Region:Middle East

Author(s):Geetanshi

Product Code:KRAA0015

Pages:86

Published On:December 2025

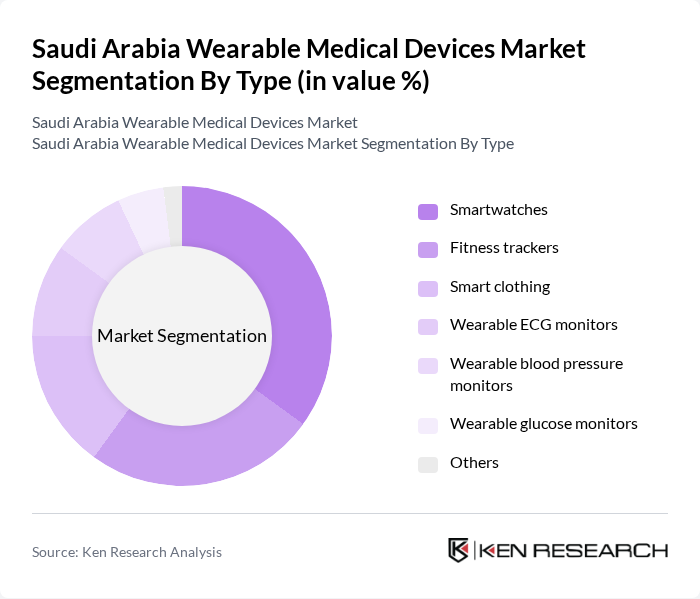

By Type:The wearable medical devices market is segmented into various types, including smartwatches, fitness trackers, smart clothing, wearable ECG monitors, wearable blood pressure monitors, wearable glucose monitors, and others. Among these, smartwatches are leading the market due to their multifunctionality, combining health monitoring (such as heart rate, ECG, blood oxygen, and sleep tracking) with lifestyle and connectivity features, which appeals to a broad consumer base and supports both wellness and medical-use applications. Fitness trackers also hold significant market share, driven by growing health consciousness, government campaigns promoting active lifestyles under Vision 2030, and rising demand for continuous activity, calorie, and vital-sign monitoring among younger, tech-savvy consumers.

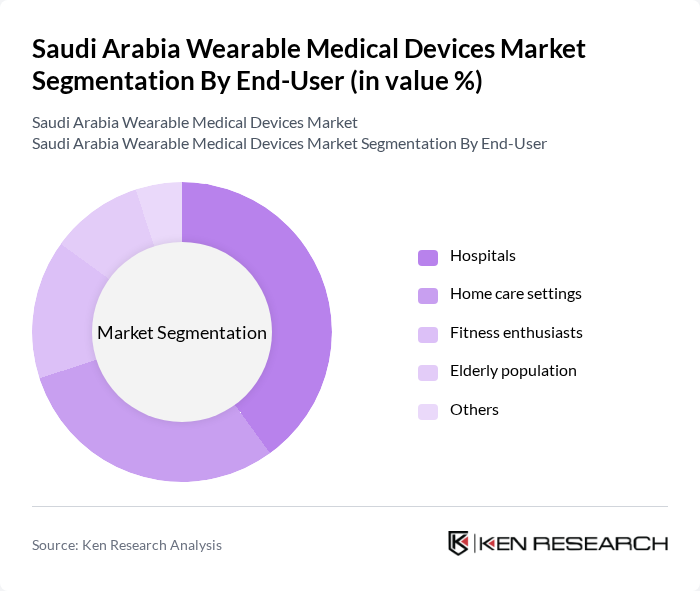

By End-User:The end-user segmentation includes hospitals, home care settings, fitness enthusiasts, the elderly population, and others. Hospitals are the dominant segment, utilizing wearable devices for inpatient and outpatient monitoring, early warning of deterioration, and integration with hospital information systems and telehealth platforms, which enhances patient care quality, clinical decision-making, and operational efficiency. Home care settings are also growing rapidly as more patients prefer to manage their health at home, supported by wearable technology for chronic disease management, post-discharge monitoring, and virtual consultations, in line with Saudi Arabia’s broader push toward digital health and remote care models.

The Saudi Arabia Wearable Medical Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, Fitbit (now part of Google), Garmin, Apple Inc., Samsung Electronics, Huawei Technologies, Medtronic, Abbott Laboratories, Omron Healthcare, Withings, Xiaomi, AliveCor, BioTelemetry, Zephyr Technology, and Polar Electro contribute to innovation, geographic expansion, and service delivery in this space.

The future of the wearable medical devices market in Saudi Arabia appears promising, driven by advancements in technology and increasing healthcare demands. The integration of artificial intelligence and machine learning into wearable devices is expected to enhance remote patient monitoring capabilities, while the expansion of telehealth services, projected to exceed 4 million consultations, will further support device adoption. Additionally, local innovations, such as those developed by King Saud University, will foster domestic growth and reduce reliance on imports, positioning the market for significant advancements in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Smartwatches Fitness trackers Smart clothing Wearable ECG monitors Wearable blood pressure monitors Wearable glucose monitors Others |

| By End-User | Hospitals Home care settings Fitness enthusiasts Elderly population Others |

| By Application | Chronic disease management Fitness and wellness tracking Remote patient monitoring Emergency response Others |

| By Distribution Channel | Online retail Offline retail Direct sales Distributors Others |

| By Technology | Bluetooth-enabled devices Wi-Fi-enabled devices Cellular-enabled devices Others |

| By User Demographics | Age groups Gender Income levels Others |

| By Policy Support | Government subsidies Tax incentives Research grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 120 | Doctors, Nurses, Health Technologists |

| Patients Using Wearable Devices | 100 | Chronic Disease Patients, Fitness Enthusiasts |

| Manufacturers and Developers | 40 | Product Managers, R&D Heads |

| Healthcare Policy Makers | 50 | Government Officials, Health Administrators |

| Insurance Providers | 40 | Underwriters, Claims Managers |

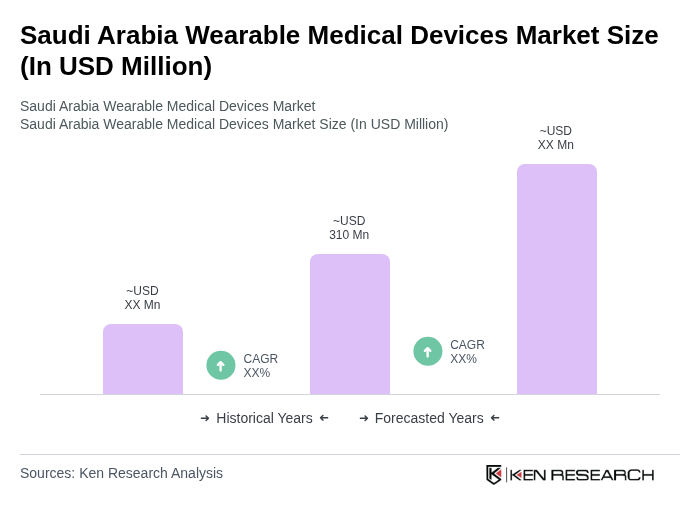

The Saudi Arabia Wearable Medical Devices Market is valued at approximately USD 310 million, reflecting a significant growth trend driven by the increasing adoption of remote patient monitoring and home healthcare solutions.