Region:Middle East

Author(s):Dev

Product Code:KRAA9624

Pages:88

Published On:November 2025

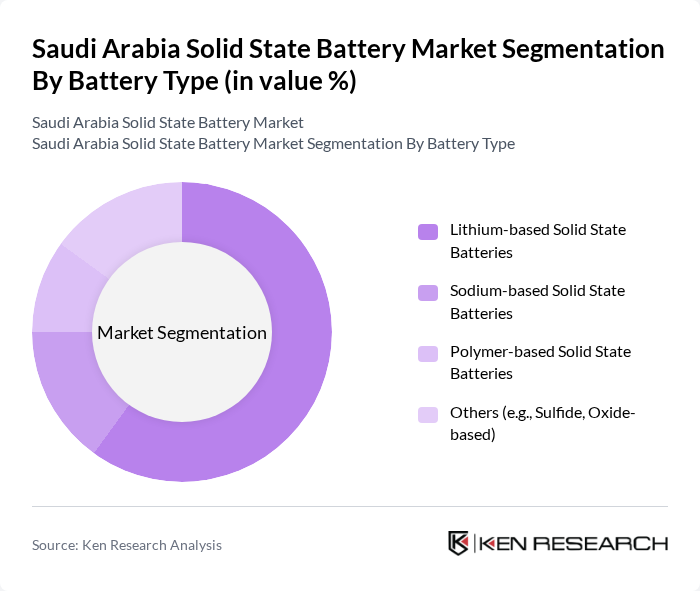

By Battery Type:The market is segmented into various battery types, including lithium-based, sodium-based, polymer-based, and others such as sulfide and oxide-based batteries. Among these, lithium-based solid-state batteries are leading the market due to their high energy density and efficiency, making them the preferred choice for electric vehicles and consumer electronics. The increasing focus on sustainability and performance is driving the demand for these advanced battery technologies.

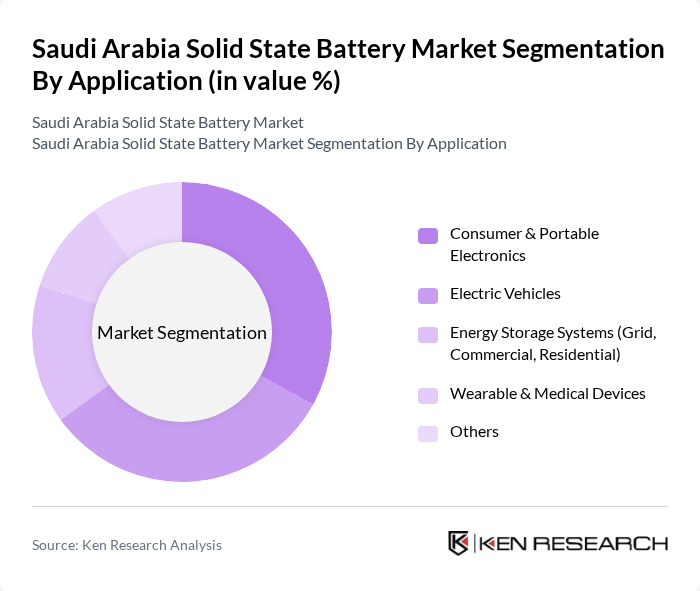

By Application:The applications of solid-state batteries span across consumer and portable electronics, electric vehicles, energy storage systems, wearable and medical devices, and others. The consumer and portable electronics segment currently holds the largest share, reflecting the early adoption of solid-state batteries in compact devices, while the electric vehicle segment is the fastest growing, driven by the global shift towards electric mobility and the need for longer-lasting, safer battery solutions. This trend is further supported by government initiatives promoting electric vehicle adoption.

The Saudi Arabia Solid State Battery Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung SDI Co., Ltd., Toyota Motor Corporation, QuantumScape Corporation, Solid Power, Inc., A123 Systems LLC, Ionic Materials, Inc., Panasonic Corporation, LG Chem Ltd., BYD Company Limited, Contemporary Amperex Technology Co. Limited (CATL), Northvolt AB, Envision AESC Group Ltd., Farasis Energy Inc., Sila Nanotechnologies Inc., Solvay SA, Cymbet Corporation, Robert Bosch GmbH, TotalEnergies SE, Saft Groupe S.A., SABIC (Saudi Basic Industries Corporation) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the solid state battery market in Saudi Arabia appears promising, driven by increasing investments in renewable energy and technological advancements. As the government continues to support electric vehicle adoption and energy storage solutions, the market is expected to witness significant growth. Collaborations between battery manufacturers and automotive companies will likely enhance innovation, while consumer awareness of sustainable energy solutions will further propel demand for solid state batteries, positioning them as a key player in the energy transition.

| Segment | Sub-Segments |

|---|---|

| By Battery Type | Lithium-based Solid State Batteries Sodium-based Solid State Batteries Polymer-based Solid State Batteries Others (e.g., Sulfide, Oxide-based) |

| By Application | Consumer & Portable Electronics Electric Vehicles Energy Storage Systems (Grid, Commercial, Residential) Wearable & Medical Devices Others |

| By End-User | Automotive OEMs Utilities & Energy Providers Industrial & Commercial Enterprises Consumer Electronics Manufacturers Others |

| By Material | Solid Electrolytes (Sulfide, Oxide, Polymer) Anode Materials Cathode Materials Composite Materials Others |

| By Region | Central Region (Riyadh) Eastern Region (Dammam, Khobar) Western Region (Jeddah, Makkah) Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Electric Vehicle Battery Manufacturers | 60 | Production Managers, R&D Directors |

| Consumer Electronics Battery Suppliers | 50 | Product Development Managers, Supply Chain Analysts |

| Renewable Energy Storage Solutions | 40 | Energy Policy Experts, Technical Engineers |

| Academic and Research Institutions | 45 | Research Scientists, Professors in Energy Technology |

| Government Regulatory Bodies | 40 | Policy Makers, Regulatory Affairs Specialists |

The Saudi Arabia Solid State Battery Market is valued at approximately USD 5 million, driven by increasing demand for electric vehicles, advancements in battery technology, and investments in renewable energy solutions.