Region:Middle East

Author(s):Shubham

Product Code:KRAC2877

Pages:98

Published On:October 2025

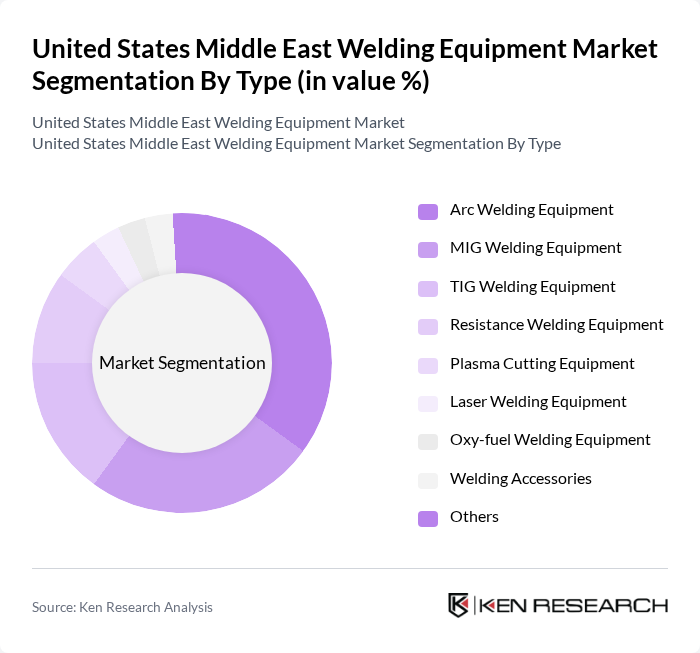

By Type:

The market is segmented into various types of welding equipment, including Arc Welding Equipment, MIG Welding Equipment, TIG Welding Equipment, Resistance Welding Equipment, Plasma Cutting Equipment, Laser Welding Equipment, Oxy-fuel Welding Equipment, Welding Accessories, and Others. Among these,Arc Welding Equipmentremains the dominant segment due to its versatility and widespread application in industries such as automotive, construction, and shipbuilding. The increasing adoption of automated welding processes and the demand for high-quality welds in manufacturing and infrastructure projects further bolster the growth of this segment. Additionally, the trend towards energy-efficient and cost-effective welding solutions is driving the preference for Arc Welding Equipment .

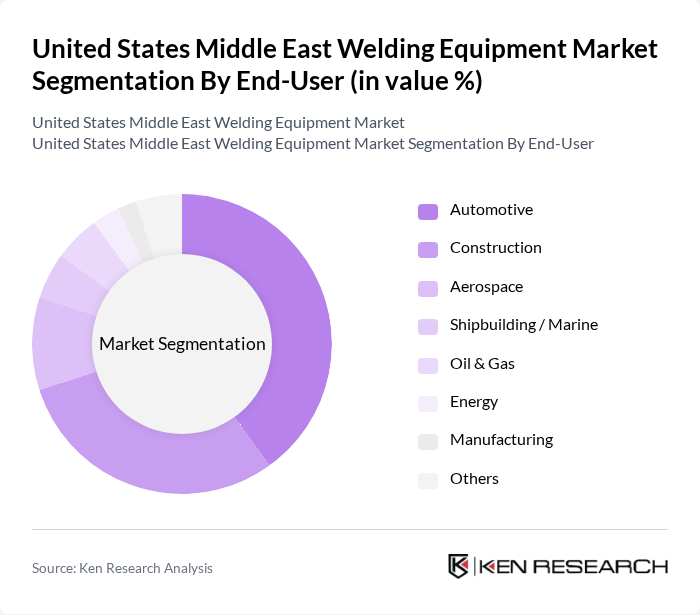

By End-User:

The end-user segmentation includes Automotive, Construction, Aerospace, Shipbuilding/Marine, Oil & Gas, Energy, Manufacturing, and Others. TheAutomotivesector is the leading end-user, driven by increasing vehicle production and the need for high-quality welding in automotive assembly lines. The construction industry follows closely, fueled by ongoing infrastructure projects and the demand for durable and reliable welding solutions. Aerospace and shipbuilding sectors also contribute significantly, as they require specialized welding equipment to meet stringent safety and quality standards. The oil & gas and energy sectors are experiencing steady growth due to investments in new facilities and maintenance of existing infrastructure .

The United States Middle East Welding Equipment Market is characterized by a dynamic mix of regional and international players. Leading participants such as Lincoln Electric Holdings, Inc., Miller Electric Mfg. LLC (ITW), ESAB Corporation, Hobart Brothers LLC (ITW), Panasonic Welding Systems Co., Ltd., 3M Company, KUKA AG, OTC Daihen Inc., Fronius International GmbH, ARO Welding Technologies SAS, Victor Technologies International, Inc. (ESAB), Weldability Sif, CEA S.p.A., Lorch Schweißtechnik GmbH, TWI Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the welding equipment market in the United States is poised for significant transformation, driven by technological advancements and a focus on sustainability. As industries increasingly adopt smart welding solutions, the integration of IoT and AI technologies will enhance operational efficiency. Additionally, the growing emphasis on eco-friendly practices will lead to the development of sustainable welding solutions, aligning with global environmental goals. These trends are expected to reshape the market landscape, fostering innovation and competitiveness.

| Segment | Sub-Segments |

|---|---|

| By Type | Arc Welding Equipment MIG Welding Equipment TIG Welding Equipment Resistance Welding Equipment Plasma Cutting Equipment Laser Welding Equipment Oxy-fuel Welding Equipment Welding Accessories Others |

| By End-User | Automotive Construction Aerospace Shipbuilding / Marine Oil & Gas Energy Manufacturing Others |

| By Application | Structural Welding Fabrication Maintenance and Repair Production Welding Others |

| By Sales Channel | Direct Sales Distributors Online Sales Retail Stores Others |

| By Distribution Mode | Wholesale Retail E-commerce Direct Delivery Others |

| By Price Range | Low-End Equipment Mid-Range Equipment High-End Equipment Others |

| By Brand Preference | Established Brands Emerging Brands Private Labels Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Construction Industry Welding Equipment | 120 | Project Managers, Site Supervisors |

| Automotive Manufacturing Welding Solutions | 95 | Production Managers, Quality Control Engineers |

| Aerospace Welding Technologies | 75 | Engineering Managers, R&D Specialists |

| Shipbuilding and Marine Welding Equipment | 65 | Procurement Officers, Operations Managers |

| Welding Equipment Distribution Channels | 85 | Sales Managers, Supply Chain Coordinators |

The United States Middle East Welding Equipment Market is valued at approximately USD 1.13 billion, reflecting a five-year historical analysis that highlights significant growth driven by advanced welding technologies and infrastructure projects in the region.