Region:Asia

Author(s):Geetanshi

Product Code:KRAA4543

Pages:85

Published On:September 2025

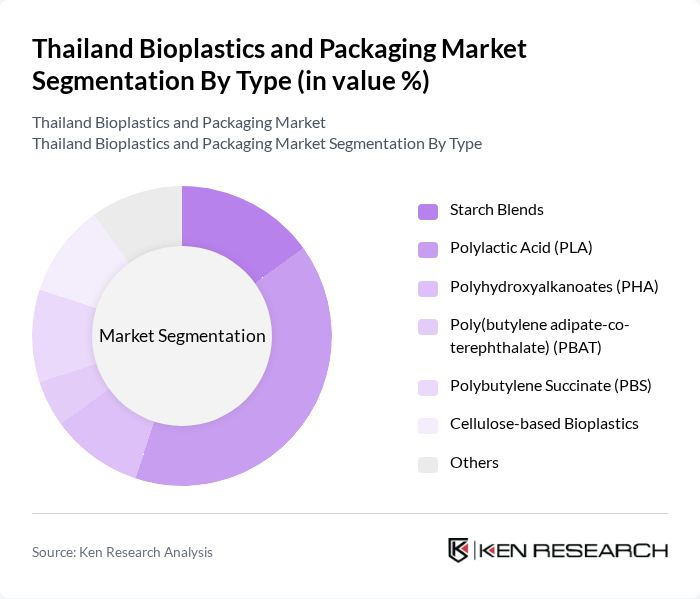

By Type:The bioplastics market in Thailand is segmented into Starch Blends, Polylactic Acid (PLA), Polyhydroxyalkanoates (PHA), Poly(butylene adipate-co-terephthalate) (PBAT), Polybutylene Succinate (PBS), Cellulose-based Bioplastics, and Others. Among these,Polylactic Acid (PLA)is the leading subsegment, favored for its processability, compostability, and strong consumer acceptance in food and consumer goods packaging. Starch blends are also prominent, especially in biodegradable films .

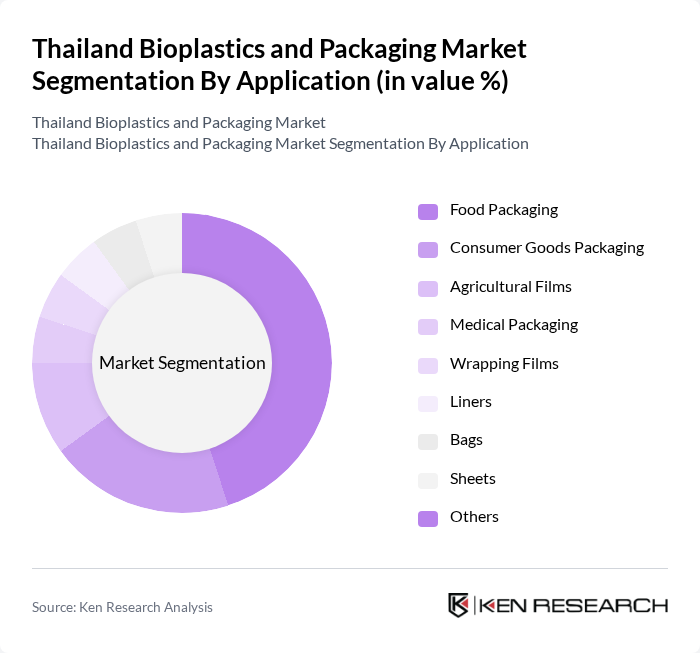

By Application:Major applications of bioplastics in Thailand include Food Packaging, Consumer Goods Packaging, Agricultural Films, Medical Packaging, Wrapping Films, Liners, Bags, Sheets, and Others.Food Packagingremains the dominant segment, propelled by rising demand for sustainable packaging in the food and beverage sector and regulatory pushes for compostable and recyclable materials .

The Thailand Bioplastics and Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as NatureWorks LLC, BASF SE, Total Corbion PLA (Thailand) Co., Ltd., PTT MCC Biochem Company Limited, Thai Bioplastics Industry Association (TBIA), Biodegradable Packaging for Environment Public Co., Ltd. (BPE), Mitr Phol Group, BioBag International AS, Kingfa Science & Technology Co., Ltd., Futamura Chemical Co., Ltd., TIPA Corp Ltd., SCG Chemicals Public Company Limited, Braskem S.A., Mitsubishi Chemical Corporation, and Danimer Scientific contribute to innovation, geographic expansion, and service delivery in this space.

The Thailand bioplastics and packaging market is poised for significant growth, driven by increasing environmental awareness and government support. As consumer preferences shift towards sustainable products, the demand for bioplastics is expected to rise. Innovations in bioplastic technology will likely enhance product performance and reduce costs, making them more competitive. Additionally, collaborations with eco-friendly brands will further expand market reach, positioning Thailand as a leader in sustainable packaging solutions in the Southeast Asian region.

| Segment | Sub-Segments |

|---|---|

| By Type | Starch Blends Polylactic Acid (PLA) Polyhydroxyalkanoates (PHA) Poly(butylene adipate-co-terephthalate) (PBAT) Polybutylene Succinate (PBS) Cellulose-based Bioplastics Others |

| By Application | Food Packaging Consumer Goods Packaging Agricultural Films Medical Packaging Wrapping Films Liners Bags Sheets Others |

| By End-User | Food & Beverage Agriculture Healthcare Personal Care & Cosmetics Electrical & Electronics Retail Sector Others |

| By Distribution Channel | Direct Sales Online Retail Distributors and Wholesalers Others |

| By Material Source | Renewable Resources Recycled Materials Others |

| By Packaging Type | Rigid Packaging Flexible Packaging Wraps & Films Bags Pouches Others |

| By Price Range | Economy Mid-range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Bioplastics Manufacturers | 60 | Production Managers, R&D Directors |

| Packaging Companies | 50 | Product Managers, Sustainability Officers |

| Retail Sector Stakeholders | 40 | Supply Chain Managers, Procurement Officers |

| Consumer Insights | 100 | General Consumers, Eco-conscious Shoppers |

| Regulatory Bodies | 40 | Policy Makers, Environmental Analysts |

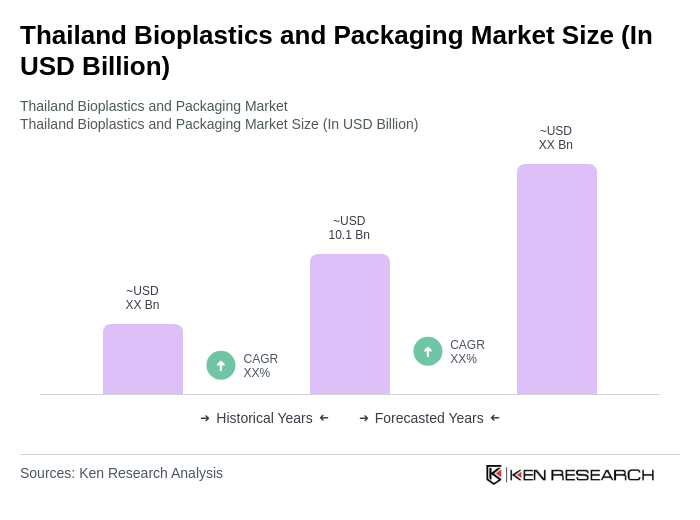

The Thailand Bioplastics and Packaging Market is valued at approximately USD 10.1 billion, reflecting a significant growth trend driven by consumer demand for sustainable packaging solutions and regulatory mandates aimed at reducing plastic waste.