Region:Middle East

Author(s):Shubham

Product Code:KRAC4281

Pages:92

Published On:October 2025

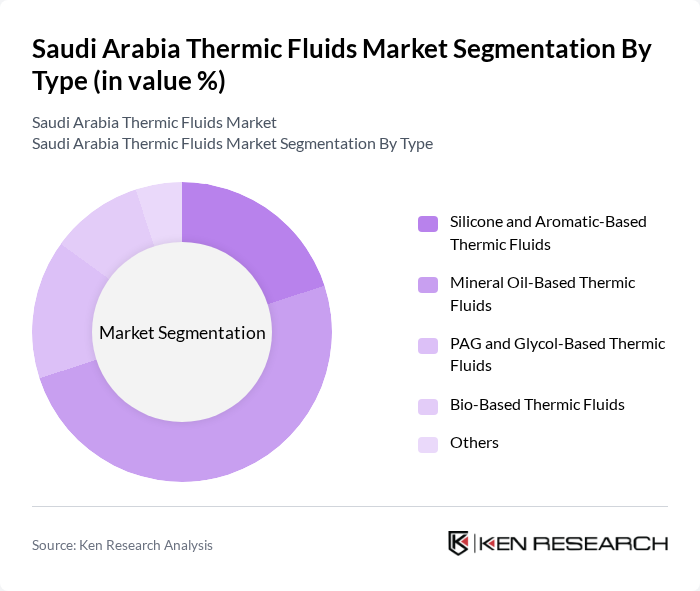

By Type:The thermic fluids market is segmented into Silicone and Aromatic-Based Thermic Fluids, Mineral Oil-Based Thermic Fluids, PAG and Glycol-Based Thermic Fluids, Bio-Based Thermic Fluids, and Others.Mineral Oil-Based Thermic Fluidsremain the most widely used, attributed to their cost-effectiveness, wide temperature range, and excellent thermal stability, making them suitable for diverse industrial applications .

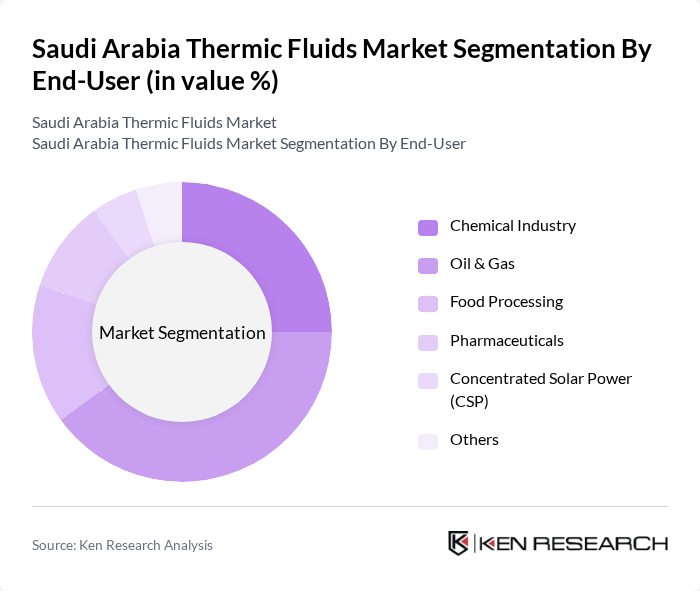

By End-User:End-user segmentation includes Chemical, Oil & Gas, Food Processing, Pharmaceuticals, Concentrated Solar Power (CSP), and Others. TheOil & Gas sectoris the leading end-user, driven by the demand for efficient heat transfer solutions in refining, petrochemical, and gas processing operations, where high-performance thermic fluids are critical for process reliability and energy efficiency .

The Saudi Arabia Thermic Fluids Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Basic Industries Corporation (SABIC), Saudi Aramco, Al Swaidi Industrial Services, Gulf Thermic Fluids, Therminol (Solutia), Dow Chemical Company, Eastman Chemical Company, Chevron Phillips Chemical Company, Solvay S.A., Huntsman Corporation, BASF SE, ExxonMobil Chemical, TotalEnergies, Clariant AG, INEOS Group contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi Arabia thermic fluids market is poised for significant growth, driven by increasing industrialization and a strong push for energy efficiency. As the government continues to invest in renewable energy and sustainable practices, the demand for innovative thermic fluid solutions is expected to rise. Additionally, advancements in technology and a growing focus on research and development will likely lead to the introduction of more efficient and eco-friendly thermic fluids, further enhancing market dynamics and opportunities for growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Silicone and Aromatic-Based Thermic Fluids Mineral Oil-Based Thermic Fluids PAG and Glycol-Based Thermic Fluids Bio-Based Thermic Fluids Others |

| By End-User | Chemical Industry Oil & Gas Food Processing Pharmaceuticals Concentrated Solar Power (CSP) Others |

| By Application | Heating Systems Cooling Systems Thermal Energy Storage CSP Systems Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Sector Thermic Fluid Usage | 45 | Process Engineers, Operations Managers |

| Chemical Processing Applications | 38 | Production Supervisors, R&D Managers |

| Food Production Thermal Management | 32 | Quality Control Managers, Plant Managers |

| Renewable Energy Sector Insights | 28 | Project Managers, Technical Directors |

| Manufacturing Industry Thermic Fluid Needs | 42 | Supply Chain Managers, Facility Managers |

The Saudi Arabia Thermic Fluids Market is valued at approximately USD 110 million, driven by industrial investments in sectors such as oil and gas, chemicals, and food processing, which increasingly utilize advanced thermal systems for energy efficiency and operational safety.