Region:Asia

Author(s):Geetanshi

Product Code:KRAA4375

Pages:83

Published On:January 2026

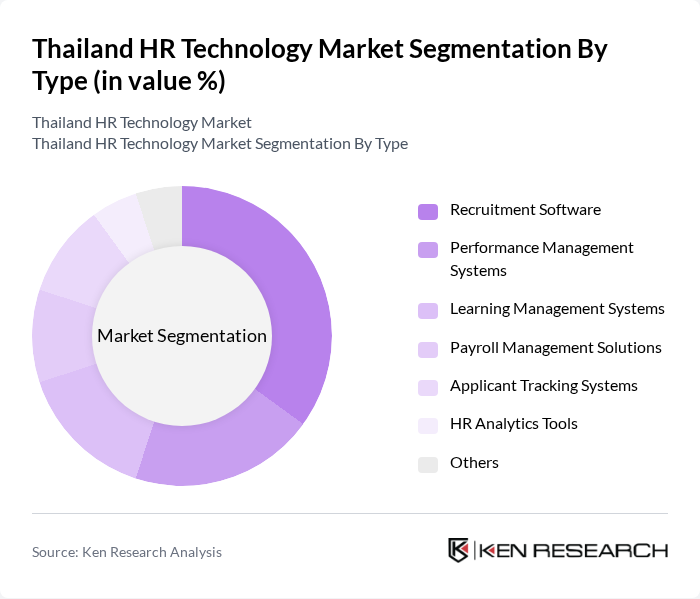

By Type:The HR technology market can be segmented into various types, including Recruitment Software, Performance Management Systems, Learning Management Systems, Payroll Management Solutions, Applicant Tracking Systems, HR Analytics Tools, and Others. Among these, Recruitment Software is currently the leading sub-segment, driven by the increasing demand for efficient hiring processes and the integration of AI technologies to enhance candidate sourcing and selection.

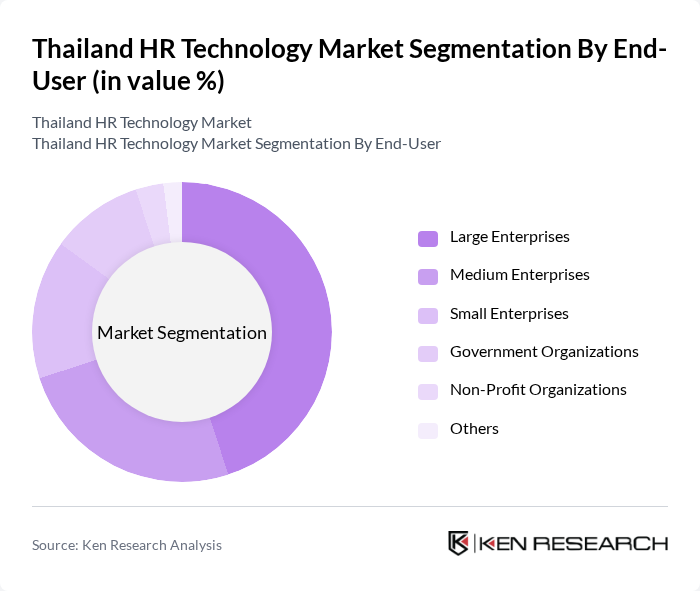

By End-User:The HR technology market is segmented by end-user into Large Enterprises, Medium Enterprises, Small Enterprises, Government Organizations, Non-Profit Organizations, and Others. Large Enterprises dominate the market due to their substantial budgets for technology investments and the need for comprehensive HR solutions to manage large workforces effectively.

The Thailand HR Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as SAP SuccessFactors, Oracle HCM Cloud, Workday, BambooHR, ADP Workforce Now, Cornerstone OnDemand, Paycor, Zoho People, Gusto, Ceridian Dayforce, Talentsoft, Sage People, Kronos Workforce Ready, Namely, and PeopleSoft contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Thailand HR technology market appears promising, driven by ongoing digital transformation initiatives and a growing emphasis on employee-centric solutions. As organizations increasingly adopt cloud-based platforms and AI-driven analytics, the market is expected to evolve significantly. By future, the integration of advanced technologies will likely enhance HR processes, improve employee experiences, and foster a more agile workforce, positioning Thailand as a leader in HR innovation within Southeast Asia.

| Segment | Sub-Segments |

|---|---|

| By Type | Recruitment Software Performance Management Systems Learning Management Systems Payroll Management Solutions Applicant Tracking Systems HR Analytics Tools Others |

| By End-User | Large Enterprises Medium Enterprises Small Enterprises Government Organizations Non-Profit Organizations Others |

| By Industry | IT and Software Manufacturing Retail Healthcare Education Financial Services Others |

| By Deployment Model | On-Premise Cloud-Based Hybrid Others |

| By Functionality | Recruitment and Staffing Employee Management Talent Management Compensation and Benefits Compliance Management Others |

| By User Type | HR Professionals Line Managers Employees Executives Others |

| By Policy Support | Subsidies for HR Tech Adoption Tax Incentives for Technology Investments Grants for Innovation in HR Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector HR Technology Adoption | 120 | HR Managers, Operations Directors |

| IT Sector HR Software Utilization | 100 | IT Managers, HR Technology Specialists |

| Service Industry HR Solutions | 110 | HR Directors, Talent Acquisition Managers |

| SME HR Technology Implementation | 80 | Business Owners, HR Consultants |

| Government Sector HR Digital Transformation | 70 | Public Sector HR Managers, Policy Makers |

The Thailand HR Technology Market is valued at approximately USD 260 million, reflecting a significant growth trend driven by the adoption of digital solutions in human resource management and the increasing demand for efficient talent management systems.