Region:Middle East

Author(s):Rebecca

Product Code:KRAB4127

Pages:84

Published On:October 2025

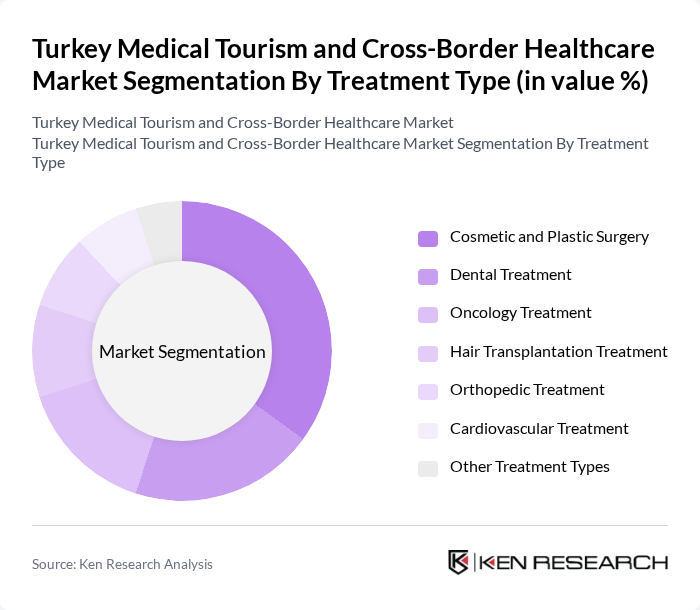

By Treatment Type:The treatment types in this market include various medical services that cater to the needs of international patients. The subsegments are Cosmetic and Plastic Surgery, Dental Treatment, Oncology Treatment, Hair Transplantation Treatment, Orthopedic Treatment, Cardiovascular Treatment, and Other Treatment Types (Gynecology, Bariatric Surgery, Urology, Neurology, Gastroenterology). Among these, Cosmetic and Plastic Surgery is the leading subsegment due to the high demand for aesthetic procedures, driven by social media influence, international patient testimonials, and Turkey’s reputation for advanced techniques and cost-effectiveness .

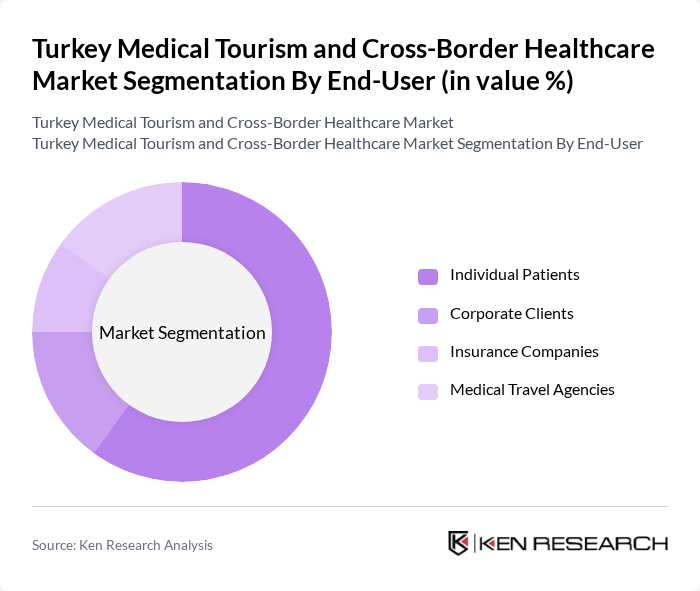

By End-User:The end-users in this market include Individual Patients, Corporate Clients, Insurance Companies, and Medical Travel Agencies. Individual Patients represent the largest segment, as they seek affordable and high-quality medical care abroad. The trend of self-funded medical travel is on the rise, with patients increasingly opting for direct payments to access specialized treatments that may not be available or affordable in their home countries. Corporate clients and insurance companies are also expanding their engagement, particularly for wellness and preventive care packages .

The Turkey Medical Tourism and Cross-Border Healthcare Market is characterized by a dynamic mix of regional and international players. Leading participants such as Acibadem Healthcare Group, Anadolu Medical Center, Medical Park Hospitals Group, Florence Nightingale Hospitals, Liv Hospital, Memorial Health Group, Taksim International Hospital, Istanbul Florence Nightingale Hospital, Turkeyana Clinic, NewMe Health, Remed Health, Euro Health Medical Tourism, ROMOY Health Tourism and Consulting, Doc's Health Tourism Agency, AkayLife contribute to innovation, geographic expansion, and service delivery in this space.

The future of Turkey's medical tourism sector appears promising, driven by increasing global demand for affordable and high-quality healthcare. As the country enhances its healthcare infrastructure and embraces technological advancements, it is likely to attract a growing number of international patients. Additionally, the integration of telemedicine and wellness tourism initiatives will further diversify the offerings, making Turkey a more appealing destination for medical travelers seeking comprehensive care solutions in future.

| Segment | Sub-Segments |

|---|---|

| By Treatment Type | Cosmetic and Plastic Surgery Dental Treatment Oncology Treatment Hair Transplantation Treatment Orthopedic Treatment Cardiovascular Treatment Other Treatment Types (Gynecology, Bariatric Surgery, Urology, Neurology, Gastroenterology) |

| By End-User | Individual Patients Corporate Clients Insurance Companies Medical Travel Agencies |

| By Service Provider | Private Hospitals Clinics Medical Tourism Facilitators Rehabilitation Centers |

| By Destination | Istanbul Antalya Ankara Izmir |

| By Payment Method | Out-of-Pocket Payments Insurance Coverage Financing Options |

| By Duration of Stay | Short-term Visits Long-term Stays |

| By Age Group | Children Adults Seniors |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Medical Tourists from Europe | 100 | Patients who traveled for elective surgeries and treatments |

| Healthcare Providers in Turkey | 80 | Hospital Administrators, Medical Directors |

| Insurance Companies Offering Coverage for Medical Tourism | 60 | Insurance Underwriters, Policy Managers |

| Travel Agencies Specializing in Medical Tourism | 50 | Travel Agents, Business Development Managers |

| Healthcare Consultants in Medical Tourism | 40 | Consultants, Market Analysts |

The Turkey Medical Tourism and Cross-Border Healthcare Market is valued at approximately USD 1.9 billion, driven by high-quality healthcare services, competitive pricing, and a diverse range of treatment options for international patients.