Region:Asia

Author(s):Shubham

Product Code:KRAA4740

Pages:90

Published On:September 2025

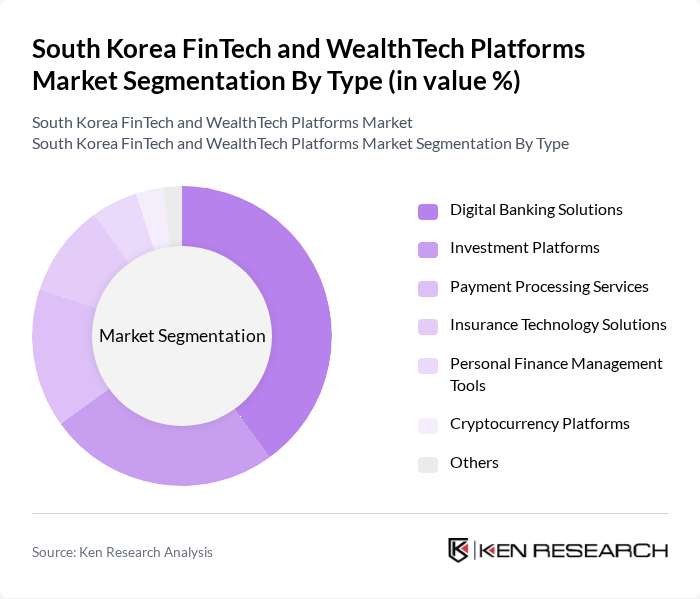

By Type:The market is segmented into various types, including Digital Banking Solutions, Investment Platforms, Payment Processing Services, Insurance Technology Solutions, Personal Finance Management Tools, Cryptocurrency Platforms, and Others. Among these, Digital Banking Solutions are leading the market due to the increasing preference for online banking services and the convenience they offer to consumers. Investment Platforms are also gaining traction as more individuals seek to manage their investments digitally.

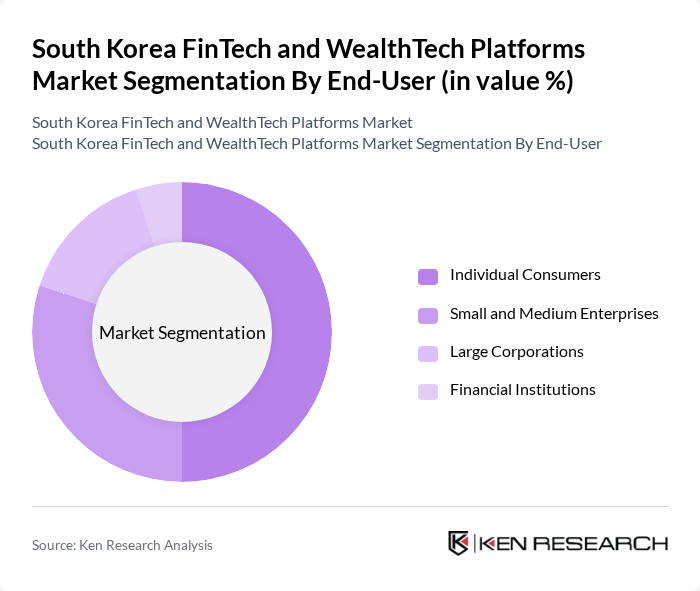

By End-User:The market is segmented by end-users, including Individual Consumers, Small and Medium Enterprises, Large Corporations, and Financial Institutions. Individual Consumers dominate the market as they increasingly adopt digital financial services for personal banking, investment, and payment solutions. Small and Medium Enterprises are also significant users, leveraging FinTech solutions to enhance operational efficiency and access to capital.

The South Korea FinTech and WealthTech Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Pay, Kakao Pay, Toss, Naver Financial, Shinhan Financial Group, KB Financial Group, NH Investment & Securities, Mirae Asset Daewoo, Hanwha Asset Management, Woori Bank, Citibank Korea, Standard Chartered Bank Korea, HSBC Korea, Daishin Securities, Korea Investment & Securities contribute to innovation, geographic expansion, and service delivery in this space.

The South Korean FinTech and WealthTech market is poised for significant evolution, driven by technological advancements and changing consumer preferences. The integration of AI and machine learning will enhance service personalization, while the growing emphasis on sustainable investing will shape product offerings. Additionally, as traditional financial institutions increasingly collaborate with FinTech startups, the market will likely witness a surge in innovative solutions. This collaborative approach will not only enhance service delivery but also expand access to financial services across diverse demographics.

| Segment | Sub-Segments |

|---|---|

| By Type | Digital Banking Solutions Investment Platforms Payment Processing Services Insurance Technology Solutions Personal Finance Management Tools Cryptocurrency Platforms Others |

| By End-User | Individual Consumers Small and Medium Enterprises Large Corporations Financial Institutions |

| By Application | Wealth Management Payment Solutions Lending Services Investment Advisory |

| By Distribution Channel | Online Platforms Mobile Applications Direct Sales |

| By Customer Segment | Retail Customers Institutional Investors High Net-Worth Individuals |

| By Pricing Model | Subscription-Based Transaction-Based Freemium |

| By Regulatory Compliance Level | Fully Compliant Partially Compliant Non-Compliant |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| FinTech User Experience | 150 | End-users of mobile banking and payment apps |

| WealthTech Adoption Trends | 100 | Wealth managers and financial advisors |

| Investment Platform Insights | 80 | Retail investors and portfolio managers |

| Regulatory Impact Assessment | 70 | Compliance officers and legal advisors in finance |

| Market Entry Barriers | 60 | Entrepreneurs and startup founders in FinTech |

The South Korea FinTech and WealthTech Platforms Market is valued at approximately USD 10 billion, reflecting significant growth driven by the adoption of digital banking solutions, mobile payment systems, and investment platforms among consumers.