Region:Asia

Author(s):Geetanshi

Product Code:KRAB5131

Pages:89

Published On:October 2025

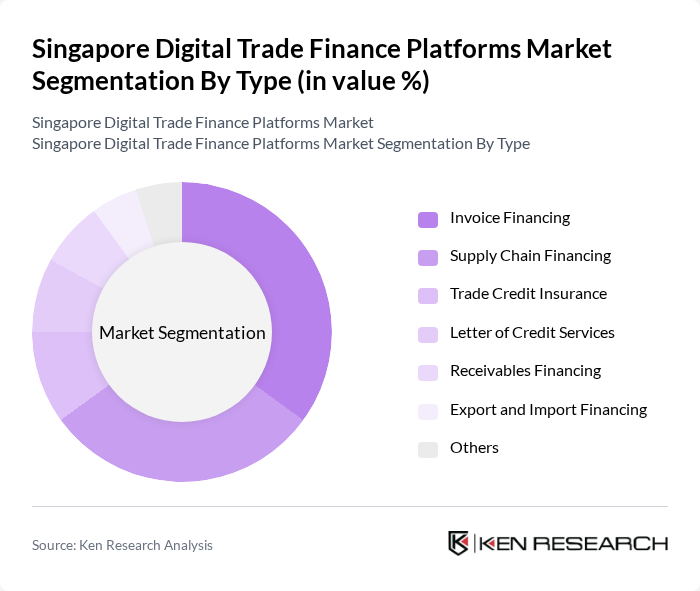

By Type:The market is segmented into Invoice Financing, Supply Chain Financing, Trade Credit Insurance, Letter of Credit Services, Receivables Financing, Export and Import Financing, and Others. Invoice Financing and Supply Chain Financing are particularly prominent, providing immediate liquidity and supporting businesses in managing cash flow. The surge in demand for these services is driven by the need for efficient working capital management and the increasing adoption of digital platforms that automate and simplify financing processes. Trade Credit Insurance and Letter of Credit Services remain essential for risk mitigation and international trade assurance, while Receivables Financing and Export/Import Financing are increasingly integrated with digital solutions to enhance accessibility and operational efficiency .

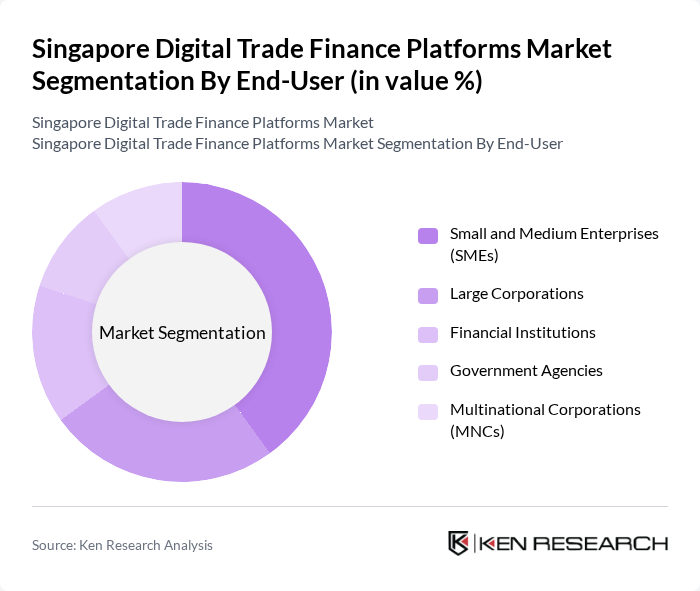

By End-User:The end-user segmentation includes Small and Medium Enterprises (SMEs), Large Corporations, Financial Institutions, Government Agencies, and Multinational Corporations (MNCs). SMEs are the dominant end-user segment, driven by their increasing reliance on digital trade finance solutions to enhance liquidity and manage cash flow effectively. The digitalization trend among SMEs has led to significant uptake, while large corporations and financial institutions leverage advanced platforms for risk management and global trade operations. Government agencies and MNCs utilize digital trade finance to support cross-border transactions and compliance requirements .

The Singapore Digital Trade Finance Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as DBS Bank Ltd., OCBC Bank, United Overseas Bank (UOB), Standard Chartered Bank Singapore, HSBC Singapore, Citibank Singapore, Trade Finance Global, Finastra, Ant Group (Ant Financial), Cogoport Singapore, Incomlend, InvoiceInterchange, Funding Societies, Triterras, GUUD Company, Tazapay, LiquidX, Marco Polo Network contribute to innovation, geographic expansion, and service delivery in this space.

The Singapore digital trade finance landscape is poised for significant transformation, driven by technological advancements and evolving consumer expectations. As platforms increasingly integrate artificial intelligence for risk assessment and enhance user experiences through mobile-first solutions, the market will likely see a surge in adoption. Additionally, the focus on sustainability in finance will shape product offerings, aligning with global trends. This evolution will create a more competitive environment, fostering innovation and collaboration among stakeholders in the digital finance ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Invoice Financing Supply Chain Financing Trade Credit Insurance Letter of Credit Services Receivables Financing Export and Import Financing Others |

| By End-User | Small and Medium Enterprises (SMEs) Large Corporations Financial Institutions Government Agencies Multinational Corporations (MNCs) |

| By Industry Vertical | Manufacturing Retail Logistics and Transportation Agriculture Energy & Commodities Others |

| By Payment Method | Digital Wallets Bank Transfers Credit and Debit Cards SWIFT Payments Others |

| By Service Model | Platform-as-a-Service (PaaS) Software-as-a-Service (SaaS) Managed Services API-based Solutions |

| By Geographic Reach | Domestic Regional (ASEAN) Global |

| By Customer Segment | B2B B2C C2C Platform Aggregators Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Trade Finance Users | 120 | SME Owners, Financial Officers |

| Platform Providers | 60 | Product Managers, Business Development Leads |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Industry Experts | 50 | Consultants, Academics in Trade Finance |

| Financial Institutions | 70 | Banking Executives, Risk Management Professionals |

The Singapore Digital Trade Finance Platforms Market is valued at approximately USD 3.1 billion, reflecting its significant role in the Asia Pacific trade finance sector, where Singapore holds about 4.76% of the regional market share.