Region:Asia

Author(s):Geetanshi

Product Code:KRAB4508

Pages:87

Published On:October 2025

By Type:The luxury fashion e-commerce market in Singapore is segmented into apparel, footwear, accessories, handbags, jewelry, watches, eyewear, fragrances & beauty, and others.Apparelremains the leading sub-segment, driven by demand for high-end clothing and the influence of evolving fashion trends, especially among younger consumers.Footwearandhandbagsalso command significant market presence, appealing to consumers seeking both style and functionality. The market is further characterized by the rise of gender-fluid fashion, sustainable luxury, and niche categories such as techwear and modest wear, which are increasingly popular on digital platforms .

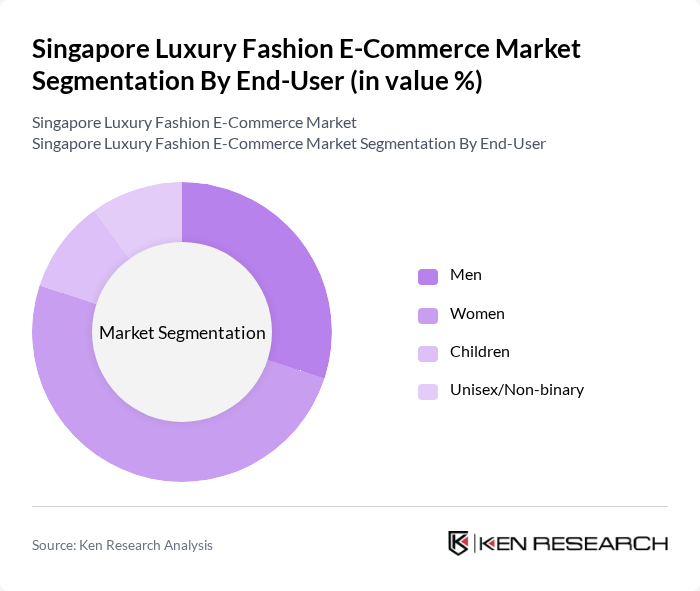

By End-User:The market is segmented by end-user demographics: men, women, children, and unisex/non-binary.Womenrepresent the largest segment, reflecting higher spending on luxury fashion and a strong interest in evolving trends. Themen’ssegment is also substantial, with increasing brand awareness and acceptance of luxury fashion among male consumers. Thechildren’ssegment is expanding as parents invest in premium fashion for their children, whileunisex/non-binarycategories are gaining traction, driven by Gen Z’s preference for gender-fluid and inclusive fashion .

The Singapore Luxury Fashion E-Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Zalora, Farfetch, Net-a-Porter, MatchesFashion, SSENSE, Mytheresa, Luisaviaroma, Shopbop, The Outnet, Reebonz, StyleTribute, TheRealReal, Vestiaire Collective, Love, Bonito, OnTheList contribute to innovation, geographic expansion, and service delivery in this space.

The Singapore luxury fashion e-commerce market is poised for significant transformation, driven by technological advancements and changing consumer preferences. As digital marketing strategies evolve, brands will increasingly leverage social media and influencer partnerships to engage consumers. Additionally, the integration of augmented reality (AR) and virtual reality (VR) technologies will enhance online shopping experiences, allowing customers to visualize products better. This dynamic environment will foster innovation and adaptability among luxury brands, ensuring sustained growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Apparel Footwear Accessories Handbags Jewelry Watches Eyewear Fragrances & Beauty Others |

| By End-User | Men Women Children Unisex/Non-binary |

| By Sales Channel | Direct-to-Consumer (Brand E-Boutiques) Online Marketplaces (Multi-brand Platforms) Social Commerce (Live-streaming, Social Platforms) Resale & Rental Platforms |

| By Price Range | Premium (SGD 500–2,000) Super Premium (SGD 2,000–5,000) Luxury (Above SGD 5,000) |

| By Brand Origin | Local Brands International Brands |

| By Consumer Demographics | Age Group (Gen Z, Millennials, Gen X, Boomers) Income Level Lifestyle Preferences (Eco-conscious, Trend-driven, Classic, etc.) |

| By Shopping Behavior | Impulse Buyers Planned Purchases Seasonal Shoppers Gift Purchasers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Luxury Apparel Purchasers | 60 | Fashion Enthusiasts, Online Shoppers |

| Luxury Accessories Buyers | 40 | Accessory Collectors, Trendsetters |

| Footwear Consumers | 50 | Sneakerheads, Fashion Bloggers |

| Luxury Brand Loyalty | 45 | Brand Advocates, Repeat Customers |

| Online Shopping Experience Feedback | 55 | General Consumers, E-commerce Users |

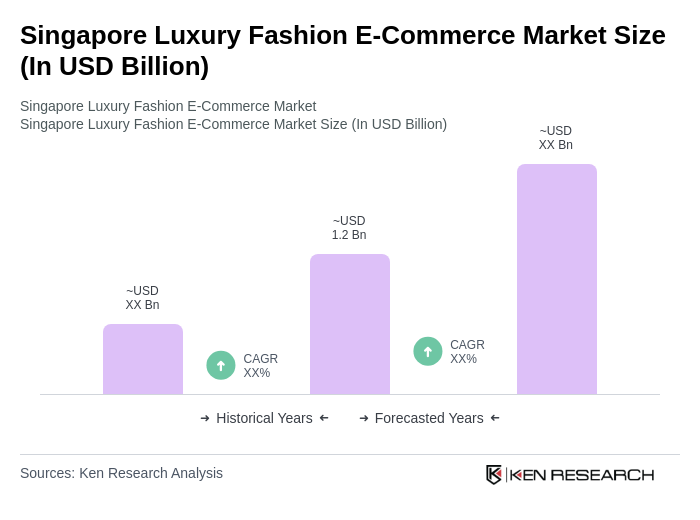

The Singapore Luxury Fashion E-Commerce Market is valued at approximately USD 1.2 billion, reflecting strong demand for premium apparel, footwear, and accessories sold online, driven by rising disposable incomes and a shift towards digital shopping channels.