Region:Europe

Author(s):Geetanshi

Product Code:KRAA1991

Pages:93

Published On:August 2025

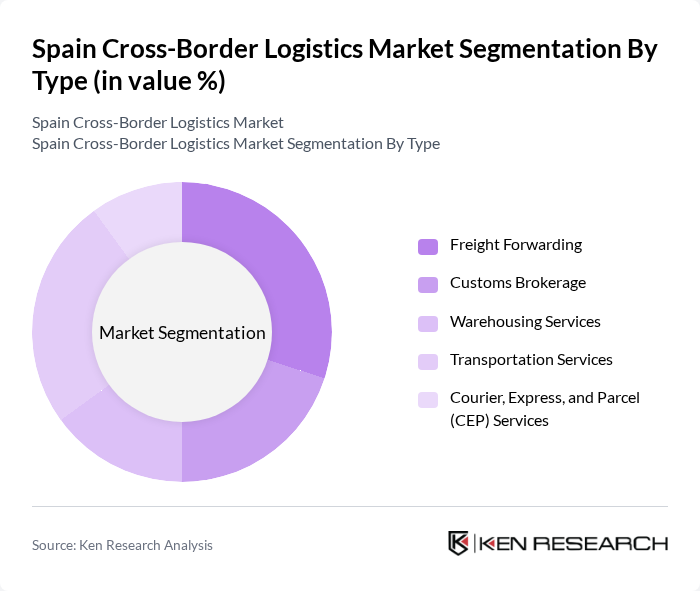

By Type:

The dominant subsegment in this category isFreight Forwarding, which plays a crucial role in managing the logistics of goods across borders. The increasing complexity of international trade regulations and the demand for timely deliveries have led to a surge in freight forwarding services. Companies are increasingly relying on freight forwarders to navigate customs and optimize shipping routes, making this subsegment essential for businesses engaged in cross-border trade. The segment benefits from Spain’s strategic location and robust infrastructure, with automation and data analytics further enhancing efficiency.

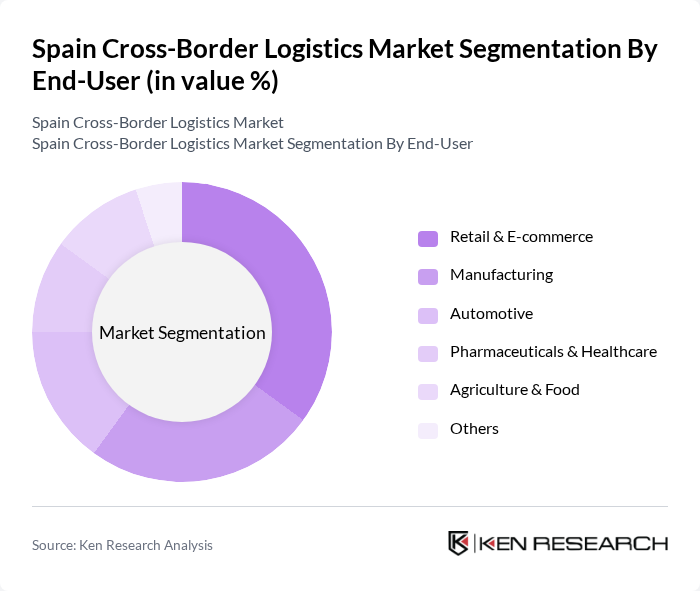

By End-User:

TheRetail & E-commercesector is the leading subsegment, driven by the exponential growth of online shopping and consumer demand for quick delivery options. As more consumers turn to e-commerce platforms for their shopping needs, logistics providers are adapting to meet the increasing volume of shipments. This trend has resulted in significant investment in logistics infrastructure and technology to enhance delivery speed and efficiency, solidifying the retail and e-commerce sector's dominance in the market. Urban logistics and last-mile delivery solutions are particularly emphasized to meet consumer expectations.

The Spain Cross-Border Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain Iberia, SEUR, XPO Logistics, Kuehne + Nagel, DB Schenker, Geodis, DSV, Transcoma Grupo Empresarial, Grupo Sesé, MRW, FedEx Express, UPS Supply Chain Solutions, Rhenus Logistics, Logista, Grupo TSB contribute to innovation, geographic expansion, and service delivery in this space.

The future of Spain's cross-border logistics market appears promising, driven by technological advancements and evolving consumer preferences. As e-commerce continues to expand, logistics providers are likely to invest in automation and digital solutions to enhance efficiency. Furthermore, the increasing emphasis on sustainability will push companies to adopt greener practices, aligning with global trends. The integration of AI and data analytics in logistics operations is expected to streamline processes, reduce costs, and improve service delivery, positioning Spain as a leader in cross-border logistics.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Forwarding Customs Brokerage Warehousing Services Transportation Services Courier, Express, and Parcel (CEP) Services |

| By End-User | Retail & E-commerce Manufacturing Automotive Pharmaceuticals & Healthcare Agriculture & Food Others |

| By Distribution Mode | Road Transport Rail Transport Air Freight Sea Freight Multimodal Transport |

| By Service Type | Full Truck Load (FTL) Less Than Truck Load (LTL) Intermodal Services Express Services Temperature-Controlled Logistics Others |

| By Customer Type | B2B B2C C2C Others |

| By Payment Method | Prepaid Postpaid Credit Terms Others |

| By Region | Northern Spain Southern Spain Eastern Spain Western Spain Central Spain Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cross-Border E-commerce Logistics | 100 | Logistics Coordinators, E-commerce Managers |

| Automotive Parts Cross-Border Shipping | 60 | Supply Chain Managers, Operations Directors |

| Textile Import/Export Logistics | 50 | Procurement Managers, Freight Forwarders |

| Pharmaceuticals Regulatory Compliance | 40 | Quality Assurance Managers, Compliance Officers |

| Consumer Electronics Returns Management | 50 | Customer Service Managers, Logistics Analysts |

The Spain Cross-Border Logistics Market is valued at approximately EUR 15 billion, driven by the growing demand for efficient supply chain solutions, e-commerce expansion, and the need for faster delivery services across borders.