Region:Asia

Author(s):Rebecca

Product Code:KRAA4388

Pages:96

Published On:January 2026

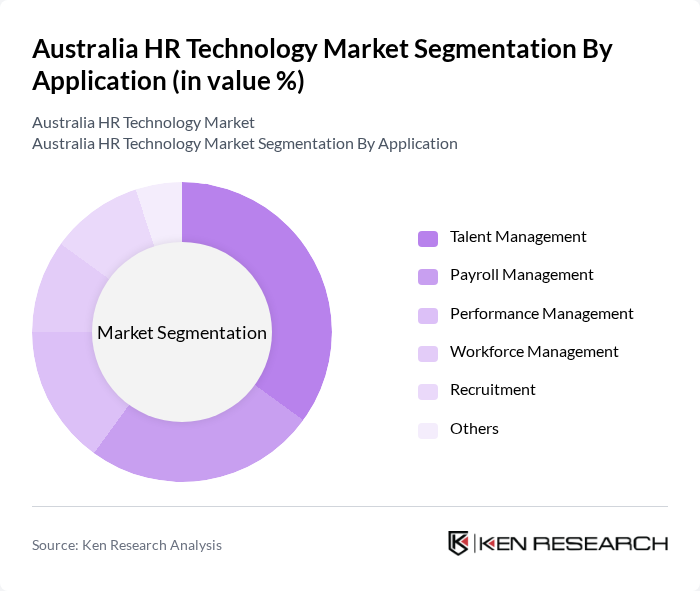

By Application:The application segment of the HR technology market includes various sub-segments such as Talent Management, Payroll Management, Performance Management, Workforce Management, Recruitment, and Others. Among these, Talent Management is currently the leading sub-segment, driven by the increasing focus on employee development and retention strategies. Organizations are investing heavily in talent management solutions to enhance employee engagement and align workforce capabilities with business goals.

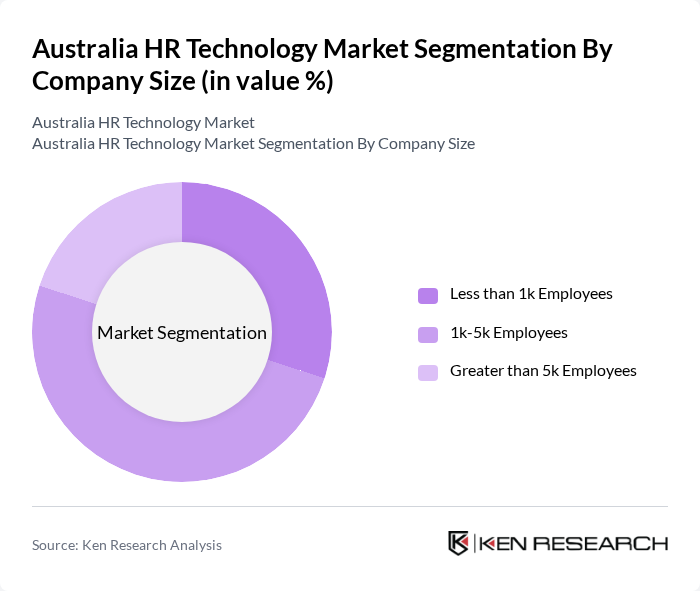

By Company Size:The company size segmentation includes Less than 1k Employees, 1k-5k Employees, and Greater than 5k Employees. The segment of companies with 1k-5k employees is currently leading the market, as these organizations are increasingly adopting HR technology solutions to manage their growing workforce efficiently. The need for scalable HR solutions that can adapt to changing business needs is driving this trend.

The Australia HR Technology Market is characterized by a dynamic mix of regional and international players. Leading participants such as Xero, Employment Hero, PageUp, SAP SuccessFactors, Workday, BambooHR, ADP, Oracle HCM Cloud, UKG (Ultimate Kronos Group), Talentsoft, Gusto, Ceridian, Paylocity, Zoho People, Sage People contribute to innovation, geographic expansion, and service delivery in this space.

The future of the HR technology market in Australia is poised for transformative growth, driven by advancements in artificial intelligence and machine learning. As organizations increasingly prioritize data-driven decision-making, the demand for sophisticated analytics tools will rise. Additionally, the focus on employee wellbeing and engagement will lead to the development of tailored HR solutions that cater to diverse workforce needs. Companies that embrace these trends will likely enhance their competitive edge and foster a more agile and responsive HR environment.

| Segment | Sub-Segments |

|---|---|

| By Application | Talent Management Payroll Management Performance Management Workforce Management Recruitment Others |

| By Company Size | Less than 1k Employees k-5k Employees Greater than 5k Employees |

| By End-Use Industry | BFSI Healthcare Information Technology TTH (Travel, Transportation, Hospitality) Public Sector Others |

| By Deployment Model | Cloud-Based On-Premises Hybrid |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Small to Medium Enterprises (SMEs) HR Technology Adoption | 100 | HR Managers, Business Owners |

| Large Corporations' HR Software Utilization | 80 | Chief HR Officers, IT Directors |

| Recruitment Technology Trends | 70 | Recruitment Specialists, Talent Acquisition Managers |

| Employee Engagement Tools Assessment | 60 | Employee Experience Managers, HR Consultants |

| Payroll and Compliance Software Insights | 90 | Payroll Managers, Compliance Officers |

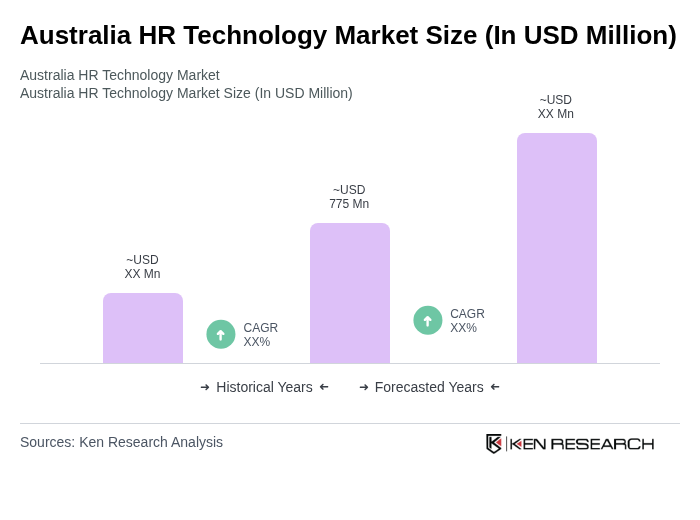

The Australia HR Technology Market is valued at approximately USD 775 million, reflecting significant growth driven by the adoption of cloud-based solutions, automation tools, and the demand for employee engagement technologies.