Region:Europe

Author(s):Rebecca

Product Code:KRAA3837

Pages:94

Published On:September 2025

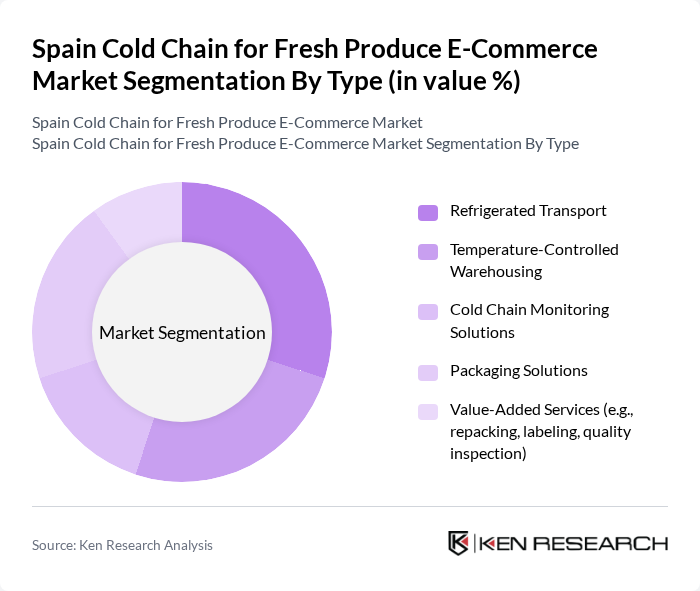

By Type:The market can be segmented into Refrigerated Transport, Temperature-Controlled Warehousing, Cold Chain Monitoring Solutions, Packaging Solutions, and Value-Added Services. Each of these segments plays a crucial role in ensuring the integrity and quality of fresh produce during transportation and storage. Refrigerated transport is particularly critical due to the need for rapid and reliable delivery of perishable goods, while temperature-controlled warehousing supports inventory management and order fulfillment. Cold chain monitoring solutions and advanced packaging technologies are increasingly adopted to minimize spoilage and extend shelf life, and value-added services such as repacking and quality inspection are gaining traction among e-commerce platforms .

The Refrigerated Transport segment is currently leading the market due to the increasing demand for efficient and reliable transportation of perishable goods. This segment benefits from advancements in logistics technology, including GPS tracking, telematics, and real-time temperature monitoring, which enhance the efficiency and reliability of delivery systems. The growing trend of online grocery shopping has also contributed to the rising need for refrigerated transport solutions, as consumers expect quick and safe delivery of fresh produce .

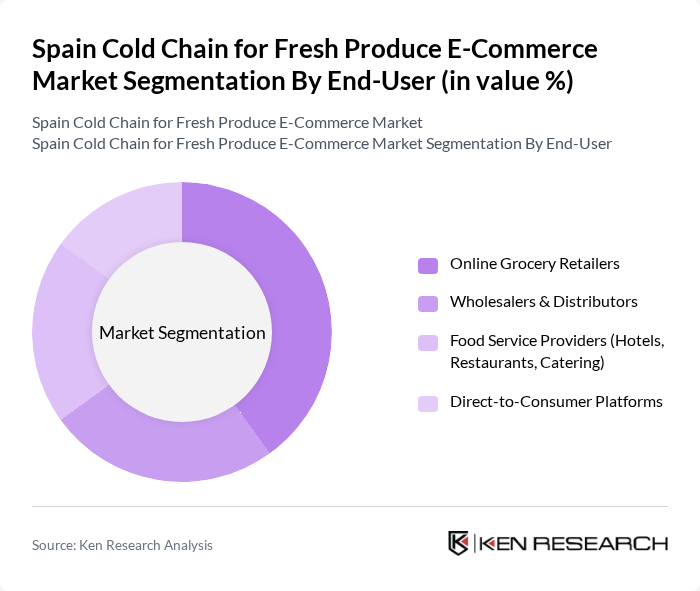

By End-User:The end-user segmentation includes Online Grocery Retailers, Wholesalers & Distributors, Food Service Providers (Hotels, Restaurants, Catering), and Direct-to-Consumer Platforms. Each of these segments has unique requirements and contributes differently to the overall market dynamics. Online grocery retailers are driving the largest share due to the rapid adoption of digital platforms and the convenience of home delivery. Wholesalers and distributors rely on robust cold chain logistics for bulk handling and distribution, while food service providers require specialized solutions for quality assurance. Direct-to-consumer platforms are emerging as a fast-growing segment, leveraging technology to connect producers directly with end-users .

The Online Grocery Retailers segment is the dominant player in the market, driven by the increasing consumer shift towards online shopping for fresh produce. This segment benefits from the convenience of home delivery and a wider selection of products, which enhances customer satisfaction and loyalty. The rise of digital platforms and mobile applications has significantly transformed consumer purchasing behavior, making this segment crucial for market growth .

The Spain Cold Chain for Fresh Produce E-Commerce Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo Logista, Transcoma Global Logistics, Frioexpress, Frigorificos Gelada SL, XPO Logistics, DHL Supply Chain, Kuehne + Nagel, SEUR, Grupo TSE, Frimercat, A.P. Moller-Maersk, DB Schenker, Agility Logistics, CEVA Logistics, DSV contribute to innovation, geographic expansion, and service delivery in this space.

The future of the cold chain for fresh produce e-commerce market in Spain appears promising, driven by increasing consumer demand for fresh and organic products. As online grocery shopping continues to expand, businesses will need to invest in advanced logistics solutions to maintain product quality. Additionally, the integration of smart technologies will enhance operational efficiencies, allowing companies to better manage inventory and reduce waste. Overall, the market is poised for significant growth, supported by evolving consumer preferences and technological advancements.

| Segment | Sub-Segments |

|---|---|

| By Type | Refrigerated Transport Temperature-Controlled Warehousing Cold Chain Monitoring Solutions Packaging Solutions Value-Added Services (e.g., repacking, labeling, quality inspection) |

| By End-User | Online Grocery Retailers Wholesalers & Distributors Food Service Providers (Hotels, Restaurants, Catering) Direct-to-Consumer Platforms |

| By Distribution Channel | E-Commerce Platforms Direct Sales (B2B/B2C) Third-Party Logistics (3PL) Providers Marketplace Aggregators |

| By Product Category | Fruits Vegetables Fresh Herbs & Leafy Greens Exotic Produce & Berries |

| By Packaging Type | Plastic Containers & Crates Cardboard & Corrugated Boxes Insulated Packaging (Thermal Bags, Gel Packs) Reusable Packaging Solutions |

| By Service Type | Transportation Services Cold Storage & Warehousing Real-Time Monitoring & Tracking Last-Mile Delivery Services |

| By Price Range | Budget Mid-Range Premium Subscription-Based Models |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cold Chain Logistics Providers | 60 | Logistics Managers, Operations Directors |

| Fresh Produce Suppliers | 50 | Supply Chain Managers, Procurement Officers |

| E-commerce Platforms for Fresh Produce | 45 | eCommerce Managers, Marketing Directors |

| Consumer Insights on Fresh Produce Purchases | 100 | Regular Online Shoppers, Grocery Buyers |

| Regulatory Bodies and Industry Associations | 40 | Policy Makers, Industry Analysts |

The Spain Cold Chain for Fresh Produce E-Commerce Market is valued at approximately USD 4.7 billion, driven by increasing demand for fresh produce through online platforms and advancements in cold chain technologies.