Region:Middle East

Author(s):Dev

Product Code:KRAB7077

Pages:92

Published On:October 2025

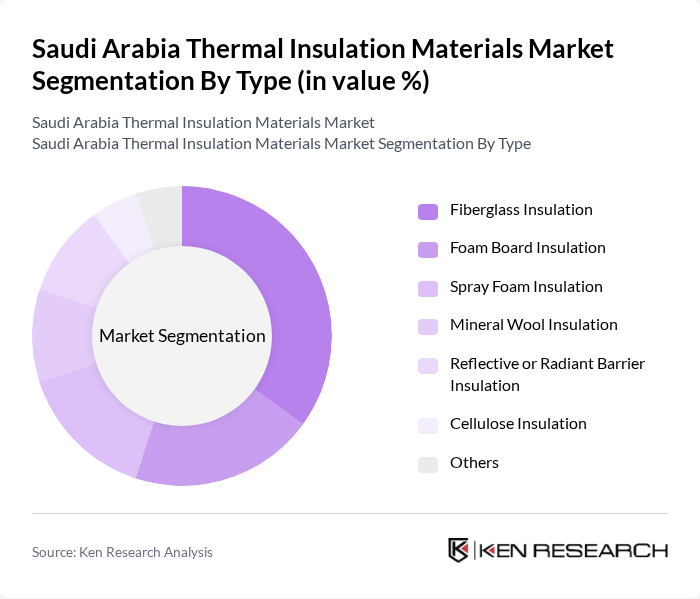

By Type:The market is segmented into various types of thermal insulation materials, each catering to different applications and consumer preferences. The primary types include Fiberglass Insulation, Foam Board Insulation, Spray Foam Insulation, Mineral Wool Insulation, Reflective or Radiant Barrier Insulation, Cellulose Insulation, and Others. Among these, Fiberglass Insulation is the most widely used due to its cost-effectiveness and excellent thermal performance, making it a preferred choice for both residential and commercial applications.

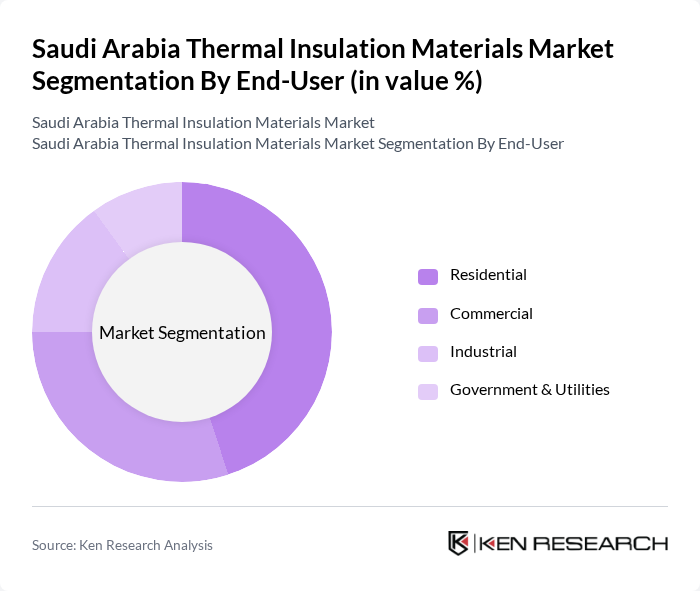

By End-User:The thermal insulation materials market is segmented by end-user into Residential, Commercial, Industrial, and Government & Utilities. The Residential segment holds the largest share, driven by the increasing number of housing projects and the growing trend of energy-efficient homes. The Commercial sector follows closely, with businesses seeking to reduce energy costs and enhance comfort for occupants.

The Saudi Arabia Thermal Insulation Materials Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Rockwool Factory, Al-Fanar Insulation, Saudi Insulation Company, Kingspan Insulation, BASF Saudi Arabia, Owens Corning, Saint-Gobain, Knauf Insulation, Armacell International, Rockwool International, Isover, Thermafiber, Urethane Foam Products, Sika AG, 3M Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the thermal insulation materials market in Saudi Arabia appears promising, driven by increasing regulatory support and a shift towards sustainable construction practices. As the government continues to implement energy efficiency standards, the demand for innovative insulation solutions is expected to rise. Additionally, the integration of smart technologies in building designs will further enhance the performance of insulation materials, creating new opportunities for manufacturers and suppliers in the market.

| Segment | Sub-Segments |

|---|---|

| By Type | Fiberglass Insulation Foam Board Insulation Spray Foam Insulation Mineral Wool Insulation Reflective or Radiant Barrier Insulation Cellulose Insulation Others |

| By End-User | Residential Commercial Industrial Government & Utilities |

| By Application | Roof Insulation Wall Insulation Floor Insulation HVAC Insulation Pipe Insulation Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Retail Stores |

| By Material Source | Domestic Production Imported Materials |

| By Price Range | Low Price Mid Price High Price |

| By Policy Support | Subsidies Tax Exemptions Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Building Projects | 100 | Project Managers, Architects |

| Commercial Construction | 80 | Construction Managers, Engineers |

| Industrial Facility Insulation | 70 | Facility Managers, Procurement Officers |

| Government Infrastructure Projects | 60 | Policy Makers, Urban Planners |

| Retail Sector Insulation Needs | 50 | Store Managers, Operations Directors |

The Saudi Arabia Thermal Insulation Materials Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing demand for energy-efficient building solutions and government initiatives promoting sustainable construction.