Region:Middle East

Author(s):Geetanshi

Product Code:KRAD3930

Pages:91

Published On:November 2025

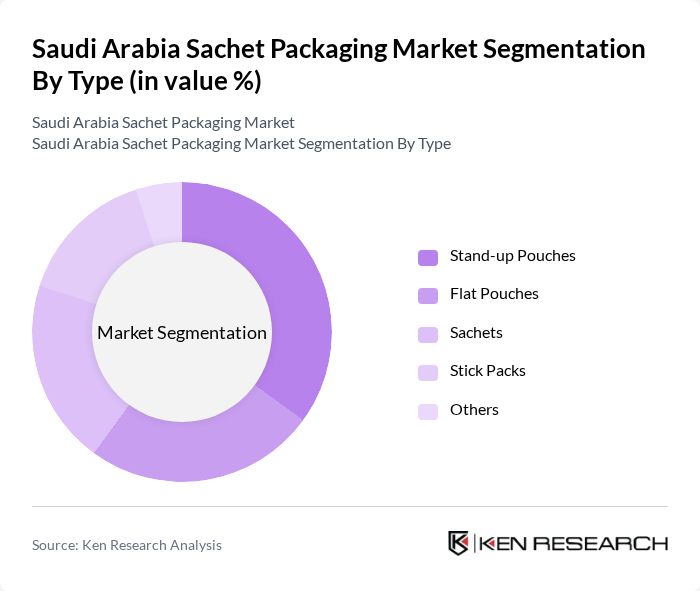

By Type:The market is segmented into various types of sachet packaging, including Stand-up Pouches, Flat Pouches, Sachets, Stick Packs, and Others. Among these, Stand-up Pouches are gaining significant traction due to their convenience and ability to stand on shelves, enhancing visibility and consumer appeal. Flat Pouches and Sachets are also popular for their cost-effectiveness and versatility in packaging various products. Resealable stand-up pouches are particularly favored by food and snack companies for maintaining product freshness and improving shelf appearance.

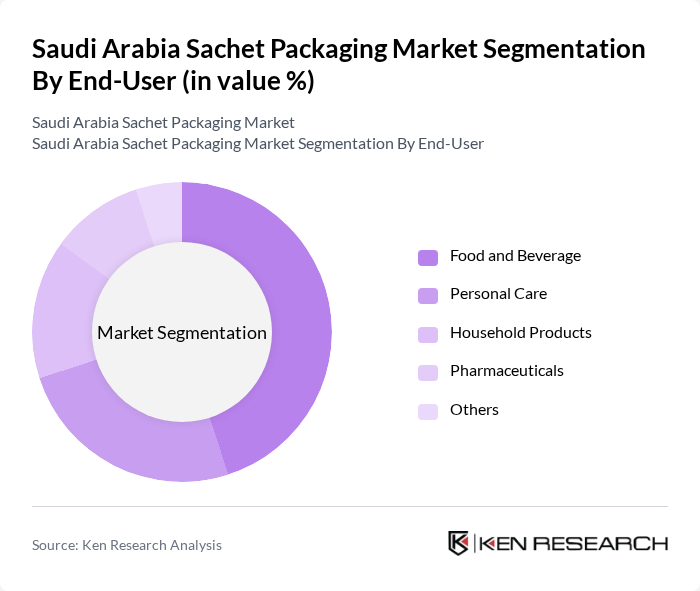

By End-User:The end-user segmentation includes Food and Beverage, Personal Care, Household Products, Pharmaceuticals, and Others. The Food and Beverage sector is the largest consumer of sachet packaging, driven by the growing trend of on-the-go consumption and the need for portion control. Personal Care products also utilize sachet packaging extensively, catering to the demand for travel-sized items. The pharmaceutical industry is witnessing growing demand for specialized sachet formats as healthcare infrastructure expands and cold-chain packaging requirements increase.

The Saudi Arabia Sachet Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Bayader International, National Factory for Plastic Industry, Al-Hokair Group, Al-Faisal Group, Al-Muhaidib Group, Saudi Packaging Industry, Al-Jazira Factory for Plastic Products, Al-Mansour Group, Al-Suwaidi Industrial Services, Al-Sahra Plastic Factory, Al-Fahad Group, Al-Rajhi Packaging, Al-Turki Packaging, Al-Ghadeer Packaging, Al-Murjan Packaging contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia sachet packaging market appears promising, driven by evolving consumer preferences and technological advancements. As sustainability becomes a priority, companies are likely to invest in eco-friendly materials and innovative packaging solutions. The rise of e-commerce and direct-to-consumer models will further enhance market accessibility, allowing brands to reach a broader audience. Additionally, the increasing focus on health and wellness will drive demand for portion-controlled packaging, aligning with consumer trends towards convenience and quality.

| Segment | Sub-Segments |

|---|---|

| By Type | Stand-up Pouches Flat Pouches Sachets Stick Packs Others |

| By End-User | Food and Beverage Personal Care Household Products Pharmaceuticals Others |

| By Material | Plastic Paper Aluminum Composites Others |

| By Size | Small (up to 50g) Medium (51g to 200g) Large (201g and above) Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Direct Sales Others |

| By Region | Central Region Eastern Region Western Region Southern Region Others |

| By Application | Food Packaging Beverage Packaging Cosmetic Packaging Pharmaceutical Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Sector | 100 | Product Managers, Packaging Engineers |

| Cosmetics and Personal Care | 60 | Brand Managers, R&D Specialists |

| Pharmaceutical Industry | 50 | Quality Assurance Managers, Regulatory Affairs Officers |

| Household Products | 40 | Marketing Directors, Supply Chain Managers |

| Retail and Distribution Channels | 50 | Logistics Coordinators, Sales Executives |

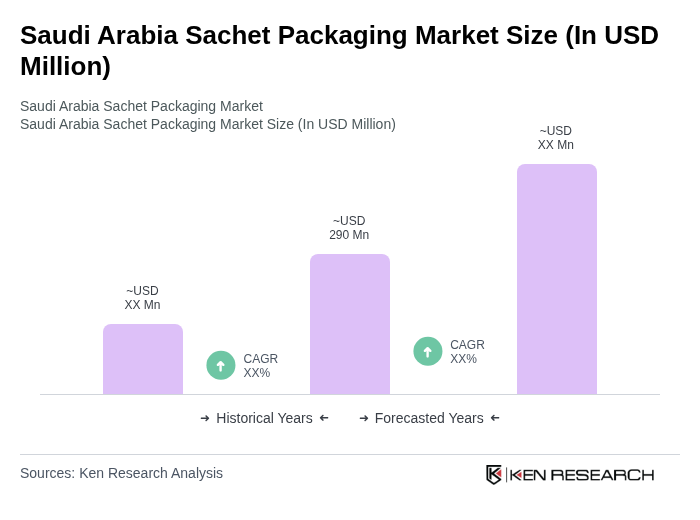

The Saudi Arabia Sachet Packaging Market is valued at approximately USD 290 million, reflecting a significant growth driven by the increasing demand for convenient packaging solutions across various sectors, including food and beverage, personal care, and pharmaceuticals.