Thailand Specialty Oleochemicals Market Overview

- The Thailand Specialty Oleochemicals Market is valued at USD 1.2 billion, based on a five‑year historical analysis. This growth is primarily driven by the increasing demand for bio-based products, rising consumer awareness regarding sustainability, and the expansion of the personal care and food industries. The market is also supported by the growing trend of replacing petrochemical products with renewable alternatives, which has led to a surge in the production and consumption of specialty oleochemicals.

- Key players in this market include Bangkok Synthetics Co., Ltd., Thai Oleochemicals Co., Ltd., and PTT Global Chemical Public Company Limited. These companies dominate the market due to their extensive production capabilities, strong distribution networks, and commitment to innovation in sustainable practices, which align with the increasing consumer preference for eco-friendly products.

- In 2023, the Thai government implemented regulations to promote the use of renewable resources in the oleochemical industry. This includes a policy mandating that at least 20% of the raw materials used in the production of oleochemicals must come from renewable sources, aiming to reduce the environmental impact and enhance the sustainability of the sector.

Thailand Specialty Oleochemicals Market Segmentation

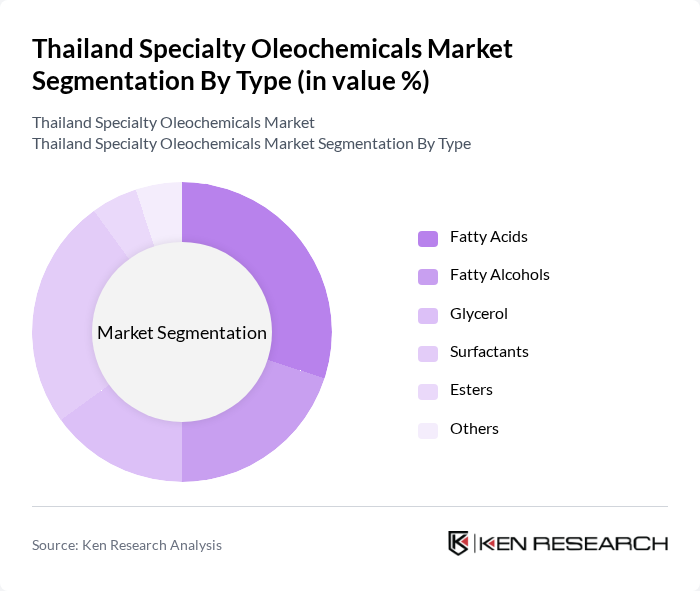

By Type:The market is segmented into various types, including Fatty Acids, Fatty Alcohols, Glycerol, Surfactants, Esters, and Others. Among these, Fatty Acids and Surfactants are the leading subsegments due to their extensive applications in personal care and industrial cleaning products. The increasing demand for natural and biodegradable products has further propelled the growth of these segments, as consumers are increasingly opting for sustainable alternatives in their daily lives.

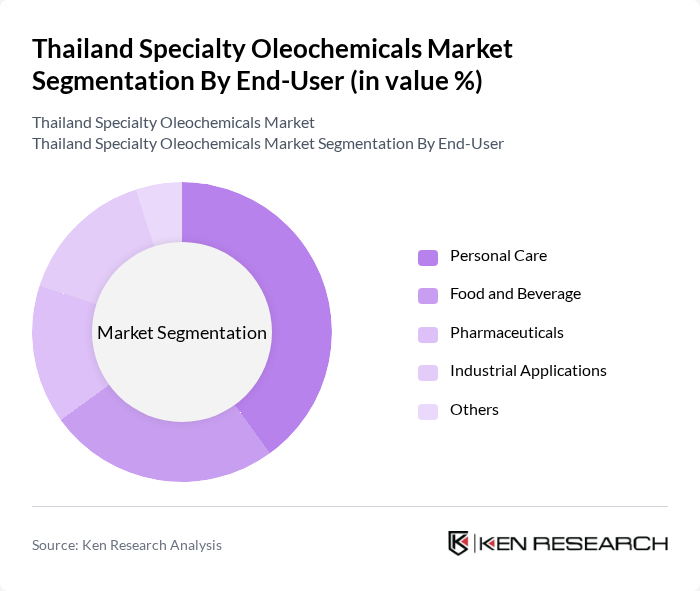

By End-User:The end-user segmentation includes Personal Care, Food and Beverage, Pharmaceuticals, Industrial Applications, and Others. The Personal Care segment is the most significant, driven by the rising demand for natural ingredients in cosmetics and skincare products. The trend towards clean beauty and organic formulations has led to increased consumption of specialty oleochemicals, making this segment a key driver of market growth.

Thailand Specialty Oleochemicals Market Competitive Landscape

The Thailand Specialty Oleochemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as PTT Global Chemical Public Company Limited, Thai Oleochemicals Co., Ltd., Univanich Palm Oil Public Company Limited, Wilmar International Limited, Cargill, Incorporated, BASF SE, Evonik Industries AG, Kao Corporation, Croda International Plc, AAK AB, Musim Mas Holdings, IOI Group, Emery Oleochemicals, Cargill Bioindustrial, Green Biologics Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

Thailand Specialty Oleochemicals Market Industry Analysis

Growth Drivers

- Increasing Demand for Biodegradable Products:The Thai market for biodegradable products is projected to reach approximately 1.5 million tons in future, driven by heightened consumer preference for sustainable options. This shift is supported by a 20% annual growth rate in the biodegradable segment, reflecting a broader global trend towards eco-friendly alternatives. The increasing awareness of environmental issues among consumers is a significant factor, as 70% of Thai consumers express a willingness to pay more for sustainable products, further fueling demand.

- Government Support for Sustainable Practices:The Thai government has allocated over THB 2 billion (approximately USD 60 million) in future to promote sustainable practices within the oleochemical industry. This funding supports initiatives aimed at reducing carbon emissions and enhancing the production of bio-based chemicals. Additionally, the government’s commitment to achieving a 30% reduction in greenhouse gas emissions by 2030 encourages investments in green technologies, creating a favorable environment for the growth of specialty oleochemicals.

- Rising Consumer Awareness of Eco-Friendly Products:A recent survey indicated that 65% of Thai consumers are increasingly aware of the environmental impact of their purchases. This awareness is driving demand for eco-friendly products, particularly in sectors like personal care and household goods. The Thai specialty oleochemicals market is benefiting from this trend, as manufacturers are responding by developing products that align with consumer preferences for sustainability, leading to an estimated growth of 15% in eco-friendly product lines in future.

Market Challenges

- Fluctuating Raw Material Prices:The specialty oleochemicals market in Thailand faces significant challenges due to the volatility of raw material prices, particularly palm oil and fatty acids. In future, palm oil prices fluctuated between THB 30,000 to THB 40,000 per ton, impacting production costs. This instability can lead to unpredictable pricing for end products, making it difficult for manufacturers to maintain profit margins and plan for future investments, ultimately hindering market growth.

- Regulatory Compliance Costs:Compliance with environmental regulations in Thailand has become increasingly stringent, leading to higher operational costs for manufacturers. In future, companies are expected to spend an average of THB 1 million (approximately USD 30,000) annually on compliance-related activities. These costs can disproportionately affect small and medium-sized enterprises, limiting their ability to compete effectively in the specialty oleochemicals market and stifling innovation.

Thailand Specialty Oleochemicals Market Future Outlook

The future of the Thailand specialty oleochemicals market appears promising, driven by a strong emphasis on sustainability and innovation. As consumer preferences shift towards eco-friendly products, manufacturers are likely to invest in research and development to create advanced, biodegradable alternatives. Additionally, the government's supportive policies and funding initiatives will further enhance the market's growth potential. In future, the integration of technology in production processes is expected to streamline operations, reduce costs, and improve product quality, positioning Thailand as a leader in the specialty oleochemicals sector.

Market Opportunities

- Growth in Personal Care and Cosmetics Sector:The personal care and cosmetics sector in Thailand is projected to grow to THB 100 billion (approximately USD 3 billion) in future. This growth presents significant opportunities for specialty oleochemicals, as manufacturers seek natural and sustainable ingredients to meet consumer demand for eco-friendly products, enhancing market penetration and profitability.

- Development of Innovative Oleochemical Products:There is a growing opportunity for the development of innovative oleochemical products tailored to specific industries, such as food and pharmaceuticals. With an estimated investment of THB 500 million (around USD 15 million) in R&D in future, companies can create specialized formulations that cater to niche markets, driving growth and expanding their product offerings.