Region:Middle East

Author(s):Rebecca

Product Code:KRAE3359

Pages:94

Published On:February 2026

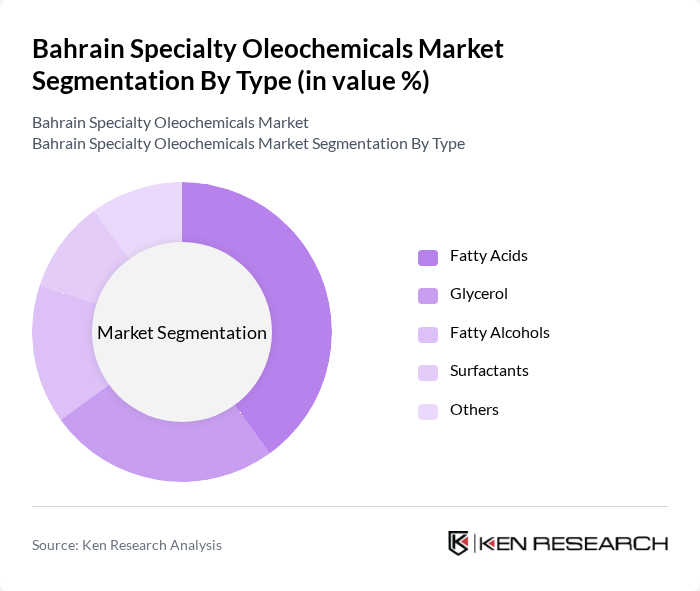

By Type:The market is segmented into various types, including Fatty Acids, Glycerol, Fatty Alcohols, Surfactants, and Others. Among these, Fatty Acids are the most dominant due to their extensive use in personal care products and industrial applications. The increasing consumer preference for natural ingredients in cosmetics and personal care has significantly boosted the demand for fatty acids, making them a key player in the market.

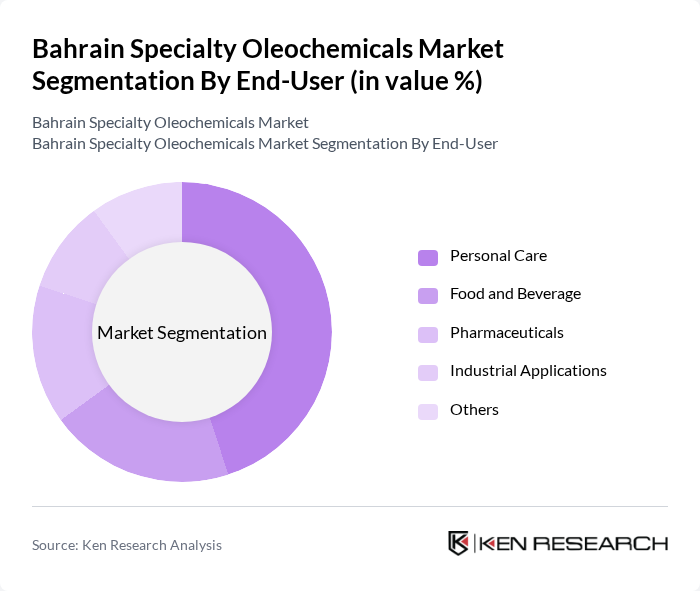

By End-User:The end-user segmentation includes Personal Care, Food and Beverage, Pharmaceuticals, Industrial Applications, and Others. The Personal Care segment leads the market, driven by the rising demand for natural and organic products. Consumers are increasingly seeking products that are free from harmful chemicals, which has led to a surge in the use of oleochemicals in cosmetics and skincare formulations.

The Bahrain Specialty Oleochemicals Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Wilmar International Limited, Cargill, Incorporated, IOI Group, Kuala Lumpur Kepong Berhad, Emery Oleochemicals, Croda International Plc, AAK AB, Musim Mas Holdings, Godrej Industries Limited, Oleon NV, P&G Chemicals, Ecogreen Oleochemicals, Green Biologics, BioAmber Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The Bahrain specialty oleochemicals market is poised for significant growth, driven by increasing consumer demand for sustainable products and government support for eco-friendly practices. As the personal care and cosmetics sectors expand, manufacturers are likely to innovate and diversify their product offerings. Additionally, advancements in production technologies will enhance efficiency, allowing for greater competitiveness against synthetic alternatives. The focus on sustainability will continue to shape market dynamics, presenting both challenges and opportunities for stakeholders.

| Segment | Sub-Segments |

|---|---|

| By Type | Fatty Acids Glycerol Fatty Alcohols Surfactants Others |

| By End-User | Personal Care Food and Beverage Pharmaceuticals Industrial Applications Others |

| By Application | Emulsifiers Lubricants Coatings Adhesives Others |

| By Source | Plant-Based Animal-Based Synthetic Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Geography | Northern Governorate Southern Governorate Capital Governorate Muharraq Governorate Others |

| By Product Form | Liquid Solid Powder Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Personal Care Product Manufacturers | 100 | Product Managers, R&D Directors |

| Food Industry Oleochemical Users | 80 | Quality Assurance Managers, Procurement Specialists |

| Pharmaceuticals and Nutraceuticals | 70 | Regulatory Affairs Managers, Production Supervisors |

| Industrial Applications of Oleochemicals | 60 | Operations Managers, Supply Chain Coordinators |

| Research Institutions and Academia | 50 | Research Scientists, Professors in Chemical Engineering |

The Bahrain Specialty Oleochemicals Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by the increasing demand for sustainable and biodegradable products across various industries, including personal care, food, and pharmaceuticals.