Region:Middle East

Author(s):Dev

Product Code:KRAD5246

Pages:89

Published On:December 2025

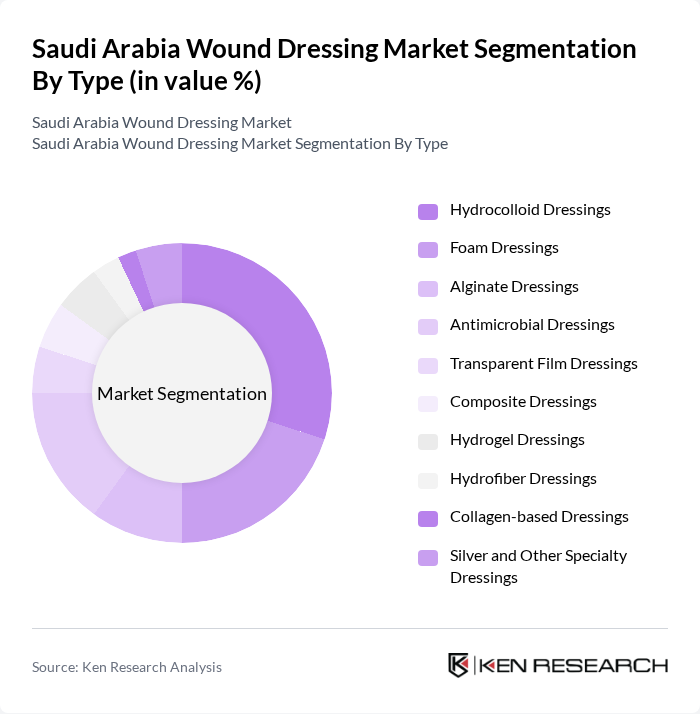

By Type:The market is segmented into various types of wound dressings, including Hydrocolloid Dressings, Foam Dressings, Alginate Dressings, Antimicrobial Dressings, Transparent Film Dressings, Composite Dressings, Hydrogel Dressings, Hydrofiber Dressings, Collagen-based Dressings, and Silver and Other Specialty Dressings. Among these, Hydrocolloid Dressings are leading the market due to their versatility and effectiveness in managing various wound types. Their ability to maintain a moist environment while providing a barrier against external contaminants makes them a preferred choice among healthcare professionals. The increasing adoption of these dressings in both hospital and home care settings is driving their market share.

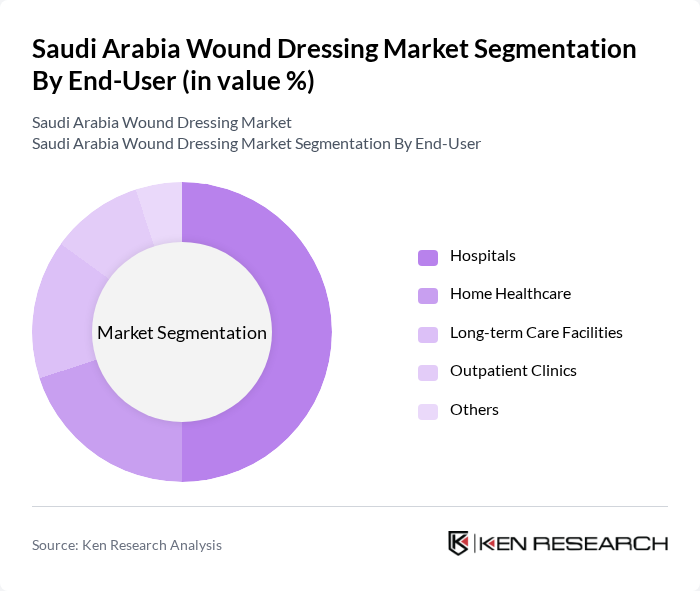

By End-User:The end-user segmentation includes Hospitals, Home Healthcare, Long-term Care Facilities, Outpatient Clinics, and Others. Hospitals are the dominant end-user segment, accounting for a significant portion of the market share. This is attributed to the high volume of surgical procedures and the need for advanced wound care solutions in hospital settings. The increasing number of hospitals and healthcare facilities in urban areas further supports the growth of this segment, as they require a wide range of wound dressing products to cater to diverse patient needs.

The Saudi Arabia Wound Dressing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Johnson & Johnson (Ethicon), 3M Company, Smith & Nephew plc, Mölnlycke Health Care AB, Paul Hartmann AG, B. Braun Melsungen AG, ConvaTec Group plc, Coloplast A/S, Medline Industries LP, Medtronic plc, Baxter International Inc., Derma Sciences (Integra LifeSciences), KCI Licensing, Inc. (Acelity, part of 3M), BSN Medical (Essity), Local and Regional Distributors (e.g., Tamer Group, Nupco, others) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia wound dressing market appears promising, driven by ongoing advancements in healthcare infrastructure and technology. As the government invests in healthcare facilities, the accessibility of advanced wound care products is expected to improve. Additionally, the integration of digital health technologies will enhance patient monitoring and treatment efficacy. These trends indicate a shift towards more personalized and effective wound management solutions, positioning the market for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Hydrocolloid Dressings Foam Dressings Alginate Dressings Antimicrobial Dressings Transparent Film Dressings Composite Dressings Hydrogel Dressings Hydrofiber Dressings Collagen-based Dressings Silver and Other Specialty Dressings |

| By End-User | Hospitals Home Healthcare Long-term Care Facilities Outpatient Clinics Others |

| By Application | Chronic Ulcers (Diabetic Foot Ulcers, Venous Leg Ulcers, Pressure Ulcers) Surgical Wounds Traumatic Wounds Burn Wounds Others |

| By Distribution Channel | Direct Sales to Healthcare Facilities Medical Supply Distributors Pharmacies Online Retail Others |

| By Region | Central Region (including Riyadh) Eastern Region (including Dammam, Khobar) Western Region (including Jeddah, Mecca) Southern Region |

| By Product Formulation | Moist Dressings Antimicrobial Formulations Active/Bioactive Dressings Non-antimicrobial Conventional Dressings |

| By Material | Synthetic Materials Natural Materials Biodegradable and Hybrid Materials |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Wound Care Departments | 100 | Wound Care Specialists, Nursing Staff |

| Medical Supply Distributors | 80 | Sales Managers, Product Line Managers |

| Pharmaceutical Companies with Wound Care Products | 70 | Product Development Managers, Regulatory Affairs Specialists |

| Outpatient Clinics and Rehabilitation Centers | 60 | Clinic Managers, Physical Therapists |

| Healthcare Policy Makers | 50 | Health Economists, Policy Analysts |

The Saudi Arabia Wound Dressing Market is valued at approximately USD 130 million, reflecting a significant growth driven by the increasing prevalence of chronic wounds, surgical procedures, and a rising geriatric population.