Region:Europe

Author(s):Geetanshi

Product Code:KRAA0187

Pages:95

Published On:August 2025

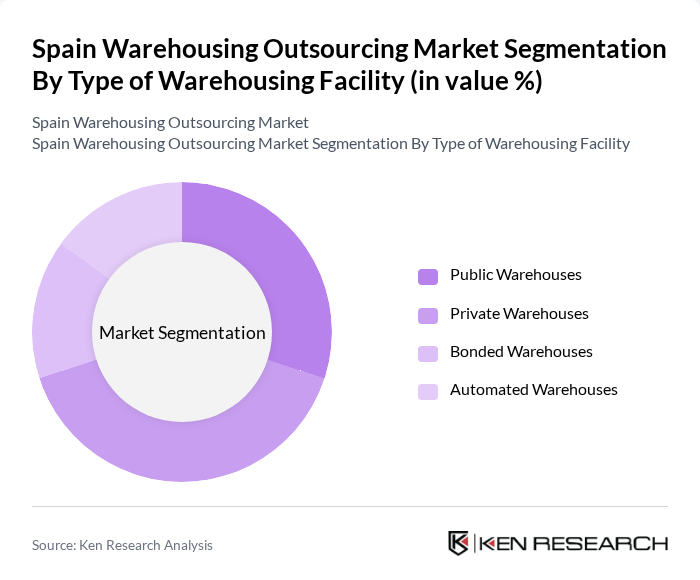

By Type of Warehousing Facility:The warehousing outsourcing market is segmented into four main types: Public Warehouses, Private Warehouses, Bonded Warehouses, and Automated Warehouses. Public Warehouses are typically utilized by multiple clients, offering flexibility and cost-effectiveness. Private Warehouses are owned or leased by companies for their exclusive use, providing tailored solutions and greater control over inventory. Bonded Warehouses are used for storing goods that are subject to customs duties, facilitating international trade and customs clearance. Automated Warehouses leverage robotics, artificial intelligence, and advanced warehouse management systems for efficient, high-throughput operations and reduced labor costs .

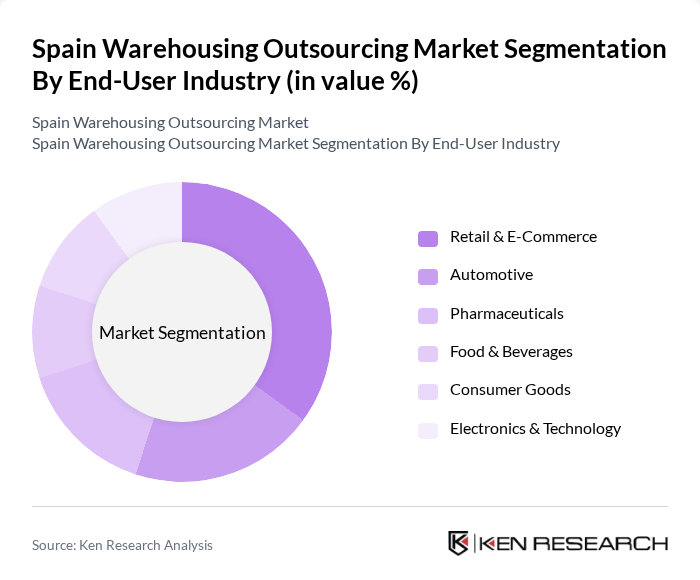

By End-User Industry:The market is also segmented by end-user industries, including Retail & E-Commerce, Automotive, Pharmaceuticals, Food & Beverages, Consumer Goods, and Electronics & Technology. Retail & E-Commerce is the leading segment, driven by the surge in online shopping, omnichannel retail strategies, and the need for efficient distribution networks. The Automotive and Pharmaceuticals sectors also contribute significantly due to their specific storage, regulatory, and distribution requirements. Food & Beverages, Consumer Goods, and Electronics & Technology segments are growing, supported by increased demand for temperature-controlled storage, just-in-time inventory, and rapid fulfillment capabilities .

The Spain Warehousing Outsourcing Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, XPO Logistics, Kuehne + Nagel, DB Schenker, CEVA Logistics, Geodis, DSV, Rhenus Logistics, FM Logistic, Logista, Stef Iberia, FedEx Logistics, Noatum Logistics, Grupo Sesé, Azkar Dachser Group contribute to innovation, geographic expansion, and service delivery in this space .

The future of the Spain warehousing outsourcing market appears promising, driven by the ongoing digital transformation and the increasing need for efficient logistics solutions. As businesses continue to embrace e-commerce, the demand for flexible and scalable warehousing solutions will grow. Additionally, the focus on sustainability and green logistics will shape investment strategies, encouraging companies to adopt eco-friendly practices and technologies that enhance operational efficiency while meeting regulatory requirements.

| Segment | Sub-Segments |

|---|---|

| By Type of Warehousing Facility | Public Warehouses Private Warehouses Bonded Warehouses Automated Warehouses |

| By End-User Industry | Retail & E-Commerce Automotive Pharmaceuticals Food & Beverages Consumer Goods Electronics & Technology |

| By Business Type | Warehouse Distribution Value Added Services |

| By Mode of Operation | Storage Roadways Distribution Seaways Distribution Other Modes of Operations |

| By Geography | Northern Spain Central Spain Eastern Spain Southern Spain Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Warehousing Operations | 100 | Warehouse Managers, Logistics Coordinators |

| Pharmaceutical Distribution Centers | 60 | Supply Chain Managers, Compliance Officers |

| Automotive Parts Warehousing | 50 | Operations Managers, Inventory Control Specialists |

| E-commerce Fulfillment Centers | 80 | eCommerce Operations Managers, Logistics Analysts |

| Third-Party Logistics Providers | 40 | Business Development Managers, Client Relationship Managers |

The Spain Warehousing Outsourcing Market is valued at approximately EUR 5.3 billion, reflecting significant growth driven by the demand for efficient logistics solutions, e-commerce expansion, and supply chain optimization.