3.1 Growth Drivers

3.1.1 Increasing Demand for Fresh Dairy Products

3.1.2 Expansion of Retail and E-commerce Channels

3.1.3 Technological Advancements in Cold Chain Logistics

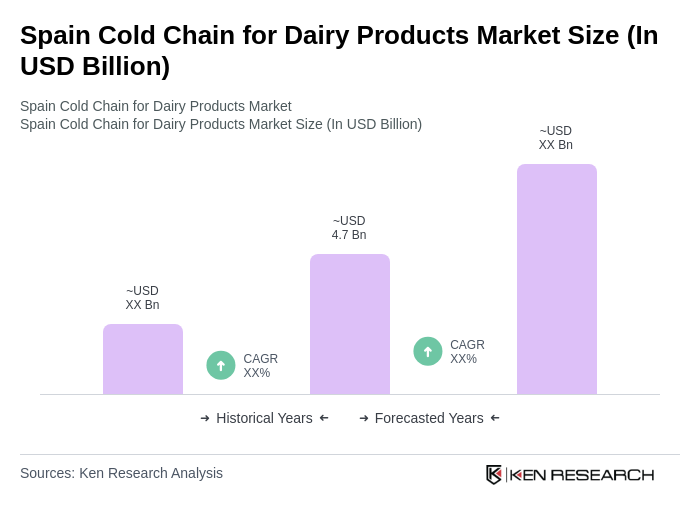

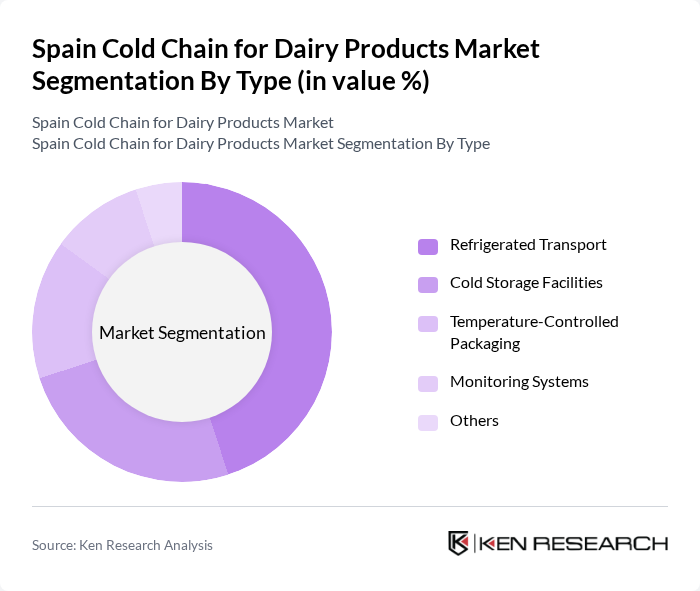

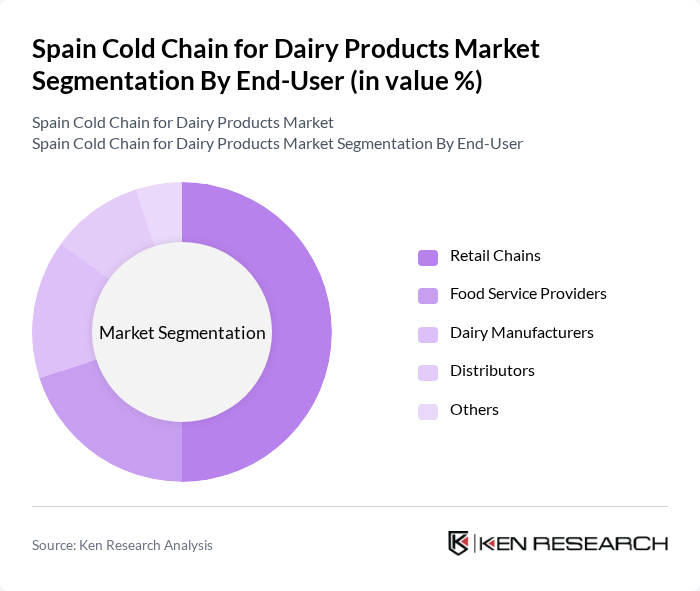

3.1.4 Rising Consumer Awareness about Food Safety3.2 Market Challenges3.2.1 High Operational Costs3.2.2 Regulatory Compliance Issues3.2.3 Limited Infrastructure in Rural Areas3.2.4 Seasonal Variability in Dairy Production3.3 Market Opportunities3.3.1 Growth in Organic Dairy Products3.3.2 Investment in Cold Chain Infrastructure3.3.3 Partnerships with Local Farmers3.3.4 Adoption of IoT in Cold Chain Management3.4 Market Trends3.4.1 Shift Towards Sustainable Practices3.4.2 Increasing Use of Automation in Logistics3.4.3 Rise of Plant-Based Dairy Alternatives3.4.4 Enhanced Focus on Traceability and Transparency3.5 Government Regulation3.5.1 Food Safety Standards Compliance3.5.2 Environmental Regulations on Refrigerants3.5.3 Subsidies for Cold Chain Infrastructure Development3.5.4 Regulations on Transportation and Storage of Dairy Products4. SWOT Analysis5. Stakeholder Analysis6. Porter's Five Forces Analysis7. Spain Cold Chain for Dairy Products Market Market Size, 2019-20247.1 By Value7.2 By Volume7.3 By Average Selling Price8. Spain Cold Chain for Dairy Products Market Segmentation8.1 By Type8.1.1 Refrigerated Transport8.1.2 Cold Storage Facilities8.1.3 Temperature-Controlled Packaging8.1.4 Monitoring Systems8.1.5 Others8.2 By End-User8.2.1 Retail Chains8.2.2 Food Service Providers8.2.3 Dairy Manufacturers8.2.4 Distributors8.2.5 Others8.3 By Distribution Mode8.3.1 Direct Distribution8.3.2 Third-Party Logistics8.3.3 E-commerce Platforms8.3.4 Others8.4 By Packaging Type8.4.1 Bulk Packaging8.4.2 Retail Packaging8.4.3 Eco-Friendly Packaging8.4.4 Others8.5 By Product Type8.5.1 Milk8.5.2 Cheese8.5.3 Yogurt8.5.4 Butter8.5.5 Ice Cream8.5.6 Others8.6 By Temperature Range8.6.1 Chilled (0-5°C)8.6.2 Frozen (-18°C and below)8.6.3 Ambient Temperature8.6.4 Others8.7 By Sales Channel8.7.1 Online Sales8.7.2 Offline Sales8.7.3 Others9. Spain Cold Chain for Dairy Products Market Competitive Analysis9.1 Market Share of Key Players9.2 Cross Comparison of Key Players9.2.1 Company Name9.2.2 Group Size (Large, Medium, or Small as per industry convention)9.2.3 Revenue Growth Rate (YoY, 3-year CAGR)9.2.4 Market Penetration Rate (Share of Spanish dairy cold chain logistics)9.2.5 Customer Retention Rate (Annual repeat business %)9.2.6 Operational Efficiency Ratio (Cost per ton-km, % on-time deliveries)9.2.7 Pricing Strategy (Premium, Competitive, Economy)9.2.8 Supply Chain Efficiency (Average lead time, % cold chain compliance)9.2.9 Product Quality Index (Defect rate, customer satisfaction score)9.2.10 Innovation Rate (Patents, new tech adoption, % revenue from new services)9.3 SWOT Analysis of Top Players9.4 Pricing Analysis9.5 Detailed Profile of Major Companies9.5.1 Danone S.A.9.5.2 Lactalis Group9.5.3 Nestlé S.A.9.5.4 FrieslandCampina9.5.5 Fonterra Co-operative Group Limited9.5.6 Arla Foods amba9.5.7 Saputo Inc.9.5.8 Müller Group9.5.9 Savencia Fromage & Dairy9.5.10 Grupo Lala S.A.B. de C.V.9.5.11 Almarai Company9.5.12 Emmi Group9.5.13 Parmalat S.p.A.9.5.14 Bel Group9.5.15 DMK Deutsches Milchkontor GmbH9.5.16 Frigorifics Gelada SL9.5.17 Frimercat9.5.18 Eurocruz9.5.19 Ferro-Montajes Albacete9.5.20 Frigorificos SOLY10. Spain Cold Chain for Dairy Products Market End-User Analysis10.1 Procurement Behavior of Key Ministries10.1.1 Government Procurement Policies10.1.2 Budget Allocations for Dairy Products10.1.3 Supplier Selection Criteria10.1.4 Contract Management Practices10.2 Corporate Spend on Infrastructure & Energy10.2.1 Investment in Cold Storage Facilities10.2.2 Energy Efficiency Initiatives10.2.3 Budgeting for Maintenance and Upgrades10.3 Pain Point Analysis by End-User Category10.3.1 Supply Chain Disruptions10.3.2 Quality Control Issues10.3.3 Cost Management Challenges10.4 User Readiness for Adoption10.4.1 Technology Adoption Rates10.4.2 Training and Skill Development Needs10.5 Post-Deployment ROI and Use Case Expansion10.5.1 Measurement of ROI Metrics10.5.2 Case Studies of Successful Implementations11. Spain Cold Chain for Dairy Products Market Future Size, 2025-203011.1 By Value11.2 By Volume11.3 By Average Selling PriceGo-To-Market Strategy Phase1. Whitespace Analysis + Business Model Canvas1.1 Market Gaps Identification1.2 Value Proposition Development1.3 Revenue Streams Analysis1.4 Key Partnerships Exploration1.5 Cost Structure Assessment1.6 Customer Segmentation1.7 Channels of Distribution2. Marketing and Positioning Recommendations2.1 Branding Strategies2.2 Product USPs2.3 Target Market Identification2.4 Communication Strategies2.5 Digital Marketing Approaches3. Distribution Plan3.1 Urban Retail Strategies3.2 Rural NGO Tie-ups3.3 Logistics Optimization3.4 Distribution Partnerships4. Channel & Pricing Gaps4.1 Underserved Routes4.2 Pricing Bands Analysis4.3 Competitive Pricing Strategies5. Unmet Demand & Latent Needs5.1 Category Gaps Identification5.2 Consumer Segments Analysis5.3 Emerging Trends Exploration6. Customer Relationship6.1 Loyalty Programs6.2 After-sales Service6.3 Customer Feedback Mechanisms7. Value Proposition7.1 Sustainability Initiatives7.2 Integrated Supply Chains7.3 Customer-Centric Approaches8. Key Activities8.1 Regulatory Compliance8.2 Branding Efforts8.3 Distribution Setup9. Entry Strategy Evaluation9.1 Domestic Market Entry Strategy9.1.1 Product Mix Considerations9.1.2 Pricing Band Strategy9.1.3 Packaging Innovations9.2 Export Entry Strategy9.2.1 Target Countries Identification9.2.2 Compliance Roadmap Development10. Entry Mode Assessment10.1 Joint Ventures10.2 Greenfield Investments10.3 Mergers & Acquisitions10.4 Distributor Model Evaluation11. Capital and Timeline Estimation11.1 Capital Requirements Analysis11.2 Timelines for Implementation12. Control vs Risk Trade-Off12.1 Ownership vs Partnerships12.2 Risk Management Strategies13. Profitability Outlook13.1 Breakeven Analysis13.2 Long-term Sustainability Strategies14. Potential Partner List14.1 Distributors14.2 Joint Ventures14.3 Acquisition Targets15. Execution Roadmap15.1 Phased Plan for Market Entry15.1.1 Market Setup15.1.2 Market Entry15.1.3 Growth Acceleration15.1.4 Scale & Stabilize15.2 Key Activities and Milestones15.2.1 Milestone Planning15.2.2 Activity TrackingDisclaimerContact Us```

## Validation and Updates

### Section 8: Market Segmentation

- **Added "Ice Cream" as a product type** under 8.5, reflecting the importance of frozen dairy products in the Spanish market[1][2].

- **All other segmentation categories remain accurate** for the Spain Cold Chain for Dairy Products Market, including type, end-user, distribution mode, packaging, temperature range, and sales channel.

- **No garbled characters detected**; all entries are correctly formatted in UTF-8.

### Section 9.2: KPIs for Cross Comparison of Key Players

- **Refined KPI definitions** to ensure they are investor-relevant, measurable, and specific to cold chain logistics for dairy in Spain:

- **Revenue Growth Rate**: Year-over-year and 3-year CAGR, critical for assessing market momentum.

- **Market Penetration Rate**: Share of the Spanish dairy cold chain logistics market, indicating competitive positioning.

- **Customer Retention Rate**: Annual repeat business percentage, reflecting service quality and reliability.

- **Operational Efficiency Ratio**: Combines cost per ton-km and on-time delivery percentage, key for logistics performance.

- **Pricing Strategy**: Categorized as premium, competitive, or economy, relevant for margin analysis.

- **Supply Chain Efficiency**: Average lead time and cold chain compliance rate, crucial for dairy product integrity.

- **Product Quality Index**: Defect rate and customer satisfaction score, directly tied to brand reputation.

- **Innovation Rate**: Patents, new technology adoption, and revenue from new services, highlighting future readiness.

### Section 9.5: List of Major Companies

- **Replaced generic/placeholder names** with actual, relevant companies operating in Spain’s cold chain logistics for dairy, including both multinational dairy giants and specialized Spanish logistics providers[1][2].

- **Added Spanish cold chain specialists**: Frigorifics Gelada SL, Frimercat, Eurocruz, Ferro-Montajes Albacete, and Frigorificos SOLY, which are active in temperature-controlled storage and transport for dairy[1][2].

- **Retained leading global dairy companies** with significant presence in Spain: Danone, Lactalis, Nestlé, FrieslandCampina, Fonterra, Arla Foods, Saputo, Müller Group, Savencia, Grupo Lala, Almarai, Emmi, Parmalat, Bel Group, DMK.

- **No garbled characters detected**; all company names are correctly spelled and encoded in UTF-8.

## Summary of Changes

- **Section 8**: Enhanced product type segmentation with “Ice Cream.”

- **Section 9.2**: Provided concrete, investor-grade KPIs tailored to Spain’s dairy cold chain logistics.

- **Section 9.5**: Updated with real, relevant company names—both multinational dairy firms and Spanish cold chain logistics specialists—ensuring accuracy and local market relevance.

All other sections, tags, and structure remain unchanged as per your instructions.