Region:Central and South America

Author(s):Geetanshi

Product Code:KRAB6327

Pages:84

Published On:October 2025

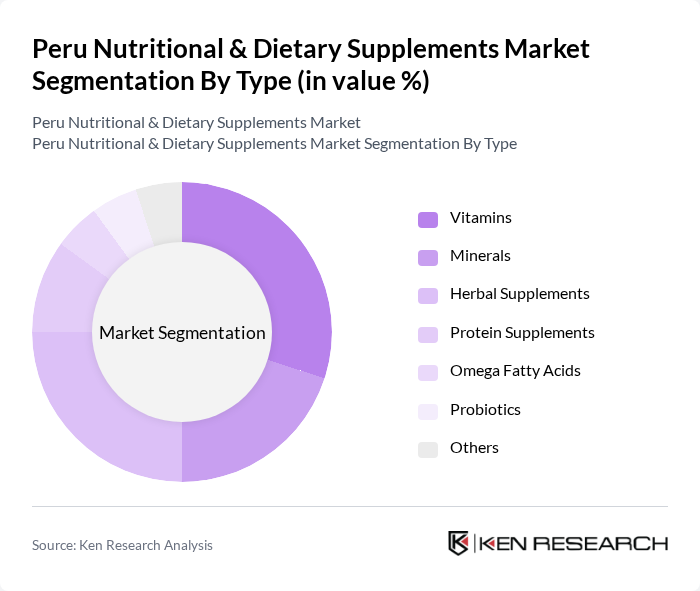

By Type:The market is segmented into various types of nutritional and dietary supplements, including Vitamins, Minerals, Herbal Supplements, Protein Supplements, Omega Fatty Acids, Probiotics, and Others. Among these, Vitamins and Herbal Supplements are particularly popular due to their perceived health benefits and natural origins. The increasing trend of self-medication and preventive health measures has led to a significant rise in the consumption of these products, making them the leading subsegments in the market.

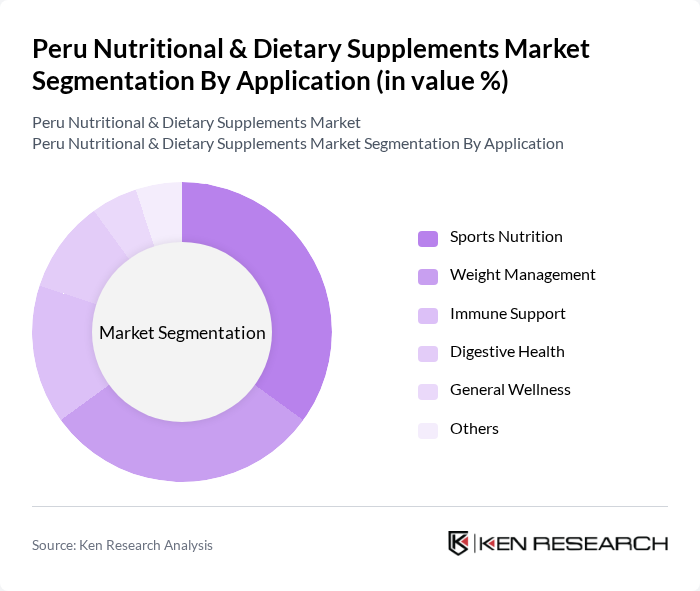

By Application:The applications of nutritional and dietary supplements include Sports Nutrition, Weight Management, Immune Support, Digestive Health, General Wellness, and Others. Sports Nutrition and Weight Management are the most prominent applications, driven by the increasing number of fitness enthusiasts and the rising prevalence of obesity. Consumers are increasingly turning to these supplements to support their fitness goals and maintain a healthy lifestyle, making these applications the leading segments in the market.

The Peru Nutritional & Dietary Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Amway Corporation, GNC Holdings, Inc., Nestlé S.A., Abbott Laboratories, Bayer AG, Glanbia plc, Nature's Bounty Co., USANA Health Sciences, Inc., Blackmores Limited, Solgar Inc., NOW Foods, Inc., Garden of Life, LLC, NutraBlast, Inc., MegaFood, LLC contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Peru Nutritional & Dietary Supplements market appears promising, driven by increasing health awareness and a shift towards preventive healthcare. As e-commerce continues to expand, companies will likely leverage digital platforms to reach a broader audience. Additionally, the trend towards personalization in supplements is expected to grow, with consumers seeking tailored solutions for their health needs. This evolving landscape presents opportunities for innovation and collaboration within the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Herbal Supplements Protein Supplements Omega Fatty Acids Probiotics Others |

| By Application | Sports Nutrition Weight Management Immune Support Digestive Health General Wellness Others |

| By Distribution Channel | Supermarkets/Hypermarkets Health Food Stores Pharmacies Online Retail Direct Sales Others |

| By Consumer Demographics | Age Group (Children, Adults, Seniors) Gender (Male, Female) Lifestyle (Active, Sedentary) |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers New Customers |

| By Packaging Type | Bottles Sachets Blister Packs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Nutritional Supplements | 150 | Store Managers, Sales Representatives |

| Consumer Preferences in Dietary Supplements | 200 | Health-Conscious Consumers, Fitness Enthusiasts |

| Healthcare Professional Insights | 100 | Nutritionists, Dietitians, General Practitioners |

| Market Trends in Herbal Supplements | 80 | Herbal Product Retailers, Alternative Medicine Practitioners |

| Online Purchasing Behavior for Supplements | 120 | E-commerce Managers, Digital Marketing Specialists |

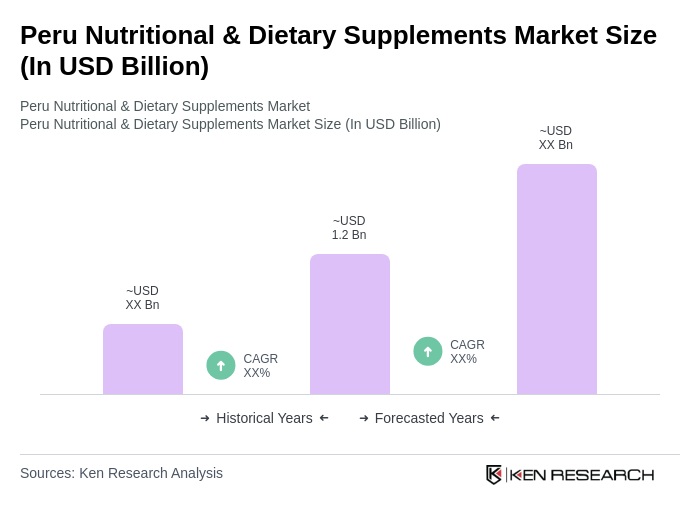

The Peru Nutritional & Dietary Supplements Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing health consciousness, rising disposable incomes, and a shift towards preventive healthcare among consumers.