Region:Asia

Author(s):Rebecca

Product Code:KRAE3360

Pages:100

Published On:February 2026

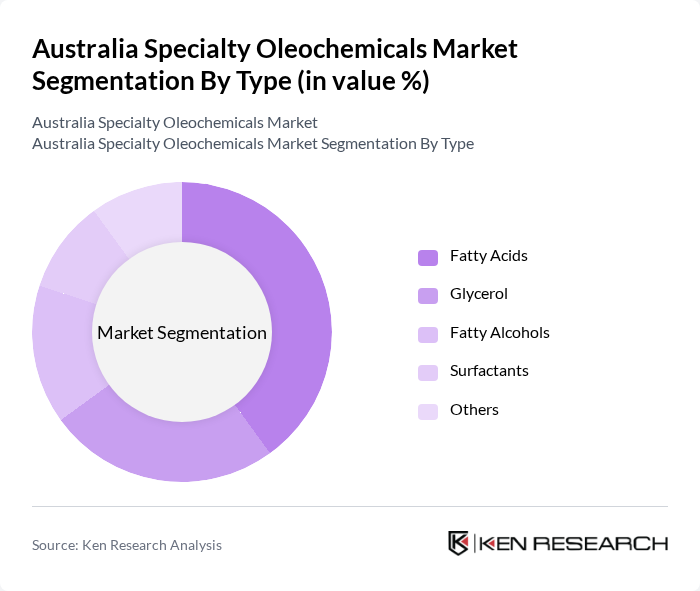

By Type:The market is segmented into various types, including Fatty Acids, Glycerol, Fatty Alcohols, Surfactants, and Others. Among these, Fatty Acids are the leading subsegment due to their extensive use in personal care products and industrial applications. The growing trend towards natural and organic products has further propelled the demand for fatty acids, making them a preferred choice for manufacturers. Glycerol and Fatty Alcohols also hold significant market shares, driven by their applications in food and pharmaceuticals.

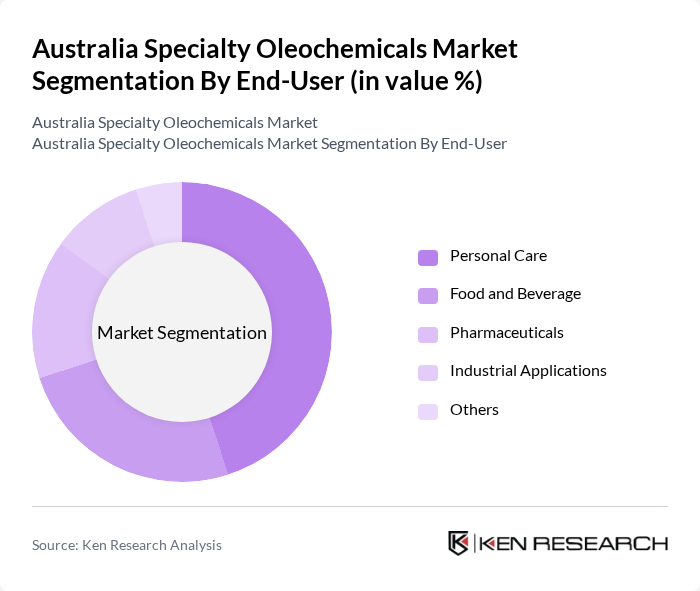

By End-User:The end-user segmentation includes Personal Care, Food and Beverage, Pharmaceuticals, Industrial Applications, and Others. The Personal Care segment is the dominant player, driven by the increasing consumer preference for natural ingredients in cosmetics and skincare products. The Food and Beverage sector is also significant, as oleochemicals are used as emulsifiers and stabilizers. Pharmaceuticals are growing steadily, with oleochemicals being utilized in drug formulations and delivery systems.

The Australia Specialty Oleochemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as Wilmar International Limited, BASF SE, Croda International Plc, Emery Oleochemicals, KLK Oleo, IOI Group, Musim Mas Holdings, AAK AB, Cargill, Incorporated, Solvay S.A., P&G Chemicals, Stepan Company, Natural Plant Products, BioAmber Inc., Green Biologics Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Australia specialty oleochemicals market appears promising, driven by increasing consumer demand for sustainable products and government support for green initiatives. As industries continue to adopt circular economy principles, the focus on renewable feedstocks and innovative product development will likely intensify. Additionally, advancements in digital manufacturing processes are expected to enhance efficiency and reduce costs, positioning the market for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Fatty Acids Glycerol Fatty Alcohols Surfactants Others |

| By End-User | Personal Care Food and Beverage Pharmaceuticals Industrial Applications Others |

| By Application | Emulsifiers Lubricants Coatings Adhesives Others |

| By Source | Plant-Based Animal-Based Synthetic Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Geography | New South Wales Victoria Queensland Western Australia Others |

| By Product Form | Liquid Solid Powder Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Care Products | 100 | Product Development Managers, Brand Managers |

| Food Industry Applications | 80 | Quality Assurance Managers, Food Technologists |

| Pharmaceuticals and Healthcare | 70 | Regulatory Affairs Specialists, R&D Directors |

| Industrial Applications | 60 | Procurement Managers, Operations Directors |

| Biodegradable Plastics Sector | 90 | Sustainability Officers, Product Managers |

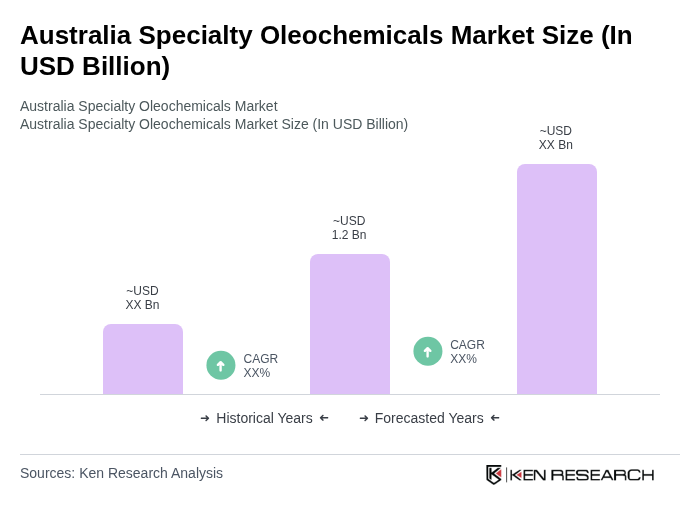

The Australia Specialty Oleochemicals Market is valued at approximately USD 1.2 billion, reflecting a robust growth trajectory driven by increasing demand for bio-based products and sustainability awareness across various industries, including personal care, food, and pharmaceuticals.