Region:Global

Author(s):Rebecca

Product Code:KRAB2277

Pages:88

Published On:January 2026

By Social Commerce Model:The social commerce model in New Zealand is diverse, encompassing various platforms and approaches, closely linked to the country’s fast?growing e-commerce and mobile?commerce landscape. The leading sub-segment is Social Network–Driven Commerce, which includes platforms like Facebook, Instagram, TikTok, and Pinterest; these platforms have become essential for brands to connect with consumers through engaging content, short?form video, influencer collaborations, and highly targeted advertising formats that increasingly enable direct checkout from posts and ads. Social Marketplace Platforms, such as Trade Me and Facebook Marketplace, also play a significant role by facilitating peer-to-peer transactions and supporting both new and second?hand goods, leveraging New Zealand’s strong online shopping culture. The rise of Social-led D2C Stores, Group Buying, and Live Shopping further illustrates the dynamic nature of this market, as merchants integrate Shopify and WooCommerce with social channels to drive direct-to-consumer sales, experiment with time?bound deals, and adopt livestream formats that merge entertainment with real?time purchasing.

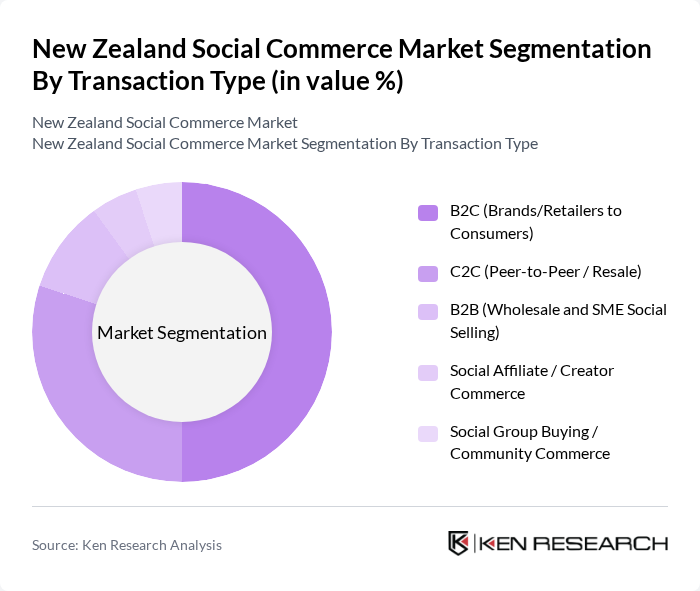

By Transaction Type:The transaction types in the New Zealand Social Commerce Market are varied, with B2C transactions leading the way, reflecting the dominance of individual consumers in the broader national e-commerce market. This segment includes brands and retailers selling directly to consumers, leveraging social media for marketing and sales, mobile?optimized experiences, and integrated payment options. C2C transactions, where consumers sell to each other, are also significant, particularly on platforms like Trade Me and Facebook Marketplace, aligning with New Zealand’s strong online shopping and resale culture. B2B transactions are growing as small and medium enterprises utilize social platforms for wholesale selling, lead generation, and account?based marketing. Social Affiliate and Group Buying transactions are emerging trends that are gaining traction among consumers, supported by creator?commerce models, influencer partnerships, and community?based deal?sharing that encourage collective purchasing behavior.

The New Zealand Social Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Trade Me, Meta (Facebook and Instagram New Zealand), TikTok New Zealand, Shopify, Xero, Canva, Snapchat, Pinterest, Afterpay, Laybuy, Hootsuite, Mailchimp, Vend, Buffer, Klaviyo contribute to innovation, geographic expansion, and service delivery in this space.

The New Zealand social commerce market is poised for significant evolution, driven by technological advancements and changing consumer behaviors. As mobile usage continues to rise, businesses will increasingly adopt innovative strategies to enhance user experiences. The integration of augmented reality and virtual reality technologies is expected to reshape how consumers interact with products online. Additionally, the focus on sustainability and ethical practices will likely influence purchasing decisions, prompting brands to align their offerings with consumer values for greater engagement.

| Segment | Sub-Segments |

|---|---|

| By Social Commerce Model | Social Network–Driven Commerce (Facebook, Instagram, TikTok, Pinterest) Social Marketplace Platforms (Trade Me, Facebook Marketplace, local marketplaces) Social-led D2C Stores (Shopify, WooCommerce integrated with social) Group Buying and Deal-Sharing Platforms Live Shopping and Livestream Commerce |

| By Transaction Type | B2C (Brands/Retailers to Consumers) C2C (Peer-to-Peer / Resale) B2B (Wholesale and SME Social Selling) Social Affiliate / Creator Commerce Social Group Buying / Community Commerce |

| By Product Category | Fashion and Apparel Beauty and Personal Care Consumer Electronics and Accessories Food, Beverage, and Groceries Home, Furniture, and Lifestyle Others (Toys, DIY, Media, Services) |

| By Purchasing Device | Smartphones Tablets Laptops/Desktops Connected TVs and Other Devices Others |

| By Payment Method | Credit/Debit Cards Digital Wallets (Apple Pay, Google Pay, PayPal, etc.) Bank Transfers and Account-to-Account Payments Buy Now Pay Later Services (Afterpay, Zip, Laybuy, etc.) Others (Cash on Delivery, Gift Cards, Loyalty Points) |

| By Customer Demographics | Age Groups Gender Income Levels Geographic Locations (Urban vs Regional/Rural) Others |

| By Engagement Type | User-Generated Content–Led Purchases Influencer and Creator–Led Purchases Brand-Owned Social Stores and Shoppable Posts Community and Group-Based Buying Social Referral and Affiliate-Based Purchases |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Behavior in Social Commerce | 140 | Online Shoppers, Social Media Users |

| Brand Engagement Strategies | 100 | Marketing Managers, Brand Strategists |

| Influencer Marketing Impact | 80 | Influencers, Social Media Managers |

| Platform Utilization Trends | 120 | eCommerce Directors, Digital Marketing Analysts |

| Consumer Trust and Security Concerns | 90 | Cybersecurity Experts, Consumer Advocacy Groups |

The New Zealand Social Commerce Market is valued at approximately USD 1.1 billion, reflecting significant growth driven by increased online shopping and social media engagement, as part of the broader national e-commerce market, which reached around NZD 10.5 billion in revenue.