Region:Asia

Author(s):Rebecca

Product Code:KRAB1800

Pages:82

Published On:October 2025

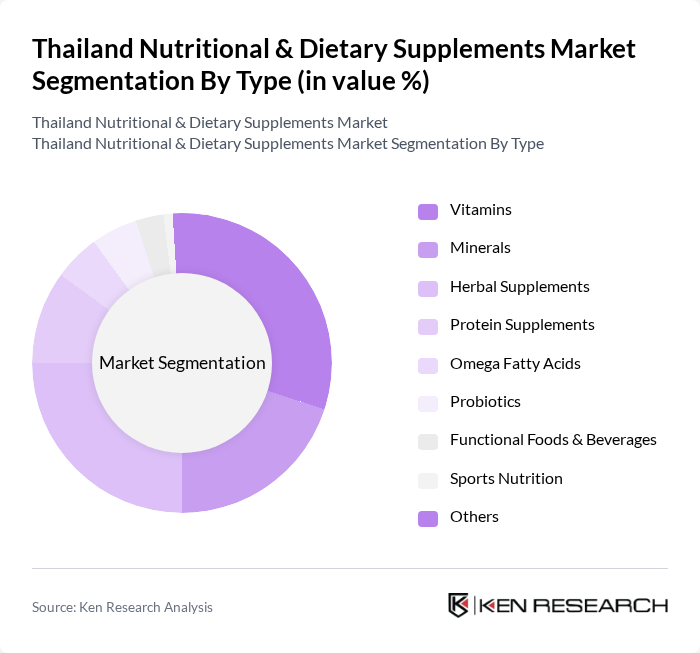

By Type:The market is segmented into various types of nutritional and dietary supplements, including vitamins, minerals, herbal supplements, protein supplements, omega fatty acids, probiotics, functional foods & beverages, sports nutrition, and others. Among these, vitamins and herbal supplements are particularly popular due to their perceived health benefits and natural origins. The increasing trend of preventive healthcare has led to a surge in demand for these products, with consumers actively seeking out supplements that support overall health and wellness. Functional foods and beverages have emerged as the largest revenue-generating segment, reflecting consumer preference for convenient nutrition solutions .

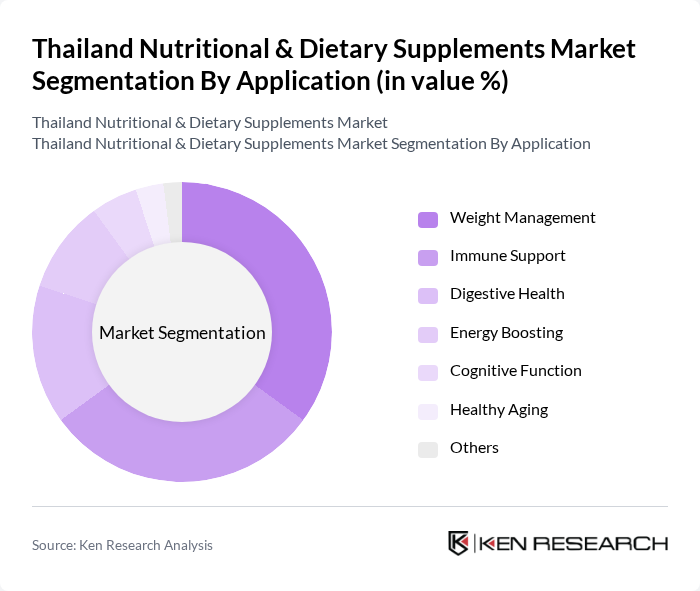

By Application:The application of nutritional and dietary supplements spans various health needs, including weight management, immune support, digestive health, energy boosting, cognitive function, healthy aging, and others. Weight management and immune support are currently the leading applications, driven by rising obesity rates and increased awareness of health and wellness, particularly in the wake of the COVID-19 pandemic. Consumers are increasingly turning to supplements that aid in weight loss and enhance immune function, reflecting a shift towards proactive health management. Bone and joint health supplements are also gaining traction due to the aging population and increased focus on mobility and long-term wellness .

The Thailand Nutritional & Dietary Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Herbalife Nutrition Ltd., Amway Corporation, Blackmores Limited, GNC Holdings, Inc., Nestlé S.A., Abbott Laboratories, DSM Nutritional Products, Swisse Wellness Pty Ltd., Nature's Way Products, LLC, Usana Health Sciences, Inc., Bio Rich Group Co., Ltd., BBI Healthcare Co., Ltd., Win Health Products Co., Ltd., Yakult (Thailand) Co., Ltd., CP-Meiji Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The Thailand Nutritional and Dietary Supplements market is poised for significant evolution, driven by increasing health awareness and a growing aging population. As consumers seek personalized and plant-based options, companies will need to adapt their product offerings accordingly. Additionally, the rise of e-commerce will facilitate broader access to these products, enhancing market penetration. Collaboration with healthcare professionals will also play a crucial role in educating consumers, ultimately fostering a more informed market landscape and driving sustainable growth in the sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Vitamins Minerals Herbal Supplements Protein Supplements Omega Fatty Acids Probiotics Functional Foods & Beverages Sports Nutrition Others |

| By Application | Weight Management Immune Support Digestive Health Energy Boosting Cognitive Function Healthy Aging Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Pharmacies Health Food Stores Direct Sales Convenience Stores Others |

| By Consumer Demographics | Age Group (Children, Adults, Seniors) Gender (Male, Female) Lifestyle (Active, Sedentary) |

| By Packaging Type | Bottles Sachets Blister Packs Stick Packs Others |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers New Customers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Dietary Supplement Usage | 120 | Health-conscious individuals, Fitness enthusiasts |

| Retailer Insights on Nutritional Products | 85 | Health store owners, Pharmacy managers |

| Healthcare Professional Perspectives | 75 | Nutritionists, Dietitians, General practitioners |

| Market Trends and Preferences | 100 | Consumers aged 18-65, Wellness bloggers |

| Regulatory Impact Assessment | 50 | Regulatory officials, Industry experts |

The Thailand Nutritional & Dietary Supplements Market is valued at approximately USD 4.1 billion, reflecting significant growth driven by increasing health consciousness, rising disposable incomes, and a growing aging population seeking preventive healthcare solutions.