Region:Middle East

Author(s):Dev

Product Code:KRAD5081

Pages:88

Published On:December 2025

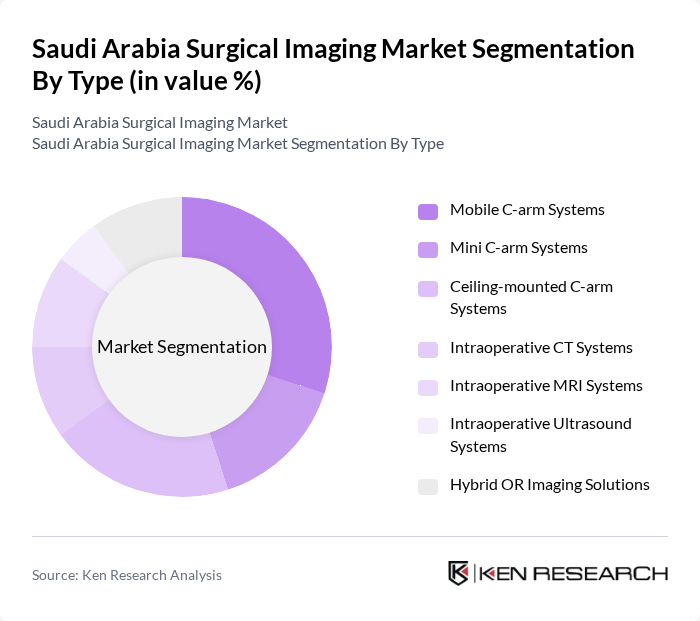

By Type:The market is segmented into various types of surgical imaging systems, including Mobile C-arm Systems, Mini C-arm Systems, Ceiling-mounted C-arm Systems, Intraoperative CT Systems, Intraoperative MRI Systems, Intraoperative Ultrasound Systems, and Hybrid OR Imaging Solutions. Among these, Mobile C-arm Systems are particularly popular due to their versatility, relatively lower capital cost compared to fixed systems, and ease of use in a wide range of surgical settings such as orthopedics, trauma, and cardiovascular procedures. The demand for these systems is driven by their ability to provide real-time fluoroscopic imaging during procedures, which enhances surgical precision, supports minimally invasive techniques, and can contribute to reduced complication rates and shorter patient recovery time.

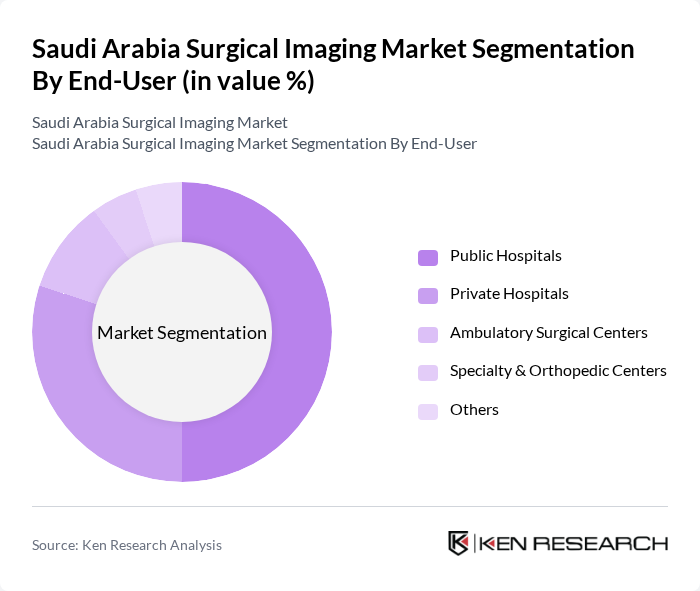

By End-User:The end-user segmentation includes Public Hospitals, Private Hospitals, Ambulatory Surgical Centers, Specialty & Orthopedic Centers, and Others. Public Hospitals are the leading end-users of surgical imaging systems, primarily due to sustained government investments in healthcare infrastructure, expansion of tertiary-care medical cities, and consolidation of services under the Health Holding Company. The increasing number of complex surgical procedures performed in these facilities, combined with centralized procurement programs and managed-service contracts with major imaging vendors, drives higher adoption of advanced imaging technologies in public hospitals and is further fueled by the need for improved patient outcomes, adherence to quality and safety standards, and operational efficiency.

The Saudi Arabia Surgical Imaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers AG, GE HealthCare Technologies Inc., Koninklijke Philips N.V., Canon Medical Systems Corporation, Ziehm Imaging GmbH, Shimadzu Corporation, FLUOROSCAN Imaging Systems (Hologic, Inc.), Medtronic plc, Stryker Corporation, Smith & Nephew plc, Orthofix Medical Inc., United Imaging Healthcare Co., Ltd., Samsung Medison Co., Ltd., Mindray Medical International Limited, Agfa-Gevaert Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the surgical imaging market in Saudi Arabia appears promising, driven by ongoing technological advancements and increased healthcare investments. The integration of artificial intelligence in imaging processes is expected to enhance diagnostic accuracy and efficiency. Additionally, the growing trend towards patient-centric care will likely lead to more personalized imaging solutions. As healthcare infrastructure continues to expand, the demand for innovative surgical imaging technologies will further solidify the market's growth trajectory in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile C-arm Systems Mini C-arm Systems Ceiling-mounted C-arm Systems Intraoperative CT Systems Intraoperative MRI Systems Intraoperative Ultrasound Systems Hybrid OR Imaging Solutions |

| By End-User | Public Hospitals Private Hospitals Ambulatory Surgical Centers Specialty & Orthopedic Centers Others |

| By Application | Orthopedic & Trauma Surgery Cardiovascular & Thoracic Surgery Neurosurgery & Spine Surgery Gastrointestinal & Urology Surgery Other Surgical Applications |

| By Technology | Flat-Panel Detector (FPD) Systems Image Intensifier Systems D Imaging Systems D / Advanced Imaging Systems |

| By Region | Central Region (incl. Riyadh) Western Region (incl. Makkah & Madinah) Eastern Region (incl. Dammam & Al Khobar) Southern & Northern Regions |

| By Investment Source | Government & Public Sector Funding Private Sector Investments Public-Private Partnership (PPP) Projects Others |

| By Policy Support | Vision 2030 & Health Sector Transformation Programs Localization & NUPCO / Group Purchasing Initiatives Incentives for Advanced Surgical & Hybrid OR Solutions Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Imaging Departments | 120 | Radiologists, Imaging Technologists |

| Private Surgical Centers | 90 | Surgical Directors, Procurement Managers |

| Healthcare Policy Makers | 40 | Health Ministry Officials, Regulatory Bodies |

| Medical Equipment Distributors | 80 | Sales Managers, Product Specialists |

| Academic Medical Institutions | 60 | Research Professors, Clinical Educators |

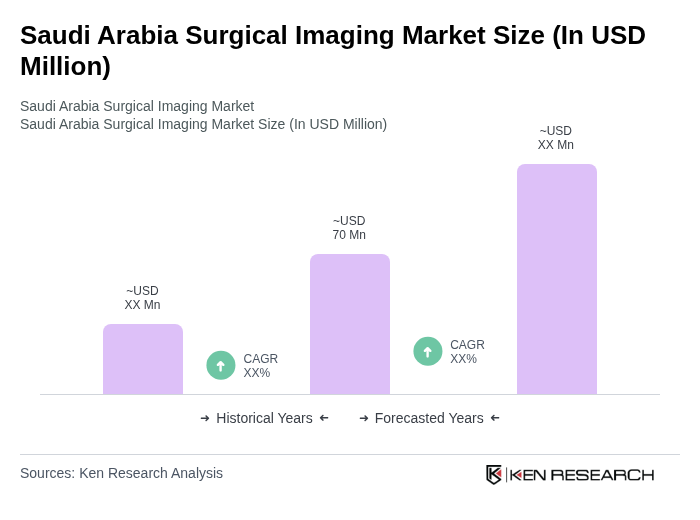

The Saudi Arabia Surgical Imaging Market is valued at approximately USD 70 million, driven by advancements in medical technology, an increase in surgical procedures, and a growing demand for minimally invasive surgeries.