Region:Europe

Author(s):Dev

Product Code:KRAB3045

Pages:82

Published On:October 2025

By Type:The market is segmented into various types of nutritional and dietary supplements, including vitamins, minerals, herbal supplements, protein supplements, omega fatty acids, probiotics, and others. Each of these sub-segments caters to different consumer needs and preferences, reflecting the diverse landscape of health and wellness products available in Spain.

The vitamins segment is the leading category in the market, driven by a growing awareness of the importance of micronutrients in daily health. Consumers are increasingly turning to vitamin supplements to address deficiencies and support overall wellness. The rise in preventive healthcare and the popularity of multivitamins among various demographics, including children and seniors, further bolster this segment's dominance. Additionally, the convenience of vitamin supplements in various forms, such as gummies and effervescent tablets, appeals to a broader audience.

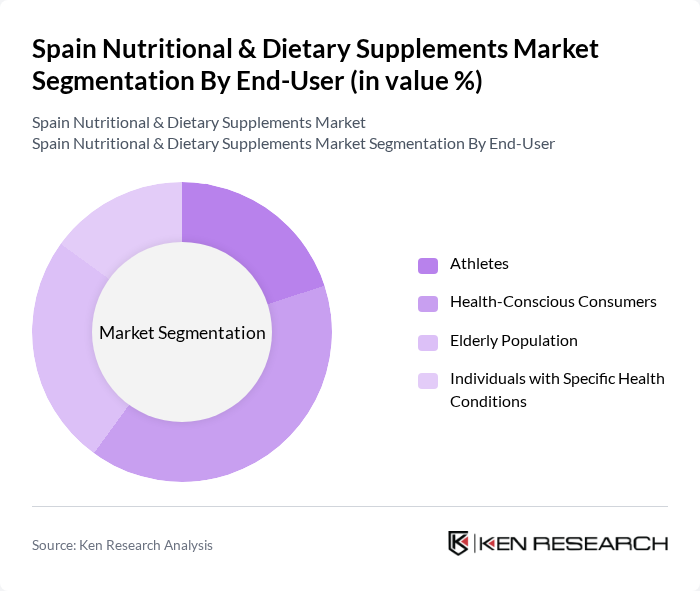

By End-User:The market is segmented by end-users, including athletes, health-conscious consumers, the elderly population, and individuals with specific health conditions. Each group has unique requirements and preferences, influencing their purchasing decisions and the types of supplements they seek.

The health-conscious consumers segment is the largest in the market, reflecting a growing trend towards preventive health measures and wellness. This demographic is increasingly aware of the benefits of dietary supplements in maintaining health and preventing diseases. The rise of social media and health influencers has also played a significant role in promoting the use of supplements among this group, leading to a surge in demand for various products tailored to enhance overall well-being.

The Spain Nutritional & Dietary Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Amway Corporation, Nestlé S.A., Glanbia plc, DSM Nutritional Products, GNC Holdings, Inc., Nature's Bounty Co., Solgar Inc., Arkopharma S.A., Laboratorios Ordesa S.A., ESI S.p.A., Pharma Nord A/S, NutraBlast LLC, BioCare Copenhagen A/S, Trec Nutrition contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Spain Nutritional & Dietary Supplements Market appears promising, driven by increasing health awareness and a shift towards preventive healthcare. As consumers continue to prioritize wellness, the demand for personalized and plant-based supplements is expected to rise. Additionally, advancements in technology will likely enhance product development, enabling companies to create innovative solutions that cater to evolving consumer preferences. This dynamic landscape presents significant opportunities for growth and expansion in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Herbal Supplements Protein Supplements Omega Fatty Acids Probiotics Others |

| By End-User | Athletes Health-Conscious Consumers Elderly Population Individuals with Specific Health Conditions |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Pharmacies Health Food Stores Direct Sales |

| By Formulation | Tablets Capsules Powders Liquids |

| By Age Group | Children Adults Seniors |

| By Price Range | Economy Mid-Range Premium |

| By Packaging Type | Bottles Blister Packs Pouches Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 150 | Store Managers, Retail Buyers |

| Consumer Preferences Survey | 200 | Health-Conscious Consumers, Fitness Enthusiasts |

| Industry Expert Interviews | 50 | Nutritionists, Health Coaches |

| Distribution Channel Analysis | 100 | Wholesalers, Distributors |

| Regulatory Impact Assessment | 30 | Regulatory Affairs Specialists, Compliance Officers |

The Spain Nutritional & Dietary Supplements Market is valued at approximately USD 2.5 billion, reflecting a significant growth trend driven by increasing health awareness and preventive healthcare measures among consumers.