Spain Offshore Wind & Renewable Projects Market Overview

- The Spain Offshore Wind & Renewable Projects Market is valued at approximately USD 13 billion, based on a five-year historical analysis. Growth is driven by rising demand for renewable energy, robust government policies supporting decarbonization, and technological advancements that improve project efficiency and grid integration. Substantial investment in both onshore and offshore wind, as well as solar projects, continues to underpin Spain's energy transition, with wind energy alone accounting for a significant share of national electricity generation and ongoing expansion in project capacity .

- Key regions such as Catalonia, Galicia, and Andalusia remain central to market activity due to their favorable wind and solar resources, established grid infrastructure, and proactive local policies. These areas attract major project developers and investors, benefiting from a pipeline of new renewable installations and continued government support for clean energy expansion .

- The Spanish government’s National Integrated Energy and Climate Plan (Plan Nacional Integrado de Energía y Clima, PNIEC), issued by the Ministry for the Ecological Transition and the Demographic Challenge in 2021, sets a binding target of 74 GW of installed renewable capacity by 2030, including 3 GW of offshore wind. This regulatory framework mandates competitive auctions, grid access protocols, and sustainability standards, directly shaping project development and accelerating the shift toward a low-carbon economy .

Spain Offshore Wind & Renewable Projects Market Segmentation

By Type:The market is segmented into Offshore Wind (Floating and Fixed-bottom), Onshore Wind, Solar Photovoltaic (PV), Concentrated Solar Power (CSP), Bioenergy, Hydropower, Waste-to-Energy, and Others (e.g., Marine Energy). Each segment plays a distinct role in Spain’s renewable energy mix, with onshore wind and solar PV leading capacity additions, while offshore wind is poised for rapid growth as regulatory and technological barriers are addressed .

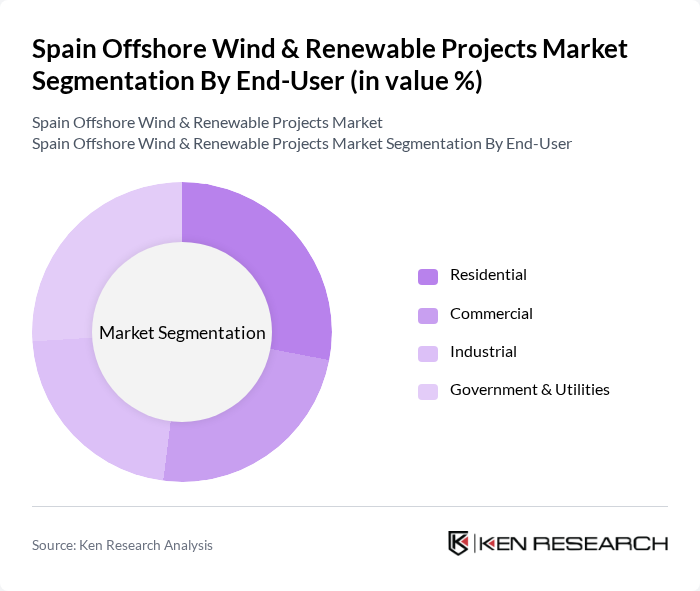

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, and Government & Utilities. Each segment demonstrates unique consumption patterns, with the industrial and utilities sectors accounting for the majority of large-scale renewable procurement, while the residential segment benefits from distributed solar and community energy initiatives .

Spain Offshore Wind & Renewable Projects Market Competitive Landscape

The Spain Offshore Wind & Renewable Projects Market is characterized by a dynamic mix of regional and international players. Leading participants such as Iberdrola S.A., Acciona Energía, Siemens Gamesa Renewable Energy S.A., EDP Renováveis S.A. (EDP Renewables), Naturgy Energy Group S.A., Enel Green Power España S.L., Vestas Wind Systems A/S, Ørsted A/S, RWE Renewables Iberia S.A., Nordex SE, Senvion S.A., GE Renewable Energy, TotalEnergies SE, BlueFloat Energy, Capital Energy, Greenalia S.A., Ocean Winds (JV: EDP Renewables & ENGIE), Saitec Offshore Technologies, X1 Wind, EnerOcean S.L. contribute to innovation, geographic expansion, and service delivery in this space.

Spain Offshore Wind & Renewable Projects Market Industry Analysis

Growth Drivers

- Increasing Energy Demand:Spain's energy consumption is projected to reach 300 terawatt-hours (TWh) in future, driven by economic recovery and population growth. The increasing demand for electricity, particularly in urban areas, necessitates a shift towards renewable sources. The Spanish government aims to generate 74% of its electricity from renewable sources in future, highlighting the urgency for offshore wind projects to meet this rising demand and ensure energy security.

- Government Support and Incentives:The Spanish government has committed to investing €30 billion in renewable energy projects in future, with a significant portion allocated to offshore wind. This includes subsidies and tax incentives aimed at attracting private investment. The recent approval of the National Integrated Energy and Climate Plan (NECP) further solidifies the government's commitment to achieving 3,000 megawatts (MW) of offshore wind capacity in future, fostering a favorable environment for market growth.

- Technological Advancements:The offshore wind sector in Spain is benefiting from advancements in turbine technology, with new models capable of generating up to 15 MW each. This increase in capacity is expected to lower the cost of energy production significantly. Additionally, innovations in floating wind technology are opening up previously inaccessible areas for development, potentially adding 1,500 MW of capacity in future, thus enhancing the overall viability of offshore wind projects.

Market Challenges

- High Initial Investment Costs:The average cost of developing offshore wind farms in Spain is estimated at €4 million per MW, leading to total project costs exceeding €1 billion for larger installations. These high upfront costs can deter investment, particularly from smaller developers. Additionally, securing financing remains a challenge, as investors often seek lower-risk opportunities, making it difficult for new entrants to compete in the market.

- Regulatory Hurdles:The regulatory landscape for offshore wind projects in Spain is complex, with multiple permits required from various governmental bodies. The average time to obtain necessary approvals can exceed 3 years, delaying project timelines. Furthermore, stringent environmental assessments can complicate the approval process, leading to increased costs and uncertainty for developers, which may hinder the overall growth of the offshore wind sector.

Spain Offshore Wind & Renewable Projects Market Future Outlook

The future of the offshore wind market in Spain appears promising, driven by increasing investments and technological advancements. In future, the sector is expected to see a surge in new projects, particularly in floating wind technology, which will expand operational capacity. Additionally, the integration of energy storage solutions is anticipated to enhance grid stability, making renewable energy more reliable. As corporate power purchase agreements gain traction, the market will likely attract further investment, fostering sustainable growth in the renewable energy landscape.

Market Opportunities

- Expansion of Offshore Wind Farms:The Spanish government plans to auction 1,000 MW of new offshore wind capacity in future, creating significant opportunities for developers. This expansion is expected to attract both domestic and international investors, enhancing competition and driving innovation within the sector, ultimately leading to lower energy costs for consumers.

- Development of Hybrid Energy Systems:The integration of offshore wind with other renewable sources, such as solar, presents a unique opportunity for Spain. Hybrid systems can optimize energy production and improve grid reliability. In future, projects combining offshore wind with energy storage solutions are expected to emerge, providing a more resilient energy infrastructure and meeting the growing demand for clean energy.