient. These trends indicate a dynamic market landscape that will likely evolve to meet the demands of a modern consumer base.

| Segment | Sub-Segments |

|---|---|

| By Type | Fast Food (Burgers, Fried Chicken, Pizza, Sandwiches) Cafés & Coffee Shops Food Trucks Takeaway Outlets Delivery-Only Restaurants (Cloud Kitchens) Fast Casual Dining Others (Bakery, Ice Cream Parlors) |

| By End-User | Families Young Professionals Students Tourists |

| By Sales Channel | Dine-In Takeaway Delivery (App, Phone, Web) |

| By Cuisine Type | Middle Eastern (Shawarma, Falafel, Grilled Meats) American (Burgers, Fried Chicken, Pizza) Asian (Chinese, Japanese, Indian) European (Italian, French, Mediterranean) |

| By Pricing Strategy | Budget Mid-Range Premium |

| By Location | Urban Areas Suburban Areas Rural Areas |

| By Franchise vs. Independent | Franchise (International & Local Chains) Independent Restaurants Others (Joint Ventures, Cloud Kitchens) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences in QSR | 120 | Regular QSR Customers, Food Enthusiasts |

| Franchise Operations Insights | 60 | Franchise Owners, Regional Managers |

| Market Trends Analysis | 50 | Industry Analysts, Market Researchers |

| Supply Chain Dynamics | 40 | Supply Chain Managers, Procurement Officers |

| Consumer Spending Behavior | 80 | Household Decision Makers, Young Professionals |

The Saudi Arabia Quick Service Restaurants market is valued at approximately USD 9.2 billion, reflecting significant growth driven by urbanization, a rising middle-class population, and changing consumer preferences for fast and convenient dining options.