Region:Europe

Author(s):Shubham

Product Code:KRAB4370

Pages:84

Published On:October 2025

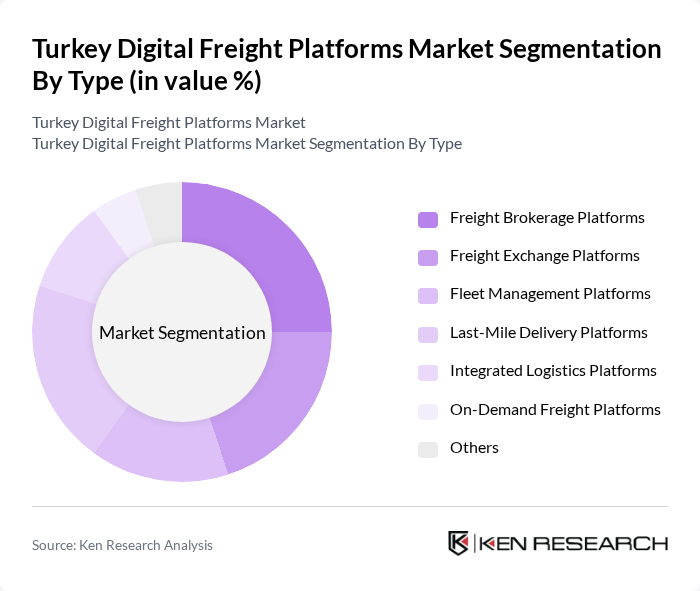

By Type:The market is segmented into various types, including Freight Brokerage Platforms, Freight Exchange Platforms, Fleet Management Platforms, Last-Mile Delivery Platforms, Integrated Logistics Platforms, On-Demand Freight Platforms, and Others. Each of these segments plays a crucial role in the overall logistics ecosystem, catering to different needs and preferences of businesses.

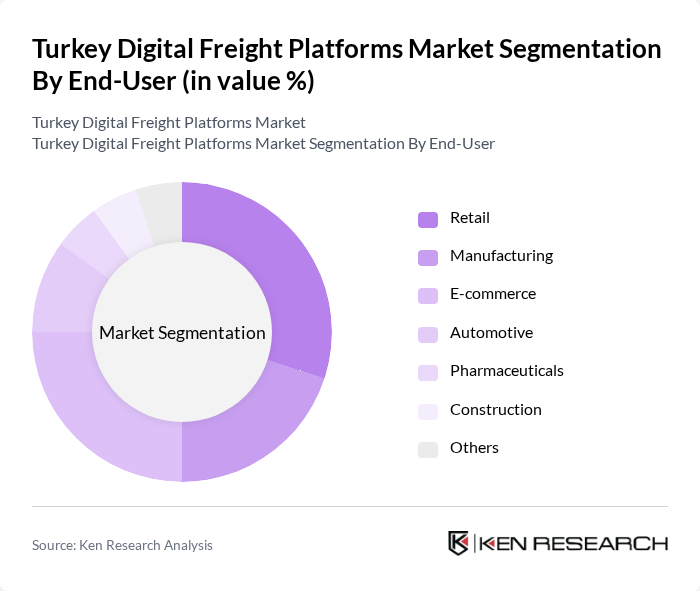

By End-User:The end-user segmentation includes Retail, Manufacturing, E-commerce, Automotive, Pharmaceuticals, Construction, and Others. Each sector has unique logistics requirements, influencing the demand for specific digital freight solutions tailored to their operational needs.

The Turkey Digital Freight Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Getir, TCDD Tasimacilik A.S., Aras Kargo, Yurtiçi Kargo, MNG Kargo, PTT Kargo, Hepsijet, Trendyol, N11, Ekol Logistics, Borusan Lojistik, Kargoist, Tofas, DHL Turkey, and UPS Turkey contribute to innovation, geographic expansion, and service delivery in this space.

The future of Turkey's digital freight platforms is promising, with anticipated advancements in technology and logistics efficiency. As the government continues to invest in infrastructure, platforms will benefit from improved connectivity and reduced operational costs. Additionally, the integration of AI and machine learning is expected to enhance route optimization and customer service. With the rise of e-commerce, platforms that adapt to consumer demands will likely thrive, positioning themselves as leaders in the logistics sector.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Brokerage Platforms Freight Exchange Platforms Fleet Management Platforms Last-Mile Delivery Platforms Integrated Logistics Platforms On-Demand Freight Platforms Others |

| By End-User | Retail Manufacturing E-commerce Automotive Pharmaceuticals Construction Others |

| By Service Type | Full Truck Load (FTL) Less Than Truck Load (LTL) Intermodal Services Expedited Freight Services Temperature-Controlled Freight Others |

| By Payment Method | Credit/Debit Cards Digital Wallets Bank Transfers Cash on Delivery Others |

| By Region | Marmara Aegean Central Anatolia Eastern Anatolia Southeastern Anatolia Black Sea Others |

| By Customer Type | Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies Non-Governmental Organizations (NGOs) Others |

| By Delivery Speed | Same-Day Delivery Next-Day Delivery Standard Delivery Scheduled Delivery Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Freight Platform Users | 150 | Logistics Managers, Operations Directors |

| Technology Providers in Freight | 100 | Product Managers, Business Development Executives |

| Industry Experts and Consultants | 80 | Supply Chain Analysts, Market Researchers |

| End-users of Freight Services | 120 | Procurement Managers, Supply Chain Coordinators |

| Regulatory Bodies and Associations | 50 | Policy Makers, Industry Representatives |

The Turkey Digital Freight Platforms Market is valued at approximately USD 1.2 billion, reflecting significant growth driven by technological adoption in logistics, the rise of e-commerce, and the demand for efficient supply chain solutions.