Region:Asia

Author(s):Geetanshi

Product Code:KRAA1312

Pages:100

Published On:August 2025

By Type:The cybersecurity market in Singapore is segmented into Network Security, Application Security, Endpoint Security, Cloud Security, Data Security, Identity and Access Management, Threat Intelligence Solutions, and Others. Each segment addresses specific security challenges, with organizations increasingly adopting integrated solutions to counter sophisticated threats. Notably, the adoption of threat intelligence platforms is rising as organizations seek real-time insights to proactively identify and mitigate risks .

The Network Security segment is currently dominating the market, driven by the increasing need for organizations to protect their networks from unauthorized access, advanced persistent threats, and ransomware. The rise of remote work, cloud adoption, and the proliferation of connected devices have intensified demand for advanced network security technologies, including next-generation firewalls, intrusion detection and prevention systems, and secure VPNs. Enterprises are prioritizing network security to ensure business continuity and regulatory compliance .

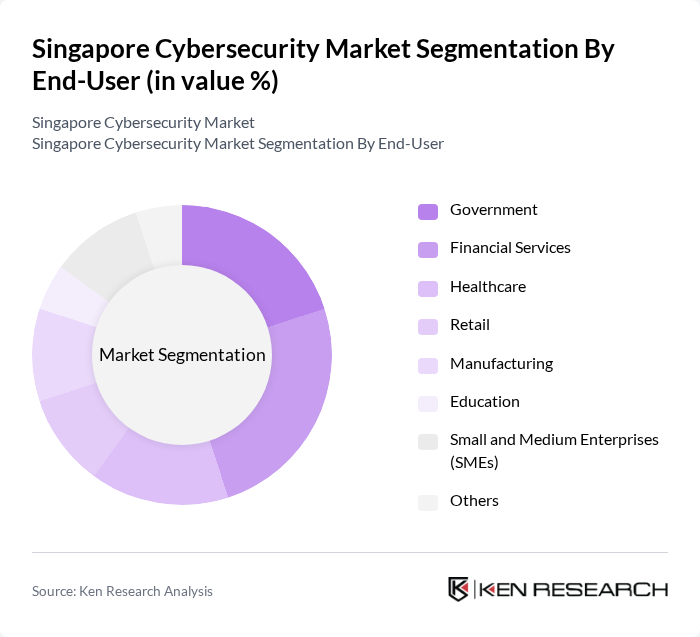

By End-User:The end-user segmentation includes Government, Financial Services, Healthcare, Retail, Manufacturing, Education, Small and Medium Enterprises (SMEs), and Others. Each sector faces unique cybersecurity risks, with critical infrastructure, financial institutions, and SMEs increasingly targeted by sophisticated cyberattacks. Regulatory compliance, digital transformation, and the need for sector-specific security solutions drive demand across these segments .

The Financial Services sector leads the end-user market, accounting for the largest share of cybersecurity spending. This is attributed to the high value of sensitive data, stringent regulatory requirements set by authorities such as the Monetary Authority of Singapore (MAS), and the sector's reliance on digital transactions and online platforms. The increasing sophistication of cyber threats targeting banks and financial services has prompted significant investments in advanced security solutions to protect customer data, ensure regulatory compliance, and maintain consumer trust .

The Singapore Cybersecurity Market is characterized by a dynamic mix of regional and international players. Leading participants such as ST Engineering, Singtel, Ensign InfoSecurity, Quann (subsidiary of Certis Group), CyberArk Software Ltd., Palo Alto Networks, Fortinet, Check Point Software Technologies, Trend Micro, Cisco Systems, IBM Security, McAfee, FireEye (now Trellix), RSA Security, CrowdStrike, Splunk, Darktrace, V-Key, Horangi Cyber Security, Kaspersky contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Singapore cybersecurity market is poised for significant evolution, driven by technological advancements and regulatory changes. As organizations increasingly adopt zero trust security models, the integration of AI and machine learning into cybersecurity practices will enhance threat detection and response capabilities. Furthermore, the rise of cyber insurance will provide businesses with additional risk management tools, fostering a more resilient cybersecurity landscape. Continuous government support and investment in cybersecurity initiatives will further solidify Singapore's position as a regional cybersecurity hub.

| Segment | Sub-Segments |

|---|---|

| By Type | Network Security Application Security Endpoint Security Cloud Security Data Security Identity and Access Management Threat Intelligence Solutions Others |

| By End-User | Government Financial Services Healthcare Retail Manufacturing Education Small and Medium Enterprises (SMEs) Others |

| By Industry Vertical | Banking, Financial Services, and Insurance (BFSI) Telecommunications Energy and Utilities Transportation and Logistics Government and Defense IT & Technology Others |

| By Deployment Mode | On-Premises Cloud-Based Hybrid |

| By Service Type | Consulting Services Managed Security Services Training and Education Incident Response & Forensics |

| By Compliance Standards | ISO/IEC 27001 NIST Cybersecurity Framework PCI DSS MAS TRM Guidelines |

| By Pricing Model | Subscription-Based Pay-Per-Use One-Time License Fee |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Financial Sector Cybersecurity | 60 | Chief Information Security Officers, IT Risk Managers |

| Healthcare Data Protection | 45 | Healthcare IT Directors, Compliance Officers |

| Government Cybersecurity Initiatives | 40 | Policy Makers, Cybersecurity Program Managers |

| SME Cybersecurity Solutions | 50 | IT Managers, Business Owners |

| Cybersecurity Training and Awareness | 40 | Training Coordinators, HR Managers |

The Singapore Cybersecurity Market is valued at approximately USD 1.3 billion, reflecting significant growth driven by increasing cyber threats, rapid digitalization, and government initiatives to enhance national cybersecurity infrastructure.