Region:North America

Author(s):Rebecca

Product Code:KRAA1359

Pages:95

Published On:August 2025

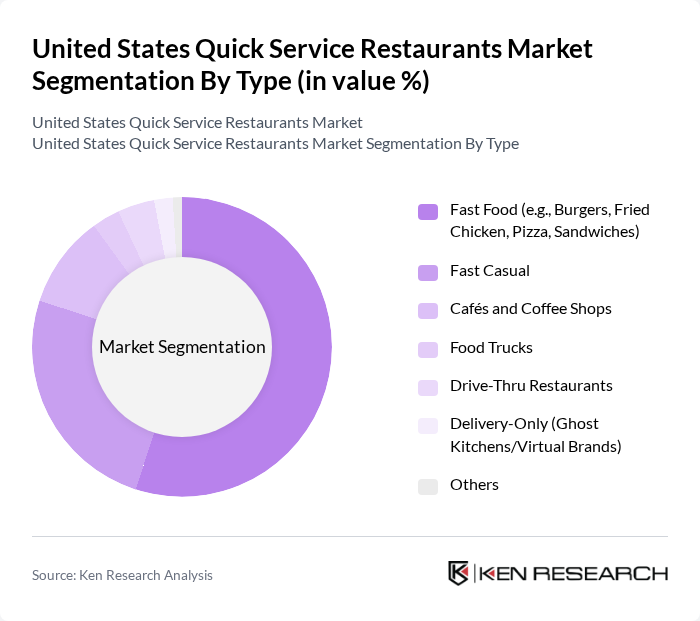

By Type:The quick service restaurant market can be segmented into various types, including Fast Food, Fast Casual, Cafés and Coffee Shops, Food Trucks, Drive-Thru Restaurants, Delivery-Only (Ghost Kitchens/Virtual Brands), and Others. Among these, Fast Food is the most dominant segment, driven by consumer preferences for quick, affordable meals and the extensive presence of established brands. Fast Casual is also gaining traction as consumers seek higher quality food in a fast-service format.

By Cuisine:The market can also be segmented by cuisine types, including American, Mexican, Italian, Asian, Mediterranean, Bakeries & Desserts, and Others. American cuisine, particularly burgers and fried chicken, dominates the market due to its widespread appeal and cultural significance. Mexican cuisine is also popular, driven by the increasing demand for flavorful and diverse meal options.

The United States Quick Service Restaurants Market is characterized by a dynamic mix of regional and international players. Leading participants such as McDonald's Corporation, Yum! Brands, Inc. (KFC, Taco Bell, Pizza Hut), Restaurant Brands International Inc. (Burger King, Popeyes, Tim Hortons), Domino's Pizza, Inc., Chipotle Mexican Grill, Inc., The Wendy's Company, Dunkin' (Inspire Brands, Inc.), Panera Bread Company (JAB Holding Company), Subway (Doctor's Associates LLC), Shake Shack Inc., Five Guys Enterprises, LLC, Wingstop Inc., Jersey Mike's Franchise Systems, Inc., QDOBA Restaurant Corporation, Blaze Pizza, LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the U.S. quick service restaurant market appears promising, driven by evolving consumer preferences and technological advancements. As the demand for convenience continues to rise, QSRs are likely to enhance their digital ordering platforms and delivery services. Additionally, the focus on sustainability and health-conscious offerings will shape menu innovations. With the integration of artificial intelligence in customer service, QSRs can improve operational efficiency and customer engagement, positioning themselves for growth in a competitive landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Fast Food (e.g., Burgers, Fried Chicken, Pizza, Sandwiches) Fast Casual Cafés and Coffee Shops Food Trucks Drive-Thru Restaurants Delivery-Only (Ghost Kitchens/Virtual Brands) Others |

| By Cuisine | American (Burgers, Chicken, Sandwiches, BBQ) Mexican (Tacos, Burritos, Quesadillas) Italian (Pizza, Pasta, Subs) Asian (Chinese, Japanese, Thai, Korean) Mediterranean (Greek, Turkish, Lebanese) Bakeries & Desserts (Donuts, Ice Cream, Pastries) Others |

| By Service Type | Dine-In Takeout Delivery (In-house & Third-Party) Drive-Thru Curbside Pickup Others |

| By Customer Demographics | Families Young Adults (Gen Z, Millennials) Professionals Students Seniors Others |

| By Location | Urban Areas Suburban Areas Rural Areas High Traffic Locations (Airports, Malls, Travel Plazas) Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Franchise vs. Independent | Chained Outlets (Franchise/Corporate-Owned) Independent Outlets Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Franchise Owner Insights | 100 | Franchise Owners, Regional Managers |

| Customer Satisfaction Surveys | 120 | Frequent Diners, Occasional Customers |

| Market Trend Analysis | 75 | Food Industry Analysts, Market Researchers |

| Operational Efficiency Interviews | 50 | Restaurant Managers, Operations Directors |

| Consumer Behavior Focus Groups | 60 | Food Enthusiasts, Health-Conscious Consumers |

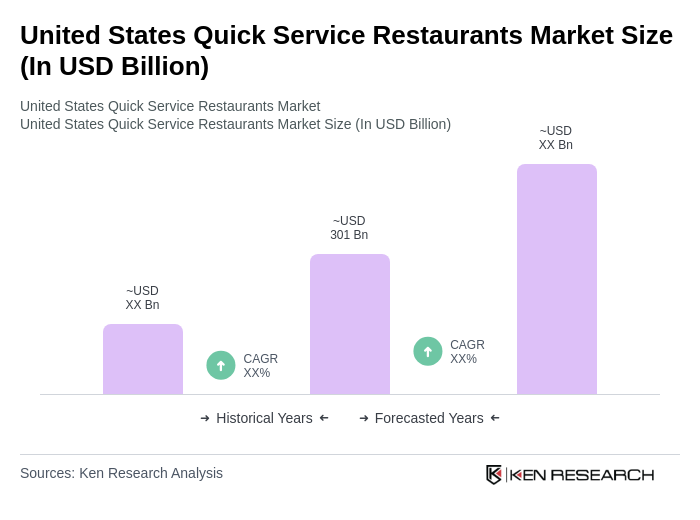

The United States Quick Service Restaurants Market is valued at approximately USD 301 billion, reflecting a significant growth driven by consumer demand for convenience, digital ordering platforms, and a shift towards fast and affordable dining options.