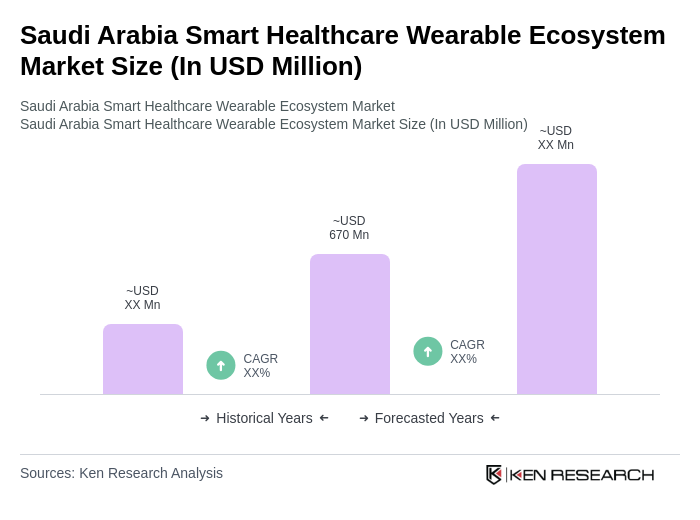

Saudi Arabia Smart Healthcare Wearable Ecosystem Market Overview

- The Saudi Arabia Smart Healthcare Wearable Ecosystem Market is valued at USD 670 million, based on a five-year historical analysis of the wearable technology and smart wearables segments. This growth is primarily driven by the increasing adoption of digital health technologies, rising health awareness among consumers, and the growing prevalence of chronic diseases. The integration of advanced technologies such as IoT and AI in healthcare wearables has further propelled market expansion .

- Key cities dominating the market includeRiyadh, Jeddah, and Dammam. Riyadh, as the capital, serves as a hub for healthcare innovation and investment, while Jeddah and Dammam benefit from their strategic locations and access to a large population. The urbanization and increasing disposable income in these cities contribute significantly to the demand for smart healthcare wearables .

- In 2023, the Saudi Arabian government implemented theNational Health Strategy, which emphasizes the use of digital health solutions, including smart wearables, to enhance patient care and streamline healthcare services. This initiative is aligned with Vision 2030 and aims to improve health outcomes and reduce healthcare costs, thereby fostering the growth of the smart healthcare wearable ecosystem. The strategy is supported by the Ministry of Health’s “National eHealth Strategy” (Ministry of Health, 2023), which mandates the integration of digital health platforms, remote patient monitoring, and wearable device adoption in both public and private healthcare sectors, with compliance requirements for device interoperability and data security .

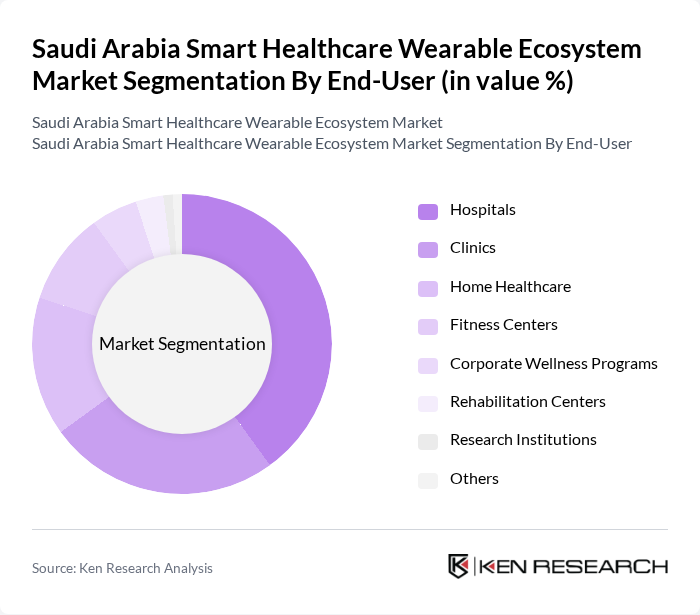

Saudi Arabia Smart Healthcare Wearable Ecosystem Market Segmentation

By Type:The market is segmented into various types of smart healthcare wearables, including fitness trackers, smartwatches, medical wearables, smart clothing, wearable ECG monitors, wearable blood pressure monitors, smart rings, head-mounted wearables, and others. Among these, fitness trackers and smartwatches are leading the market due to their popularity among health-conscious consumers and their multifunctional capabilities. Medical wearables are also gaining traction as they provide critical health monitoring features, appealing to both healthcare providers and patients .

By End-User:The end-user segmentation includes hospitals, clinics, home healthcare, fitness centers, corporate wellness programs, rehabilitation centers, research institutions, and others. Hospitals and clinics are the primary users of smart healthcare wearables, as they utilize these devices for patient monitoring and management. The growing trend of home healthcare is also contributing to the demand for wearables, as patients seek convenient and effective ways to manage their health from home .

Saudi Arabia Smart Healthcare Wearable Ecosystem Market Competitive Landscape

The Saudi Arabia Smart Healthcare Wearable Ecosystem Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, Fitbit Inc. (Google), Apple Inc., Garmin Ltd., Samsung Electronics, Huawei Technologies Co., Ltd., Xiaomi Corporation, Medtronic plc, Abbott Laboratories, Withings, OMRON Corporation, AliveCor, Inc., Zepp Health Corporation (Amazfit), Oura Health Oy, Polar Electro Oy, Suunto Oy, OPPO, HONOR, Realme, Siemens Healthineers, GE Healthcare, Johnson & Johnson, Boston Scientific, B. Braun Melsungen AG, Sajaya Healthcare Services Company contribute to innovation, geographic expansion, and service delivery in this space .

Saudi Arabia Smart Healthcare Wearable Ecosystem Market Industry Analysis

Growth Drivers

- Increasing Prevalence of Chronic Diseases:The rise in chronic diseases such as diabetes and cardiovascular conditions is a significant growth driver for the smart healthcare wearable ecosystem in Saudi Arabia. In future, approximately 8 million adults in the country are expected to be diagnosed with diabetes, according to the Saudi Ministry of Health. This growing patient population necessitates innovative monitoring solutions, driving demand for wearable devices that facilitate real-time health tracking and management.

- Rising Demand for Remote Patient Monitoring:The demand for remote patient monitoring solutions is surging, particularly in light of the COVID-19 pandemic. In future, the number of telehealth consultations in Saudi Arabia is projected to reach 12 million, as reported by the Saudi Telemedicine Association. This trend is pushing healthcare providers to adopt wearable technologies that enable continuous monitoring of patients' health metrics, thereby enhancing patient care and reducing hospital visits.

- Technological Advancements in Wearable Devices:Rapid advancements in wearable technology are propelling the smart healthcare ecosystem forward. By future, the global market for wearable health devices is expected to exceed $70 billion, according to industry reports. Innovations such as improved battery life, enhanced sensors, and AI integration are making wearables more effective and appealing to consumers, thereby increasing their adoption in Saudi Arabia's healthcare landscape.

Market Challenges

- High Cost of Advanced Wearable Technologies:The high cost associated with advanced wearable technologies poses a significant challenge to market growth. In future, the average price of premium wearable devices in Saudi Arabia is estimated to be around SAR 1,800 ($480). This price point can limit accessibility for a broader population, particularly among lower-income groups, hindering widespread adoption and utilization of these health-monitoring solutions.

- Data Privacy and Security Concerns:Data privacy and security issues are critical challenges facing the smart healthcare wearable market. In future, it is anticipated that over 65% of consumers in Saudi Arabia will express concerns regarding the security of their health data, according to a survey by the Saudi Cybersecurity Authority. These apprehensions can deter potential users from adopting wearable technologies, impacting overall market growth and acceptance.

Saudi Arabia Smart Healthcare Wearable Ecosystem Market Future Outlook

The future of the smart healthcare wearable ecosystem in Saudi Arabia appears promising, driven by increasing consumer awareness and technological advancements. As the government continues to promote digital health initiatives, the integration of AI and machine learning into wearable devices is expected to enhance their functionality. Furthermore, the expansion of telehealth services will likely create new avenues for growth, enabling healthcare providers to leverage wearables for improved patient outcomes and engagement in the coming years.

Market Opportunities

- Expansion of Telehealth Services:The ongoing expansion of telehealth services presents a significant opportunity for the smart healthcare wearable market. With an expected increase in telehealth consultations to 12 million in future, wearables can play a crucial role in facilitating remote monitoring and consultations, enhancing patient engagement and care quality.

- Integration of AI and Machine Learning:The integration of AI and machine learning into wearable devices offers substantial market opportunities. In future, it is projected that 35% of wearable devices will incorporate AI features, enabling personalized health insights and predictive analytics, which can significantly improve user experience and health outcomes.