Region:Asia

Author(s):Rebecca

Product Code:KRAA4855

Pages:83

Published On:September 2025

By Type:The market is segmented into various types, including Single-Family Homes, Multi-Family Units, Smart Apartments, Luxury Villas, Affordable Housing Projects, Mixed-Use Developments, and Others. Among these, Smart Apartments are gaining traction due to the increasing demand for technology-integrated living spaces. Consumers are increasingly looking for homes that offer convenience, energy efficiency, and modern amenities, making this sub-segment a leader in the market.

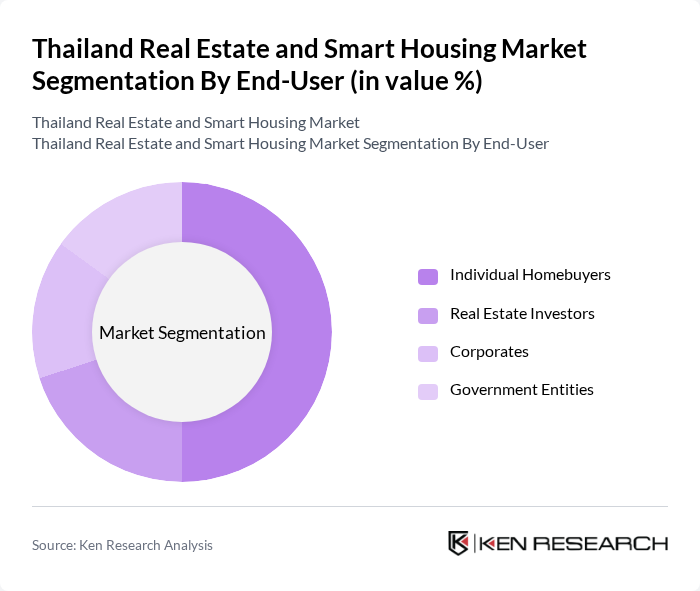

By End-User:This segmentation includes Individual Homebuyers, Real Estate Investors, Corporates, and Government Entities. Individual Homebuyers dominate the market, driven by the increasing trend of homeownership among the younger population. The desire for personal space and investment in real estate as a stable asset class has led to a surge in demand from this segment.

The Thailand Real Estate and Smart Housing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Property Perfect Public Company Limited, Land and Houses Public Company Limited, Sansiri Public Company Limited, Ananda Development Public Company Limited, Supalai Public Company Limited, Pruksa Real Estate Public Company Limited, SC Asset Corporation Public Company Limited, Quality Houses Public Company Limited, LPN Development Public Company Limited, Thai Obayashi Corporation Limited, TPI Polene Public Company Limited, Charn Issara Development Public Company Limited, Golden Land Property Development Public Company Limited, Major Development Public Company Limited, RML Property Public Company Limited contribute to innovation, geographic expansion, and service delivery in this space.

As Thailand's urbanization continues to accelerate, the demand for innovative housing solutions is expected to rise significantly. The integration of smart technologies and sustainable practices will likely become a standard in new developments. Additionally, government support for green initiatives and infrastructure expansion will create a conducive environment for investment. In the future, the focus on energy efficiency and eco-friendly materials will shape the market, driving growth and attracting both local and foreign investors to the smart housing sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Single-Family Homes Multi-Family Units Smart Apartments Luxury Villas Affordable Housing Projects Mixed-Use Developments Others |

| By End-User | Individual Homebuyers Real Estate Investors Corporates Government Entities |

| By Price Range | Below THB 1 Million THB 1 Million - THB 5 Million THB 5 Million - THB 10 Million Above THB 10 Million |

| By Location | Bangkok Metropolitan Area Central Thailand Northern Thailand Southern Thailand Eastern Seaboard Others |

| By Construction Type | Traditional Construction Prefabricated Construction Modular Construction Sustainable Construction |

| By Financing Source | Bank Loans Government Subsidies Private Equity Crowdfunding |

| By Development Stage | Pre-Construction Under Construction Completed Renovation |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Real Estate Buyers | 150 | First-time Homebuyers, Investors |

| Smart Housing Technology Users | 100 | Homeowners, Tech Enthusiasts |

| Real Estate Developers | 80 | Project Managers, Business Development Heads |

| Urban Planners and Architects | 70 | City Planners, Design Consultants |

| Property Management Firms | 60 | Property Managers, Operations Directors |

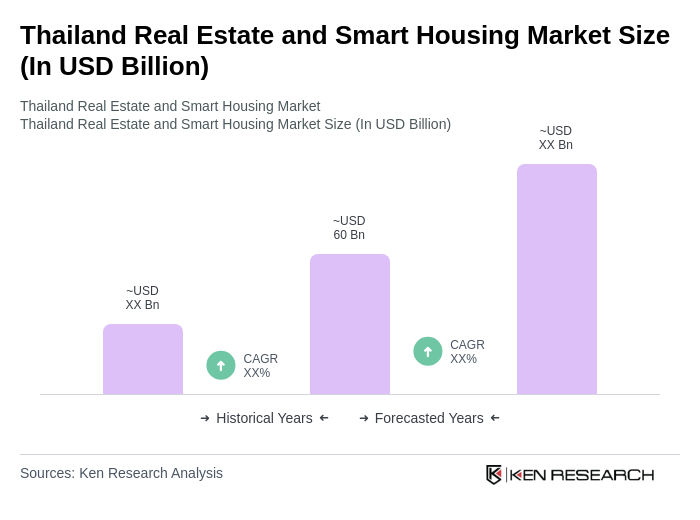

The Thailand Real Estate and Smart Housing Market is valued at approximately USD 60 billion, driven by urbanization, rising disposable incomes, and a growing demand for modern housing solutions, particularly smart housing technologies.