Region:Europe

Author(s):Shubham

Product Code:KRAB5083

Pages:98

Published On:October 2025

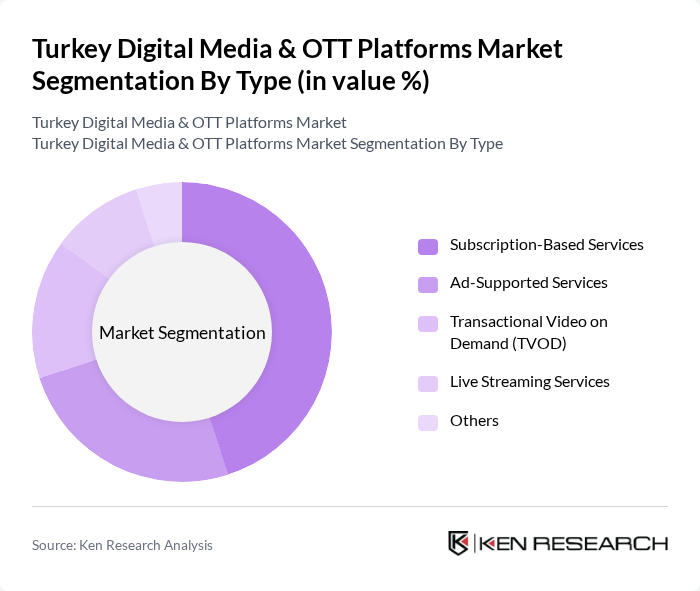

By Type:The market can be segmented into various types, including Subscription-Based Services, Ad-Supported Services, Transactional Video on Demand (TVOD), Live Streaming Services, and Others. Among these, Subscription-Based Services have emerged as the leading segment due to the increasing consumer preference for ad-free viewing experiences and exclusive content offerings.

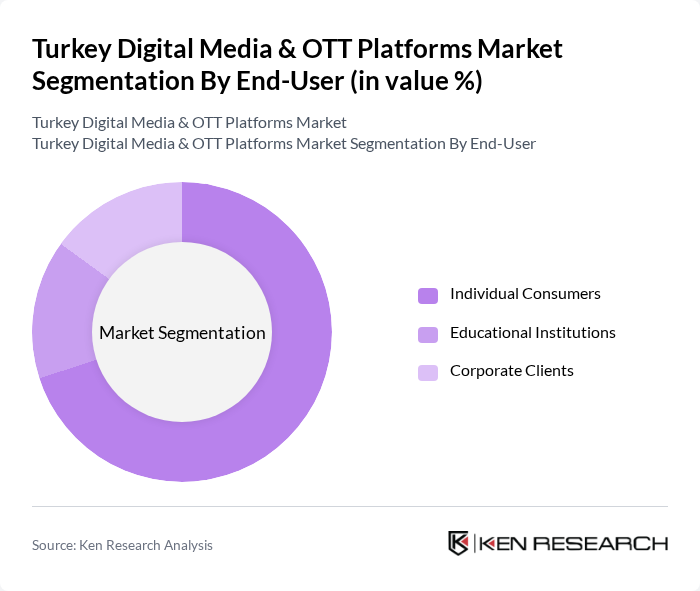

By End-User:The market is segmented by end-users, including Individual Consumers, Educational Institutions, and Corporate Clients. Individual Consumers dominate the market, driven by the increasing trend of binge-watching and the demand for personalized content experiences. The rise of mobile streaming has further fueled this segment's growth.

The Turkey Digital Media & OTT Platforms Market is characterized by a dynamic mix of regional and international players. Leading participants such as Netflix, BluTV, PuhuTV, Tivibu, YouTube, Amazon Prime Video, Disney+, Exxen, Turkcell TV+, D-Smart Go, MUBI, Apple TV+, HBO Max, Paramount+, Filmbox Live contribute to innovation, geographic expansion, and service delivery in this space.

The future of Turkey's digital media and OTT platforms market appears promising, driven by technological advancements and evolving consumer preferences. The expansion of 5G networks is expected to enhance streaming quality and accessibility, while the integration of artificial intelligence in content recommendations will personalize user experiences. Additionally, the increasing popularity of subscription models indicates a shift towards sustainable revenue streams, positioning the market for continued growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Subscription-Based Services Ad-Supported Services Transactional Video on Demand (TVOD) Live Streaming Services Others |

| By End-User | Individual Consumers Educational Institutions Corporate Clients |

| By Content Type | Movies TV Shows Documentaries Sports Others |

| By Distribution Channel | Direct-to-Consumer Third-Party Platforms Mobile Applications |

| By Pricing Model | Monthly Subscription Annual Subscription Pay-Per-View |

| By Region | Marmara Aegean Central Anatolia Eastern Anatolia Southeastern Anatolia |

| By User Demographics | Age Groups Gender Income Levels |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| OTT Platform Subscribers | 150 | Regular Users, Occasional Viewers |

| Content Producers | 100 | Producers, Directors, Scriptwriters |

| Media Analysts | 80 | Market Researchers, Industry Analysts |

| Advertising Agencies | 70 | Media Buyers, Account Managers |

| Regulatory Bodies | 50 | Policy Makers, Compliance Officers |

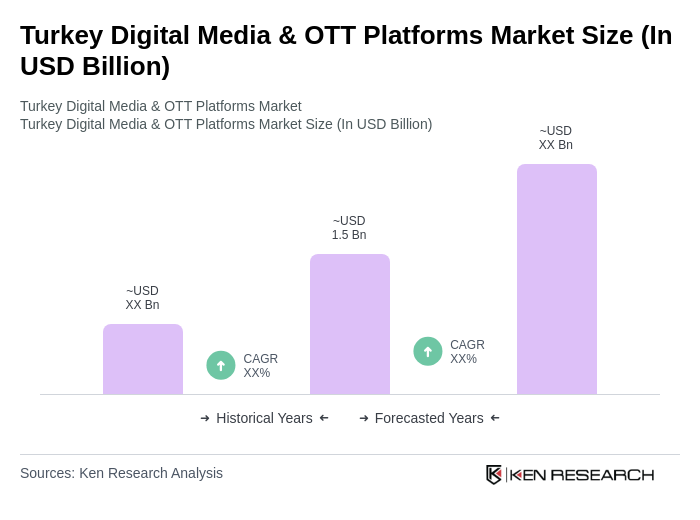

The Turkey Digital Media & OTT Platforms Market is valued at approximately USD 1.5 billion, reflecting significant growth driven by high-speed internet access, smart device proliferation, and increasing consumer demand for on-demand content.