Singapore Digital Asset Custody and Tokenization Market Overview

- The Singapore Digital Asset Custody and Tokenization Market is valued at USD 1.3 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of blockchain technology, rising demand for secure digital asset management, and the growing interest in tokenization of traditional assets. The market is also supported by a robust regulatory framework that encourages innovation and investment in digital assets .

- Singapore is a dominant player in the digital asset custody and tokenization market, primarily due to its strategic location as a financial hub in Asia, a favorable regulatory environment, and a strong technological infrastructure. The city-state attracts numerous fintech companies and institutional investors, making it a leading destination for digital asset services. Other notable countries in the region include Hong Kong and Japan, which also contribute significantly to the market .

- The Financial Services and Markets Act (FSMA), issued by the Monetary Authority of Singapore in 2022, requires all Digital Token Service Providers to obtain a license and comply with operational standards, including minimum capital requirements, local compliance officers, annual audits, anti-money laundering and counter-terrorism financing controls, and cybersecurity protocols. This regulation establishes a secure and transparent environment for digital asset transactions, fostering trust and supporting the growth of the digital asset ecosystem in Singapore .

Singapore Digital Asset Custody and Tokenization Market Segmentation

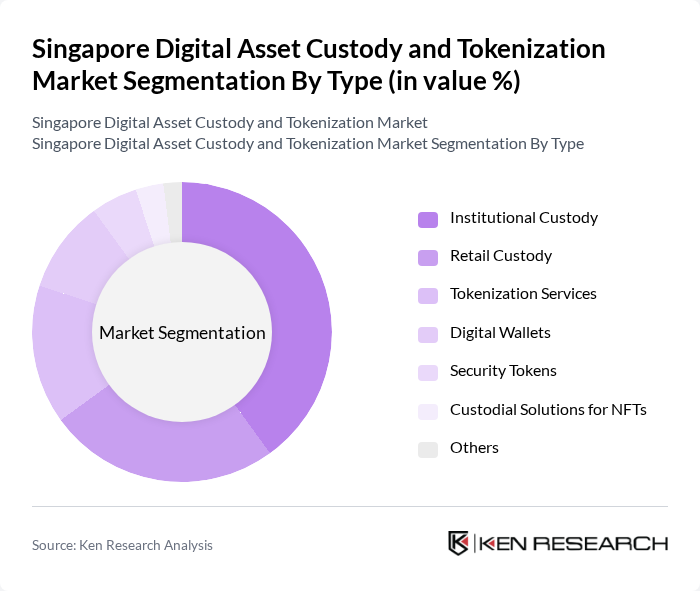

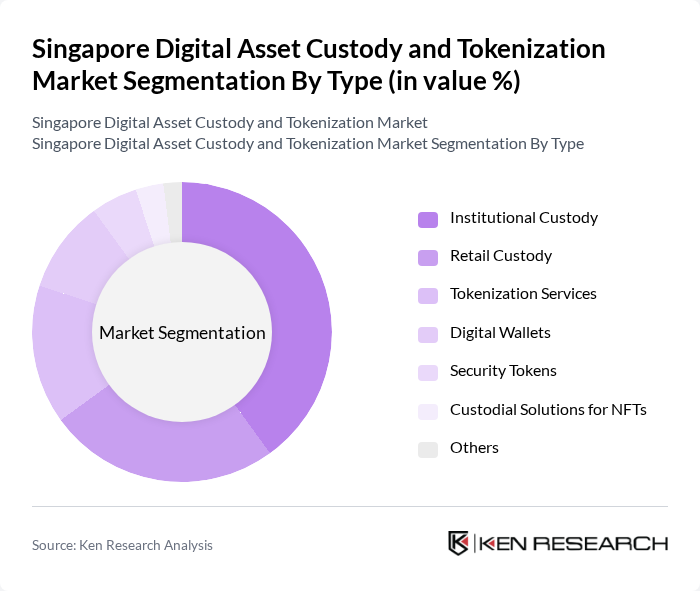

By Type:The market is segmented into various types, including Institutional Custody, Retail Custody, Tokenization Services, Digital Wallets, Security Tokens, Custodial Solutions for NFTs, and Others. Among these, Institutional Custody is currently the leading sub-segment, driven by the increasing demand from financial institutions and asset managers for secure and compliant storage solutions for digital assets. Retail Custody and Tokenization Services are also gaining traction as more individual investors and businesses explore digital asset opportunities .

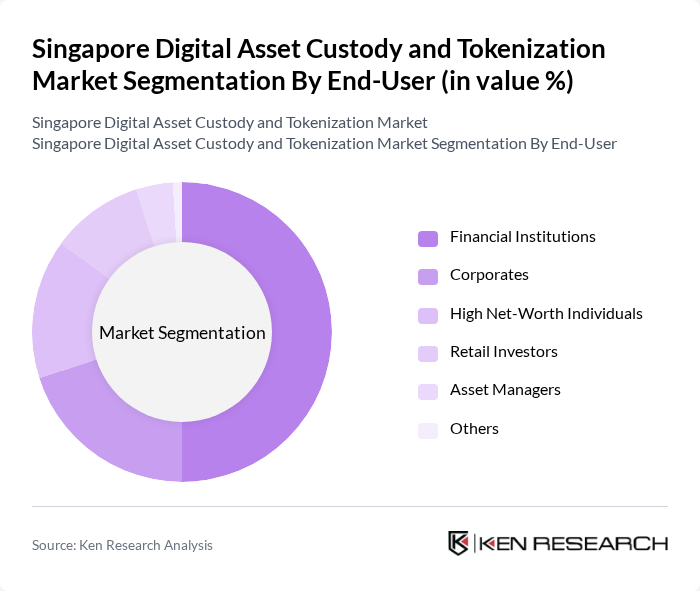

By End-User:The end-user segmentation includes Financial Institutions, Corporates, High Net-Worth Individuals, Retail Investors, Asset Managers, and Others. Financial Institutions dominate this segment, as they require robust custody solutions to manage large volumes of digital assets securely. Corporates and High Net-Worth Individuals are also increasingly engaging in digital asset investments, contributing to the growth of this market segment .

Singapore Digital Asset Custody and Tokenization Market Competitive Landscape

The Singapore Digital Asset Custody and Tokenization Market is characterized by a dynamic mix of regional and international players. Leading participants such as DBS Bank, Standard Chartered, OSL, Hex Trust, Fidelity Digital Assets, Coinbase Custody, BitGo, Anchorage Digital, Gemini Trust Company, Zodia Custody, Cobo, Safeheron, Fireblocks, Ledger Vault, Komainu, Amber Group, Atato, Zecrey Protocol, SynFutures, SEBA Bank, Julius Baer, State Street, BNY Mellon contribute to innovation, geographic expansion, and service delivery in this space.

Singapore Digital Asset Custody and Tokenization Market Industry Analysis

Growth Drivers

- Increasing Institutional Adoption:The Singapore digital asset custody market is witnessing a surge in institutional adoption, with over 200 financial institutions actively exploring blockchain technology. According to the Monetary Authority of Singapore (MAS), the number of licensed digital asset service providers increased by 30% in the future, indicating a robust interest from traditional finance. This trend is supported by a 15% rise in institutional investments in digital assets, reflecting a growing confidence in the security and potential of blockchain solutions.

- Regulatory Clarity and Support:Singapore's regulatory framework has become increasingly supportive, with the MAS issuing clear guidelines for digital asset custody services. In the future, the MAS reported a 25% increase in applications for digital asset licenses, demonstrating the positive impact of regulatory clarity. Furthermore, the government allocated SGD 10 million to support blockchain innovation, fostering an environment conducive to growth and attracting global players to the Singapore market.

- Rising Demand for Security in Digital Assets:As digital asset investments grow, so does the demand for secure custody solutions. A report by Chainalysis indicated that the total value of digital assets held in custody reached USD 50 billion in the future, up from USD 30 billion previously. This increase highlights the urgent need for robust security measures, driving innovation in custody solutions and attracting investments from both institutional and retail investors seeking to safeguard their assets.

Market Challenges

- Regulatory Compliance Complexity:Despite regulatory advancements, compliance remains a significant challenge for digital asset custodians. The MAS has implemented stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations, which require custodians to invest heavily in compliance infrastructure. In the future, compliance costs for digital asset firms rose by 20%, straining resources and potentially hindering growth, especially for smaller players in the market.

- Cybersecurity Threats:The digital asset sector is increasingly targeted by cybercriminals, with reported incidents of hacking and theft rising by 40% in the future. According to cybersecurity firm CipherTrace, losses from digital asset theft reached USD 3 billion globally, raising concerns about the security of custody solutions. This environment of heightened risk necessitates continuous investment in cybersecurity measures, which can be a financial burden for custodians, particularly startups.

Singapore Digital Asset Custody and Tokenization Market Future Outlook

The future of the Singapore digital asset custody and tokenization market appears promising, driven by ongoing technological advancements and increasing institutional interest. As regulatory frameworks continue to evolve, firms are likely to innovate their custody solutions, enhancing security and efficiency. Additionally, the growing trend of tokenization across various asset classes, including real estate and art, is expected to create new avenues for investment and custody services, further solidifying Singapore's position as a leading hub for digital assets in Asia.

Market Opportunities

- Expansion of Tokenized Assets:The tokenization of traditional assets presents a significant opportunity for growth. In the future, the total value of tokenized assets in Singapore reached USD 5 billion, with projections indicating a potential increase to USD 15 billion in the coming years. This trend offers custodians the chance to diversify their service offerings and attract a broader client base seeking innovative investment solutions.

- Partnerships with Financial Institutions:Collaborations between digital asset custodians and traditional financial institutions are on the rise. In the future, over 50 partnerships were formed, enabling custodians to leverage established networks and client bases. These partnerships can enhance service credibility and expand market reach, positioning custodians to capitalize on the growing demand for integrated financial services that include digital asset custody.