Italy Luxury Fashion E-Commerce Market Overview

- The Italy Luxury Fashion E-Commerce Market is valued at USD 15 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing adoption of online shopping, a rise in disposable income among consumers, and the growing influence of social media on fashion trends. The market has seen a significant shift towards digital platforms, with luxury brands enhancing their online presence to cater to a tech-savvy consumer base.

- Key cities such as Milan, Florence, and Rome dominate the luxury fashion e-commerce market due to their historical significance in fashion and design. Milan, being the fashion capital, hosts numerous luxury brands and attracts a global audience, while Florence and Rome contribute with their rich heritage and high tourist footfall, further boosting online sales in these regions.

- In 2023, the Italian government implemented regulations aimed at enhancing consumer protection in e-commerce. This includes mandatory transparency in pricing and return policies for online purchases, ensuring that consumers are well-informed before making a purchase. Such regulations are designed to build trust in online shopping, particularly in the luxury segment, where consumers expect high standards of service and quality.

Italy Luxury Fashion E-Commerce Market Segmentation

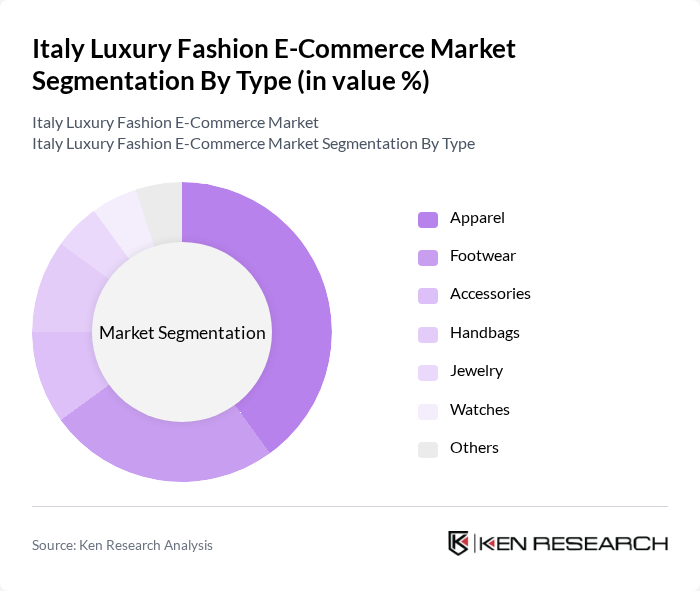

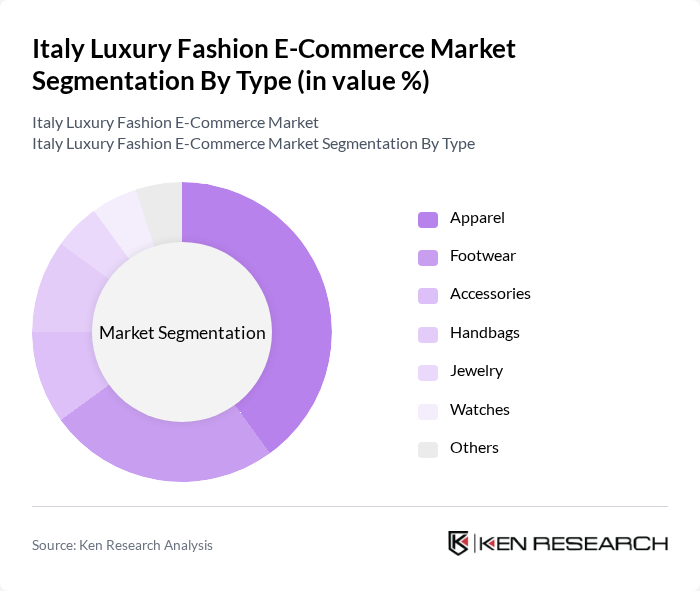

By Type:The luxury fashion e-commerce market is segmented into various types, including apparel, footwear, accessories, handbags, jewelry, watches, and others. Among these, apparel is the leading sub-segment, driven by the increasing demand for high-end clothing and the influence of fashion trends. Footwear and handbags also hold significant market shares, as consumers are increasingly investing in luxury items that reflect their personal style and status. The growing trend of online shopping has further propelled the sales of these categories, as consumers seek convenience and variety.

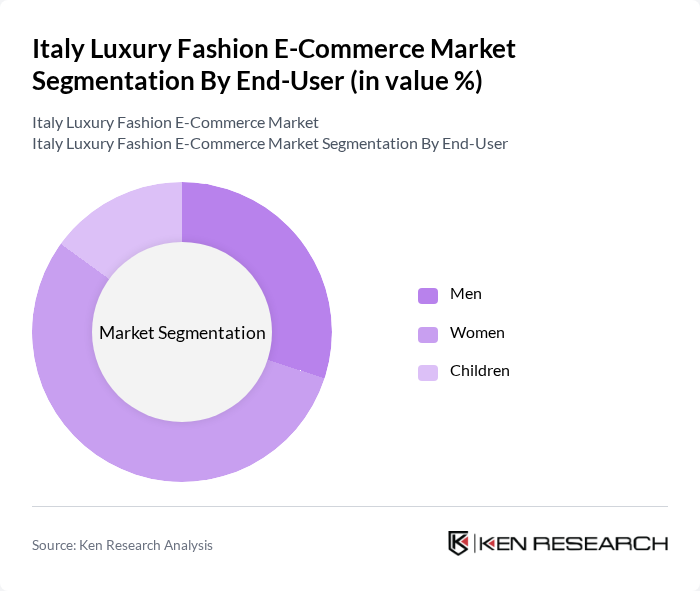

By End-User:The market is segmented by end-user into men, women, and children. The women’s segment dominates the market, driven by a higher propensity to purchase luxury fashion items. Women are more likely to invest in a variety of luxury products, including apparel, handbags, and accessories, reflecting their fashion-forward mindset. The men’s segment is also growing, as more male consumers are embracing luxury fashion, while the children’s segment remains niche but is gradually expanding due to increasing disposable incomes and a focus on branded children's apparel.

Italy Luxury Fashion E-Commerce Market Competitive Landscape

The Italy Luxury Fashion E-Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gucci, Prada, Dolce & Gabbana, Valentino, Fendi, Bottega Veneta, Versace, Salvatore Ferragamo, Ermenegildo Zegna, Moncler, Tod's, Missoni, Loro Piana, Brunello Cucinelli, Armani contribute to innovation, geographic expansion, and service delivery in this space.

Italy Luxury Fashion E-Commerce Market Industry Analysis

Growth Drivers

- Increasing Online Shopping Adoption:The Italian e-commerce market is projected to reach €48 billion in future, driven by a 20% increase in online shopping adoption. This surge is attributed to the growing number of internet users, which reached 46 million in 2023, representing 76% of the population. Additionally, the convenience of online shopping has led to a 30% increase in luxury fashion purchases made online, highlighting a significant shift in consumer behavior towards digital platforms.

- Rising Disposable Income:Italy's GDP per capita is expected to rise to €37,000 in future, reflecting a 3% increase from 2023. This growth in disposable income is crucial for the luxury fashion sector, as consumers are more willing to spend on high-end products. In 2023, the average household expenditure on luxury goods was approximately €1,250, indicating a robust market for luxury fashion e-commerce as consumers seek premium products online.

- Demand for Sustainable Fashion:The sustainable fashion market in Italy is projected to grow to €5.5 billion by future, driven by increasing consumer awareness and demand for eco-friendly products. In 2023, 62% of Italian consumers expressed a preference for brands that prioritize sustainability. This trend is influencing luxury brands to enhance their online offerings with sustainable options, thereby attracting environmentally conscious shoppers and expanding their market reach.

Market Challenges

- Intense Competition:The Italian luxury fashion e-commerce market is characterized by fierce competition, with over 210 brands vying for market share. Major players like Gucci and Prada dominate, but new entrants are emerging, increasing pressure on established brands. In 2023, the market saw a 16% increase in new luxury e-commerce platforms, intensifying the competition and making it challenging for brands to differentiate themselves and maintain customer loyalty.

- Logistics and Delivery Issues:Logistics remain a significant challenge for luxury fashion e-commerce in Italy, with delivery times averaging 4-6 days. In 2023, 42% of consumers reported dissatisfaction with delivery services, impacting their purchasing decisions. Additionally, the cost of logistics has risen by 12% due to fuel price increases, further complicating the ability of luxury brands to provide timely and efficient delivery, which is critical for customer satisfaction.

Italy Luxury Fashion E-Commerce Market Future Outlook

The future of the Italy luxury fashion e-commerce market appears promising, driven by technological advancements and changing consumer preferences. The integration of artificial intelligence and machine learning is expected to enhance personalized shopping experiences, while the rise of social commerce will further engage younger consumers. Additionally, as sustainability becomes a core value for brands, the market is likely to see increased investment in eco-friendly practices, aligning with consumer demand for responsible luxury.

Market Opportunities

- Growth of Mobile Commerce:Mobile commerce in Italy is projected to reach €22 billion by future, driven by the increasing use of smartphones for shopping. With 82% of internet users accessing e-commerce sites via mobile devices, luxury brands have a significant opportunity to optimize their mobile platforms, enhancing user experience and driving sales through targeted mobile marketing strategies.

- Collaborations with Influencers:Collaborations with influencers are expected to become a key strategy for luxury brands, with the influencer marketing industry in Italy projected to grow to €1.1 billion by future. By leveraging the reach and credibility of influencers, brands can effectively engage younger audiences, driving traffic to their e-commerce platforms and increasing brand visibility in a competitive market.