Region:Europe

Author(s):Rebecca

Product Code:KRAB4165

Pages:99

Published On:October 2025

By Type:The market is segmented into various types of digital freight platforms, each addressing specific logistics requirements. The leading sub-segment is Digital Freight Forwarding Platforms, which streamline shipping processes by offering integrated booking, tracking, and documentation solutions. These platforms are preferred for their ability to enhance operational efficiency and reduce costs for businesses. Digital Freight Matching Platforms and Fleet Management Platforms also play vital roles by optimizing load matching, capacity utilization, and fleet coordination. Freight Exchange Platforms facilitate real-time cargo exchange, while Last-Mile Delivery Platforms and Port Community Systems support specialized logistics operations. Integrated Logistics Platforms provide end-to-end supply chain visibility and management .

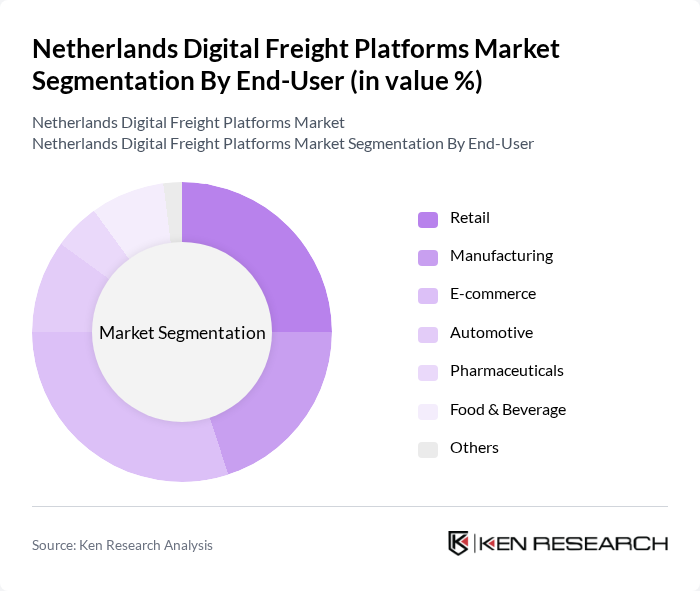

By End-User:End-user segmentation highlights the E-commerce sector as the largest segment, propelled by the surge in online shopping and the demand for rapid, efficient delivery solutions. Retail and Manufacturing sectors contribute significantly, requiring reliable logistics services for supply chain management. The Automotive and Pharmaceuticals sectors are increasingly adopting digital freight solutions to improve operational capabilities and regulatory compliance, while the Food & Beverage industry focuses on last-mile delivery innovations to meet consumer expectations. Integrated logistics platforms are also gaining traction among diverse end-users seeking comprehensive supply chain visibility .

The Netherlands Digital Freight Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Shypple, Quicargo, Uber Freight (Netherlands), Transporeon, Portbase, Flexport, Cargoplot, InstaFreight, Trans.eu, FreightHub (now Forto), DHL Freight, Kuehne + Nagel, C.H. Robinson, Sennder, TimoCom contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Netherlands digital freight platforms market appears promising, driven by technological advancements and evolving consumer expectations. As e-commerce continues to grow, platforms will increasingly leverage artificial intelligence and machine learning to enhance operational efficiency. Additionally, the push for sustainable logistics solutions will likely lead to innovations in green technologies, further shaping the market landscape. Collaboration with local businesses will also play a crucial role in expanding service offerings and improving last-mile delivery capabilities.

| Segment | Sub-Segments |

|---|---|

| By Type | Digital Freight Matching Platforms Digital Freight Forwarding Platforms Freight Exchange Platforms Fleet Management Platforms Last-Mile Delivery Platforms Port Community Systems Integrated Logistics Platforms Others |

| By End-User | Retail Manufacturing E-commerce Automotive Pharmaceuticals Food & Beverage Others |

| By Service Type | Full Truck Load (FTL) Less Than Truck Load (LTL) Intermodal Services Expedited Freight Services Warehousing & Fulfillment Others |

| By Delivery Mode | Standard Delivery Express Delivery Scheduled Delivery Same-Day Delivery Cross-Border Delivery Others |

| By Geographic Coverage | National Coverage Regional Coverage Local Coverage International Coverage Others |

| By Customer Segment | Small and Medium Enterprises (SMEs) Large Enterprises Government Agencies Freight Forwarders & Carriers Others |

| By Pricing Model | Subscription-Based Pay-Per-Use Tiered Pricing Flat Rate Pricing Commission-Based Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Digital Freight Platform Users | 120 | Logistics Coordinators, Freight Managers |

| Technology Providers in Freight | 80 | Product Managers, Software Developers |

| Regulatory Bodies and Associations | 40 | Policy Makers, Industry Analysts |

| End-users of Freight Services | 90 | Supply Chain Directors, Operations Managers |

| Consultants in Logistics and Supply Chain | 60 | Consultants, Market Researchers |

The Netherlands Digital Freight Platforms Market is valued at approximately USD 1.1 billion, reflecting a significant growth driven by the expansion of e-commerce and the adoption of advanced logistics technologies.