Region:Middle East

Author(s):Geetanshi

Product Code:KRAD4169

Pages:95

Published On:December 2025

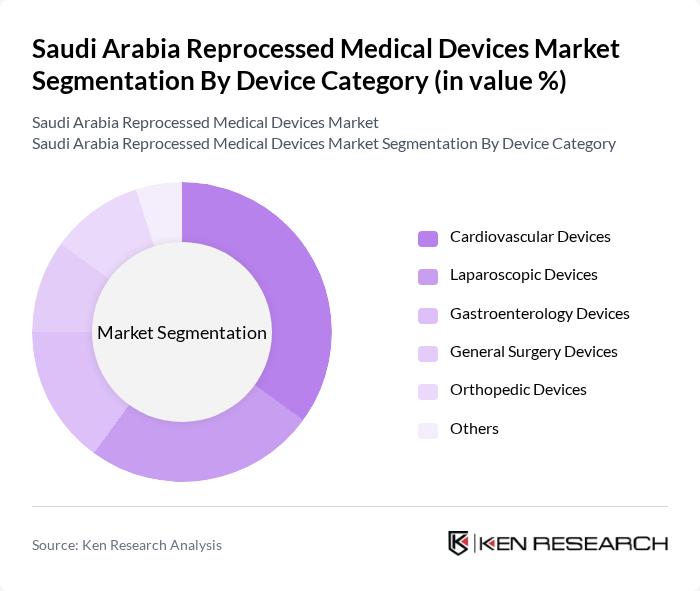

By Device Category:The market is segmented into various device categories, including cardiovascular devices, laparoscopic devices, gastroenterology devices, general surgery devices, orthopedic devices, and others, in line with leading industry taxonomies. Among these, cardiovascular devices are leading the market, consistent with being the largest revenue?generating product type in Saudi Arabia, supported by the high prevalence of cardiovascular diseases and the extensive use of electrophysiology, catheterization, and related disposable devices suitable for reprocessing. The growing focus on minimally invasive procedures has also contributed to the rise of laparoscopic devices, and global data indicate that laparoscopy is among the fastest-growing segments in reprocessed medical devices due to cost savings and waste reduction, making it a significant segment in the Saudi context as well.

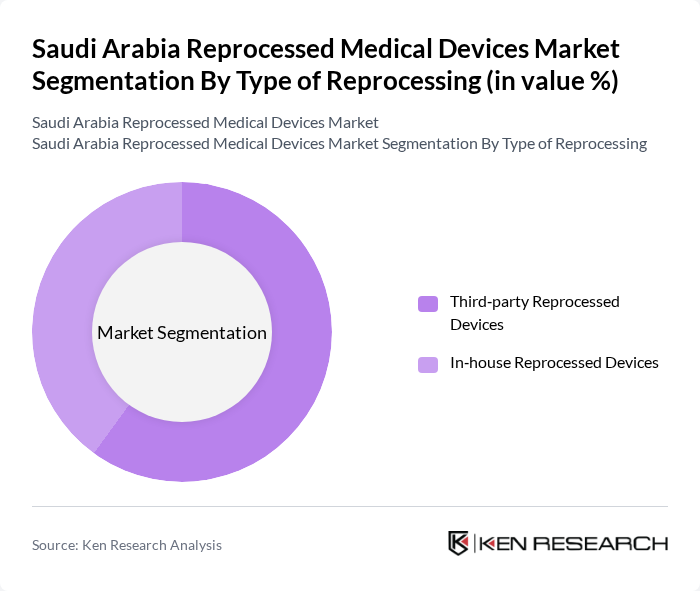

By Type of Reprocessing:The market is divided into third-party reprocessed devices and in-house reprocessed devices, reflecting the standard classification used globally in this sector. Third-party reprocessed devices dominate the market due to their cost-effectiveness, specialist quality systems, and the ability to systematically meet regulatory standards without the need for hospitals to invest heavily in dedicated in?house reprocessing infrastructure. This trend is further supported by hospitals seeking to reduce operational costs, comply with environmental and waste?reduction goals, and maintain high-quality patient care through validated, standardized reprocessing protocols offered by accredited third?party providers.

The Saudi Arabia Reprocessed Medical Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Medtronic plc, Johnson & Johnson (including ASP – Advanced Sterilization Products & Ethicon), Stryker Corporation, Vanguard AG, SterilMed (a Medtronic company), Medline Industries LP, Cardinal Health Inc., Teleflex Incorporated, B. Braun Melsungen AG, Smith & Nephew plc, Boston Scientific Corporation, Halyard Health (now Owens & Minor – HALYARD brand), ConvaTec Group plc, Aesculap AG (a B. Braun company), Selected Saudi Distributors & Service Providers (e.g., Tamer Group, Al Faisaliah Medical Systems) contribute to innovation, geographic expansion, and service delivery in this space, supported by the broader growth of the medical devices and device reprocessing markets in the Middle East and Africa.

The future of the reprocessed medical devices market in Saudi Arabia appears promising, driven by increasing healthcare investments and a shift towards sustainable practices. As the government continues to support healthcare infrastructure development, the adoption of reprocessed devices is expected to rise. Additionally, advancements in reprocessing technologies will likely enhance the safety and efficacy of these devices, addressing current concerns and fostering greater acceptance among healthcare providers and patients alike.

| Segment | Sub-Segments |

|---|---|

| By Device Category | Cardiovascular Devices Laparoscopic Devices Gastroenterology Devices General Surgery Devices Orthopedic Devices Others |

| By Type of Reprocessing | Third?party Reprocessed Devices In?house Reprocessed Devices |

| By End-User | Public Hospitals Private Hospitals Specialty Clinics & Day Surgery Centers Diagnostic & Catheterization Labs Others |

| By Distribution Channel | Direct Sales to Healthcare Facilities Tender / Government Procurement Medical Distributors & Importers Others |

| By Material / Device Use | Single?use Devices Approved for Reprocessing Multi?use Devices |

| By Regulatory Compliance | SFDA?Approved Reprocessed Devices Internationally Certified (e.g., FDA / CE) Devices Used in Saudi Arabia Others |

| By Market Maturity Tier (Within Saudi Arabia) | Tier?1 Cities (Riyadh, Jeddah, Dammam/Khobar) Tier?2 & Tier?3 Cities Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement Departments | 100 | Procurement Managers, Supply Chain Coordinators |

| Medical Device Manufacturers | 60 | Product Managers, R&D Directors |

| Healthcare Regulatory Bodies | 40 | Regulatory Affairs Specialists, Compliance Officers |

| Reprocessing Service Providers | 50 | Operations Managers, Quality Assurance Leads |

| Healthcare Facility Administrators | 90 | Facility Managers, Clinical Directors |

The Saudi Arabia Reprocessed Medical Devices Market is valued at approximately USD 8 million, reflecting a growing trend towards cost-effective healthcare solutions and sustainable practices in the medical sector.