Region:Middle East

Author(s):Dev

Product Code:KRAC4093

Pages:89

Published On:October 2025

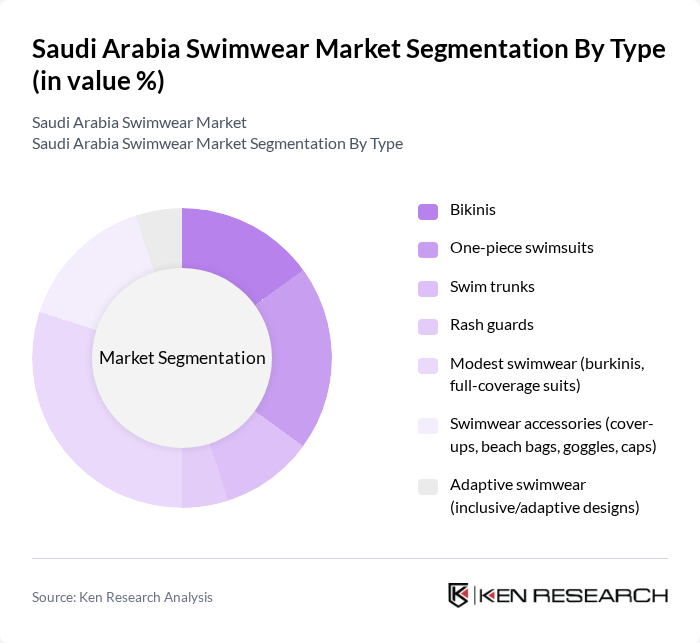

By Type:The swimwear market can be segmented into various types, including bikinis, one-piece swimsuits, swim trunks, rash guards, modest swimwear (burkinis, full-coverage suits), swimwear accessories (cover-ups, beach bags, goggles, caps), and adaptive swimwear (inclusive/adaptive designs). Among these, modest swimwear has gained significant traction due to cultural preferences and the increasing demand for inclusive options. The trend towards modesty in swimwear reflects a broader societal shift towards accommodating diverse consumer needs.

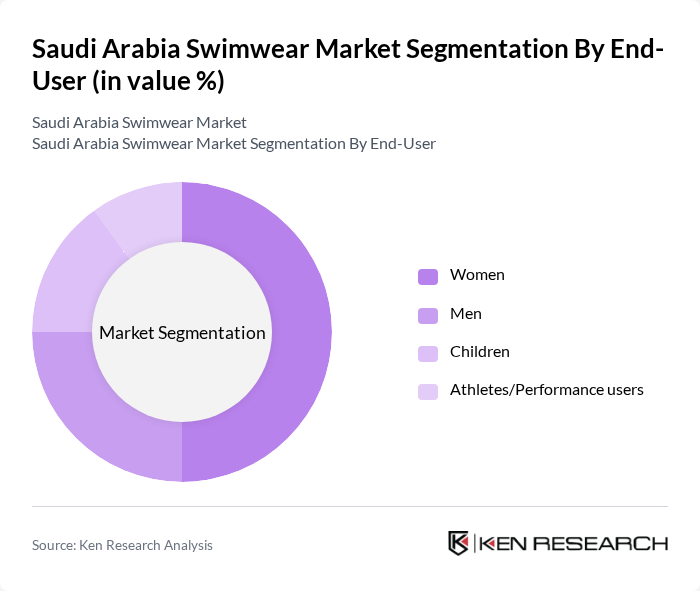

By End-User:The end-user segmentation includes women, men, children, and athletes/performance users. Women represent the largest segment due to the diverse range of swimwear styles available, catering to various preferences and body types. The increasing participation of women in sports and recreational activities has further fueled this demand. Additionally, the rise of social media influencers promoting swimwear trends has significantly impacted consumer choices.

The Saudi Arabia Swimwear Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Haramain Swimwear, Al Mufeed Swimwear, Speedo International Ltd., Arena S.p.A., Zoggs International Ltd., Decathlon S.A., O'Neill, Billabong (Boardriders, Inc.), Roxy (Boardriders, Inc.), Nike, Inc. (Nike Swim), Adidas AG (Adidas Swim), H&M Group, ASOS plc, Modanisa, Modest Swimwear Co. contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia swimwear market is poised for significant transformation, driven by evolving consumer preferences and increased participation in water-related activities. As the government continues to promote tourism and recreational sports, the demand for diverse swimwear options is expected to rise. Additionally, the integration of technology in fabric production and a growing emphasis on sustainability will likely shape future offerings. Brands that adapt to these trends and cater to local cultural preferences will be well-positioned to thrive in this dynamic market landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Bikinis One-piece swimsuits Swim trunks Rash guards Modest swimwear (burkinis, full-coverage suits) Swimwear accessories (cover-ups, beach bags, goggles, caps) Adaptive swimwear (inclusive/adaptive designs) |

| By End-User | Women Men Children Athletes/Performance users |

| By Distribution Channel | Online retail (e-commerce platforms, brand websites) Specialty swimwear stores Department stores Supermarkets & hypermarkets Resort and hotel boutiques Others |

| By Price Range | Budget Mid-range Premium/luxury |

| By Fabric Type | Polyester Nylon Spandex/elastane Recycled/eco-friendly materials |

| By Occasion | Recreational swimming Competitive swimming Beach vacations Water sports Resort/leisure wear |

| By Brand Loyalty | Brand loyal customers Price-sensitive customers Trend-driven customers Sustainability-focused customers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Swimwear Sales | 100 | Store Managers, Retail Buyers |

| Consumer Preferences Survey | 120 | General Consumers, Swimwear Shoppers |

| Online Swimwear Purchases | 80 | E-commerce Managers, Digital Marketing Specialists |

| Tourism Impact Analysis | 60 | Travel Agents, Tour Operators |

| Fashion Trends Insights | 50 | Fashion Designers, Trend Analysts |

The Saudi Arabia Swimwear Market is valued at approximately USD 330 million, reflecting a significant growth trend driven by increased participation in water sports, rising tourism, and heightened awareness of health and fitness among the population.