Region:Central and South America

Author(s):Geetanshi

Product Code:KRAB3392

Pages:90

Published On:October 2025

By Type:The market is segmented into various types, including Custody Services, Tokenization Platforms, Asset Management Solutions, Compliance and Regulatory Solutions, Security Solutions, Consulting Services, and Others. Among these, Custody Services and Tokenization Platforms are the most prominent, driven by the increasing need for secure storage and management of digital assets, as well as the growing trend of asset tokenization across various sectors.

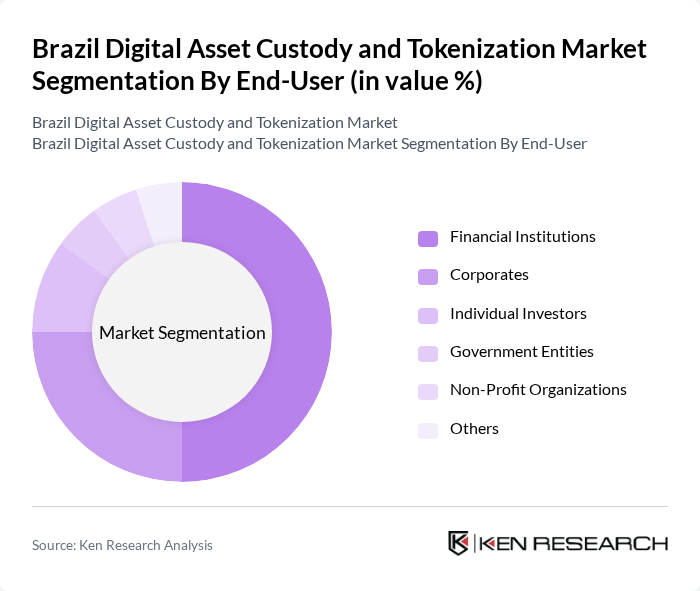

By End-User:The end-user segmentation includes Financial Institutions, Corporates, Individual Investors, Government Entities, Non-Profit Organizations, and Others. Financial Institutions and Corporates are the leading segments, as they increasingly seek to leverage digital assets for investment and operational efficiencies, driving demand for custody and tokenization services.

The Brazil Digital Asset Custody and Tokenization Market is characterized by a dynamic mix of regional and international players. Leading participants such as Banco BTG Pactual S.A., Mercado Bitcoin, Hashdex, Foxbit, Bitso, Binance Brasil, CoinBR, NovaDAX, Zro Bank, Alterbank, Bitcambio, BitcoinTrade, Sicoob, PagSeguro, Banco do Brasil S.A., BitGo Brasil Tecnologia Ltda., Itaú Unibanco S.A., Nubank contribute to innovation, geographic expansion, and service delivery in this space.

The future of Brazil's digital asset custody and tokenization market appears promising, driven by increasing institutional participation and regulatory advancements. As the government continues to refine its regulatory framework, more financial institutions are likely to enter the market, enhancing competition and innovation. Additionally, the integration of advanced technologies, such as artificial intelligence and blockchain, will improve security and efficiency in custody solutions, further attracting investors and fostering market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Custody Services Tokenization Platforms Asset Management Solutions Compliance and Regulatory Solutions Security Solutions Consulting Services Others |

| By End-User | Financial Institutions Corporates Individual Investors Government Entities Non-Profit Organizations Others |

| By Application | Wealth Management Fundraising Trading Asset Tokenization Real Estate Tokenization Supply Chain Finance Others |

| By Investment Source | Domestic Investments Foreign Direct Investments (FDI) Public-Private Partnerships (PPP) Government Grants Venture Capital & Private Equity Others |

| By Policy Support | Tax Incentives Subsidies for Technology Adoption Regulatory Support Initiatives Sandbox Programs Others |

| By Security Features | Multi-Signature Wallets Cold Storage Solutions Insurance Coverage Hardware Security Modules (HSM) Others |

| By Market Maturity | Emerging Market Growth Market Mature Market Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Asset Custody Providers | 100 | CEOs, Compliance Officers, Operations Managers |

| Financial Institutions Engaged in Tokenization | 80 | Investment Managers, Risk Analysts, Product Development Heads |

| Blockchain Technology Experts | 50 | Blockchain Developers, Technical Architects, Consultants |

| Regulatory Bodies and Legal Advisors | 40 | Regulatory Affairs Specialists, Legal Counsel, Compliance Managers |

| End-users of Tokenized Assets | 60 | Retail Investors, Institutional Investors, Wealth Managers |

The Brazil Digital Asset Custody and Tokenization Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by blockchain adoption, secure digital asset management, and increasing interest in asset tokenization across various sectors.