Region:Asia

Author(s):Geetanshi

Product Code:KRAB5167

Pages:86

Published On:October 2025

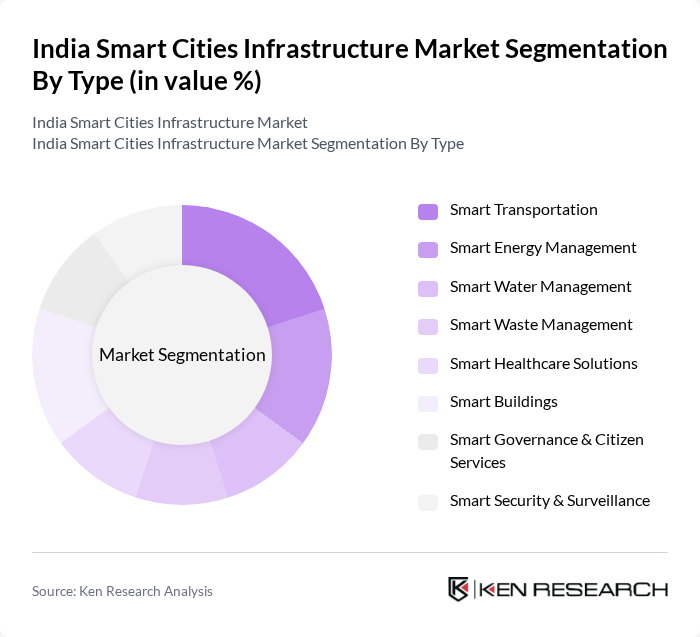

By Type:The market is segmented into various types, including Smart Transportation, Smart Energy Management, Smart Water Management, Smart Waste Management, Smart Healthcare Solutions, Smart Buildings, Smart Governance & Citizen Services, and Smart Security & Surveillance. Each of these segments plays a crucial role in enhancing urban infrastructure and improving the quality of life for residents. Smart Transportation leads the market, driven by innovations in intelligent traffic management, smart parking, and integrated public transport networks. Smart Energy Management and Smart Buildings are also significant, supported by government incentives for energy efficiency and green construction.

The Smart Transportation segment is currently dominating the market due to the increasing need for efficient urban mobility solutions. With the rise in population density and traffic congestion in major cities, there is a growing demand for smart transportation systems that integrate technology to improve traffic management, reduce travel time, and enhance public transport services. This segment is characterized by innovations such as intelligent traffic management systems, smart parking solutions, and integrated public transport networks, which are increasingly being adopted by urban planners and local governments.

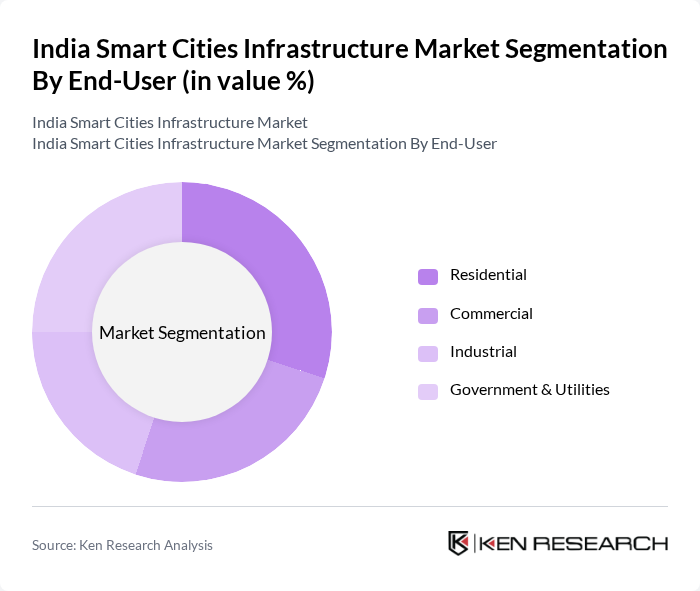

By End-User:The market is segmented by end-users into Residential, Commercial, Industrial, and Government & Utilities. Each segment has unique requirements and contributes differently to the overall growth of smart city infrastructure. The Residential segment leads, driven by urban population growth and demand for smart housing solutions. Commercial and Government & Utilities segments are expanding due to increased adoption of digital governance, smart energy, and public safety solutions.

The Residential segment is leading the market as urban populations continue to grow, driving the demand for smart housing solutions. Homeowners are increasingly seeking smart technologies that enhance energy efficiency, security, and convenience. This trend is further supported by government initiatives promoting sustainable living and smart home technologies, making it a key area for investment and development in smart city infrastructure.

The India Smart Cities Infrastructure Market is characterized by a dynamic mix of regional and international players. Leading participants such as Larsen & Toubro Limited, Tata Consultancy Services Limited, Infosys Limited, Wipro Limited, Siemens Limited, Honeywell Automation India Limited, Schneider Electric India Private Limited, Cisco Systems India Private Limited, IBM India Private Limited, Accenture Solutions Private Limited, Signify Innovations India Limited (Philips Lighting), Hitachi India Private Limited, Bosch Limited, ABB India Limited, Microsoft Corporation (India) Pvt. Ltd., NEC Corporation India Private Limited, Sterlite Technologies Limited, Tech Mahindra Limited, Bharat Electronics Limited (BEL), CESC Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India Smart Cities Infrastructure Market appears promising, driven by ongoing urbanization and technological integration. As cities evolve, the demand for smart mobility solutions and renewable energy sources will intensify. The government’s commitment to sustainable urban development will likely lead to increased investments in green technologies and citizen engagement platforms. Furthermore, the adoption of AI and machine learning will enhance operational efficiencies, paving the way for smarter, more resilient urban environments.

| Segment | Sub-Segments |

|---|---|

| By Type | Smart Transportation Smart Energy Management Smart Water Management Smart Waste Management Smart Healthcare Solutions Smart Buildings Smart Governance & Citizen Services Smart Security & Surveillance |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Region | North India South India East India West India |

| By Technology | IoT Solutions Cloud Computing Big Data Analytics AI and Machine Learning Edge Computing G Connectivity |

| By Application | Urban Mobility Energy Efficiency Public Safety Environmental Monitoring Smart Lighting E-Governance |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Regulatory Compliance Support Incentives for Green Technologies |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Smart Transportation Systems | 100 | Urban Planners, Transportation Engineers |

| Smart Energy Management | 80 | Energy Managers, Sustainability Consultants |

| Waste Management Solutions | 70 | Waste Management Officers, Environmental Engineers |

| Smart Water Supply Systems | 60 | Water Resource Managers, Civil Engineers |

| Public Safety and Security Technologies | 50 | Security Managers, IT Managers in Municipalities |

The India Smart Cities Infrastructure Market is valued at approximately USD 6.8 billion, driven by rapid urbanization, government initiatives like the Smart Cities Mission, and increasing investments in smart technologies aimed at enhancing urban living standards.