Region:Africa

Author(s):Shubham

Product Code:KRAA4738

Pages:100

Published On:September 2025

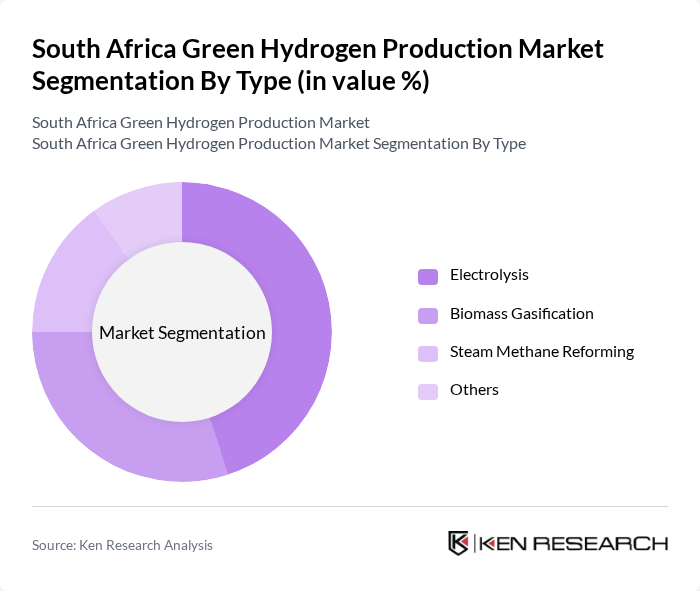

By Type:The market is segmented into various production methods, including Electrolysis, Biomass Gasification, Steam Methane Reforming, and Others. Among these, Electrolysis is currently the leading method due to its efficiency and the increasing availability of renewable energy sources, which are essential for sustainable hydrogen production. Biomass Gasification is also gaining traction as it utilizes organic materials, aligning with the circular economy principles.

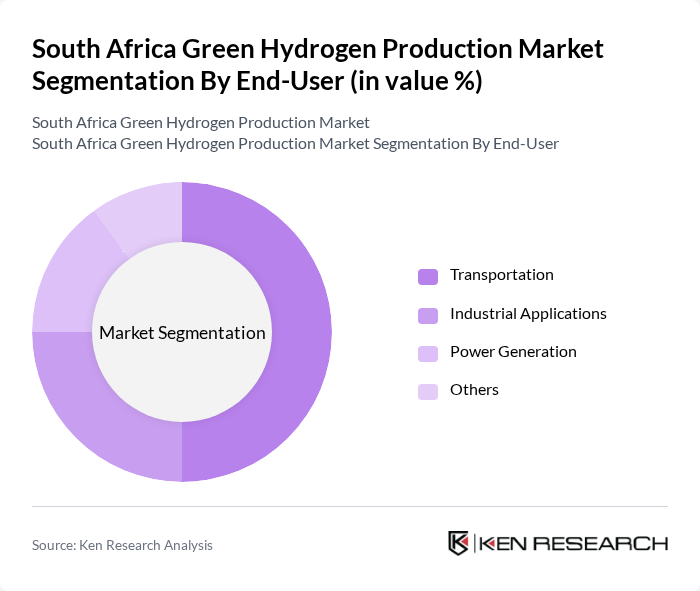

By End-User:The end-user segmentation includes Transportation, Industrial Applications, Power Generation, and Others. Transportation is the dominant segment, driven by the increasing adoption of hydrogen fuel cell vehicles and the need for cleaner alternatives to fossil fuels. Industrial applications are also significant, as industries seek to decarbonize their operations and meet sustainability targets.

The South Africa Green Hydrogen Production Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sasol Limited, Anglo American plc, H2 Green Steel, Air Products South Africa, Engie South Africa, Hydrogen South Africa, Barloworld Limited, Nel ASA, Siemens Energy, TotalEnergies, Plug Power Inc., Linde plc, Ballard Power Systems, FirstElement Fuel, ITM Power contribute to innovation, geographic expansion, and service delivery in this space.

The future of the South African green hydrogen market appears promising, driven by increasing investments in renewable technologies and a strong governmental push towards sustainability. By future, the integration of hydrogen into the national energy mix is expected to enhance energy security and reduce carbon emissions. Furthermore, as global demand for green hydrogen rises, South Africa is well-positioned to become a key player in the international hydrogen market, leveraging its abundant renewable resources and strategic partnerships.

| Segment | Sub-Segments |

|---|---|

| By Type | Electrolysis Biomass Gasification Steam Methane Reforming Others |

| By End-User | Transportation Industrial Applications Power Generation Others |

| By Application | Fuel Cells Energy Storage Chemical Production Others |

| By Investment Source | Private Investments Government Funding International Grants Others |

| By Policy Support | Subsidies Tax Incentives Renewable Energy Certificates (RECs) Others |

| By Distribution Channel | Direct Sales Online Platforms Partnerships with Energy Providers Others |

| By Market Maturity | Emerging Growth Established Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hydrogen Production Facilities | 100 | Plant Managers, Operations Directors |

| Energy Policy Makers | 50 | Government Officials, Regulatory Bodies |

| Technology Providers | 75 | Product Managers, R&D Heads |

| End-Users in Transportation Sector | 60 | Fleet Managers, Sustainability Officers |

| Academic Researchers in Renewable Energy | 40 | Professors, Research Scientists |

The South Africa Green Hydrogen Production Market is valued at approximately USD 1.5 billion, reflecting a significant growth trend driven by the demand for renewable energy, government initiatives, and advancements in production technologies.