Region:Asia

Author(s):Geetanshi

Product Code:KRAA0497

Pages:89

Published On:December 2025

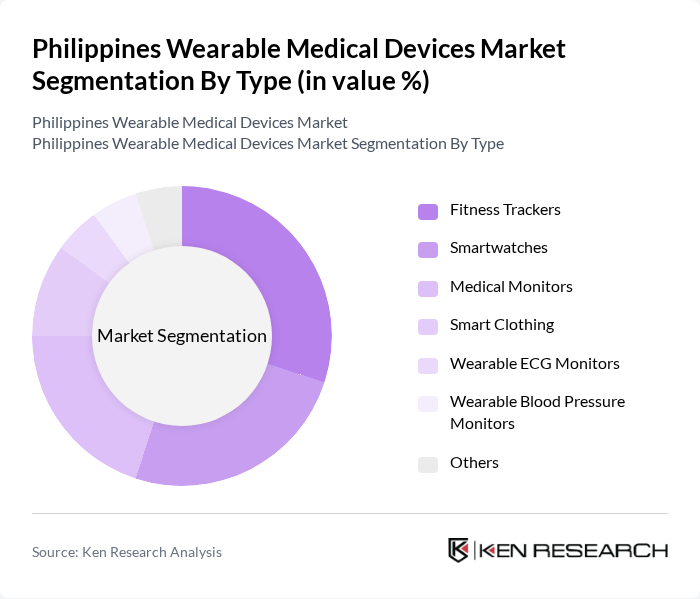

By Type:The wearable medical devices market is segmented into various types, including fitness trackers, smartwatches, medical monitors, smart clothing, wearable ECG monitors, wearable blood pressure monitors, and others. Among these, fitness trackers and smartwatches are leading the market due to their popularity among health-conscious consumers and their ability to provide real-time health data. The increasing trend of health and fitness awareness, coupled with technological advancements, has significantly contributed to the growth of these segments.

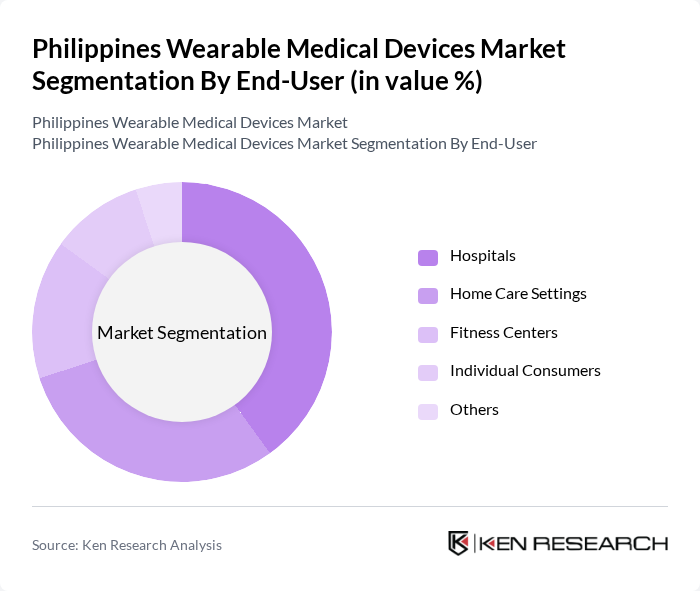

By End-User:The end-user segmentation includes hospitals, home care settings, fitness centers, individual consumers, and others. Hospitals and home care settings dominate the market due to the increasing need for remote patient monitoring and chronic disease management. The rise in healthcare costs and the demand for efficient patient care solutions have led to a growing preference for wearable medical devices in these settings.

The Philippines Wearable Medical Devices Market is characterized by a dynamic mix of regional and international players. Leading participants such as Philips Healthcare, Fitbit (now part of Google), Garmin, Apple Inc., Samsung Electronics, Xiaomi, Huawei Technologies, Withings, Omron Healthcare, AliveCor, BioTelemetry, Medtronic, Abbott Laboratories, Dexcom, iHealth Labs contribute to innovation, geographic expansion, and service delivery in this space.

The future of the wearable medical devices market in the Philippines appears promising, driven by digital transformation initiatives and increasing health awareness among consumers. The enactment of the E-Governance Act is expected to enhance the integration of digital health frameworks, facilitating the adoption of telehealth-enabled devices. Additionally, investments in infrastructure by international organizations will bolster connectivity, supporting the growth of wearable technologies. As the population becomes more tech-savvy, the demand for innovative health solutions is likely to rise, further propelling market expansion.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness Trackers Smartwatches Medical Monitors Smart Clothing Wearable ECG Monitors Wearable Blood Pressure Monitors Others |

| By End-User | Hospitals Home Care Settings Fitness Centers Individual Consumers Others |

| By Age Group | Children Adults Seniors Others |

| By Health Condition | Diabetes Management Cardiovascular Monitoring Respiratory Health General Wellness Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Others |

| By Technology | Bluetooth Enabled Devices Wi-Fi Enabled Devices Cellular Enabled Devices Others |

| By Price Range | Budget-Friendly Devices Mid-Range Devices Premium Devices Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 150 | Doctors, Nurses, Health Technologists |

| Patients Using Wearable Devices | 200 | Chronic Disease Patients, Fitness Enthusiasts |

| Device Manufacturers | 100 | Product Managers, R&D Heads |

| Healthcare Policy Makers | 80 | Government Officials, Health Administrators |

| Technology Developers | 70 | Software Engineers, Product Designers |

The Philippines Wearable Medical Devices Market is valued at approximately USD 188 billion, driven by the increasing prevalence of chronic illnesses and consumer demand for continuous health tracking through advanced technologies like biosensors and AI analytics.