South Africa AI in Online Loan & Credit Scoring Market Overview

- The South Africa AI in Online Loan & Credit Scoring Market is valued at USD 22 million, based on a five-year historical analysis of the generative AI in financial services sector, which includes credit scoring as a key application. This growth is primarily driven by the increasing adoption of digital financial services, rapid expansion of fintech companies, and the rising demand for efficient, data-driven credit assessment solutions. The integration of AI technologies has notably improved the accuracy, speed, and inclusivity of loan processing and credit scoring, establishing AI as a critical enabler in the South African financial ecosystem .

- Key cities such as Johannesburg, Cape Town, and Durban continue to dominate the market due to their advanced financial infrastructure, high population density, and concentration of fintech startups. These urban centers act as innovation and investment hubs, attracting both domestic and international players in the AI-driven lending space, and fostering a competitive environment that accelerates market development .

- The Financial Sector Regulation Act, 2017, issued by the Republic of South Africa, established the Twin Peaks model for financial sector regulation. This act mandates that financial institutions adhere to fair lending practices, implement transparent and explainable credit scoring models, and comply with enhanced consumer protection standards. The regulation specifically requires financial service providers to ensure that AI and automated decision-making in credit scoring are used ethically, with clear accountability and recourse mechanisms for consumers .

South Africa AI in Online Loan & Credit Scoring Market Segmentation

By Type:The market is segmented into a range of loan and credit products, reflecting diverse consumer and business needs. Subsegments include Personal Loans, Business Loans, Microloans, Credit Cards, Peer-to-Peer Lending, Student Loans, and Others. Among these, Personal Loans remain the largest subsegment, driven by their accessibility and the growing demand for rapid, unsecured financing among individuals. Business Loans and Microloans are also expanding, supported by AI-driven risk assessment models that enable broader access for SMEs and underserved groups .

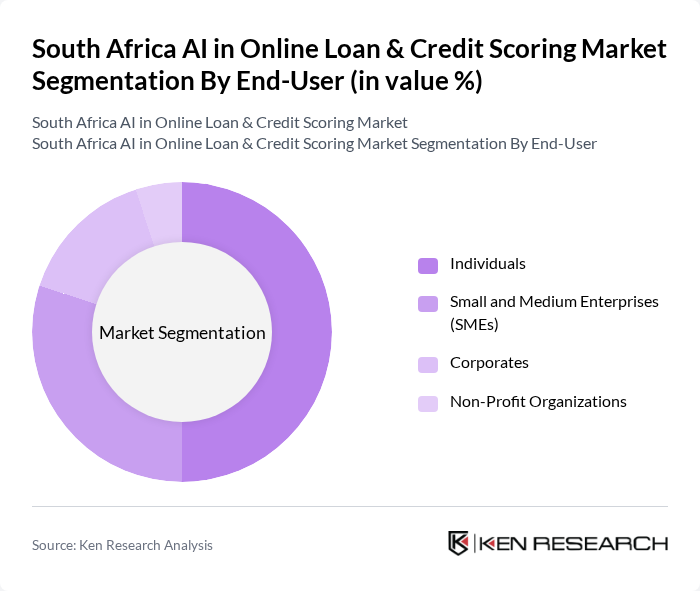

By End-User:End-user segmentation comprises Individuals, Small and Medium Enterprises (SMEs), Corporates, and Non-Profit Organizations. Individuals account for the largest share, propelled by the increasing need for flexible personal financing and the proliferation of digital lending platforms. SMEs are a rapidly growing segment, as AI-powered credit scoring enables more inclusive access to working capital and growth funding, helping to address the region’s SME financing gap .

South Africa AI in Online Loan & Credit Scoring Market Competitive Landscape

The South Africa AI in Online Loan & Credit Scoring Market is characterized by a dynamic mix of regional and international players. Leading participants such as Capitec Bank, African Bank, Standard Bank, Absa Group, Nedbank, FNB (First National Bank), PayJustNow, Fincheck, GetBucks, Wonga, MoneySmart, JUMO, Zest AI, Lulalend, Yoco contribute to innovation, geographic expansion, and service delivery in this space.

South Africa AI in Online Loan & Credit Scoring Market Industry Analysis

Growth Drivers

- Increasing Demand for Quick Loan Approvals:The South African online loan market is experiencing a surge in demand for rapid loan approvals, with 57% of consumers preferring instant credit solutions. The average time for loan approval has decreased to approximately 12 hours, driven by advancements in AI technologies. This shift is supported by a report from the South African Reserve Bank, indicating that 50% of loan applications are now processed digitally, enhancing customer satisfaction and driving market growth.

- Rise in Digital Banking and Fintech Solutions:The digital banking sector in South Africa is projected to reach a value of R120 billion, reflecting a 25% annual growth rate. This growth is fueled by the increasing adoption of fintech solutions, with over 57% of South Africans using mobile banking apps. The integration of AI in these platforms allows for more efficient credit scoring, enabling lenders to assess risk more accurately and expand their customer base significantly.

- Enhanced Data Analytics Capabilities:The utilization of advanced data analytics in the South African credit scoring market is transforming lending practices. In future, it is estimated that 75% of lenders will employ AI-driven analytics to evaluate creditworthiness. This shift is supported by a 35% increase in data availability from alternative sources, such as social media and transaction histories, allowing for more comprehensive assessments and improved lending decisions, ultimately driving market growth.

Market Challenges

- Regulatory Compliance Complexities:The South African financial sector faces significant regulatory challenges, with over 250 compliance requirements impacting lenders. The National Credit Act mandates strict adherence to responsible lending practices, which can complicate the integration of AI technologies. In future, non-compliance penalties are expected to exceed R600 million, creating a barrier for many fintech companies seeking to innovate within the online loan market.

- Data Privacy Concerns:Data privacy remains a critical challenge in the South African online loan market, with 80% of consumers expressing concerns about how their personal information is used. The implementation of the Protection of Personal Information Act (POPIA) has heightened scrutiny on data handling practices. In future, companies that fail to comply with these regulations may face fines up to R15 million, hindering the adoption of AI solutions in credit scoring.

South Africa AI in Online Loan & Credit Scoring Market Future Outlook

The South African AI in online loan and credit scoring market is poised for significant evolution, driven by technological advancements and changing consumer behaviors. As digital banking continues to expand, lenders will increasingly leverage AI to enhance customer experiences and streamline operations. The focus on financial inclusion will also drive innovation, with more tailored lending solutions emerging. The integration of AI and machine learning will likely redefine credit assessment processes, making them more efficient and accessible to a broader audience in future.

Market Opportunities

- Expansion of Mobile Lending Platforms:The mobile lending sector is expected to grow rapidly, with over 50% of loans projected to be disbursed via mobile platforms in future. This shift presents a significant opportunity for lenders to reach underserved populations, particularly in rural areas, enhancing financial inclusion and driving market growth.

- Integration of AI for Personalized Lending:The adoption of AI for personalized lending solutions is anticipated to increase, with 70% of lenders planning to implement AI-driven models in future. This trend will enable more accurate risk assessments and tailored loan offerings, improving customer satisfaction and expanding market reach.