Turkey Nutrition and Dietary Supplements Market Overview

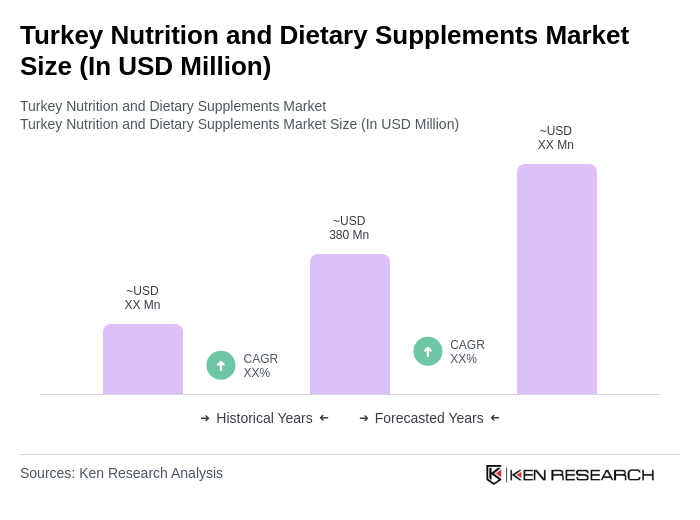

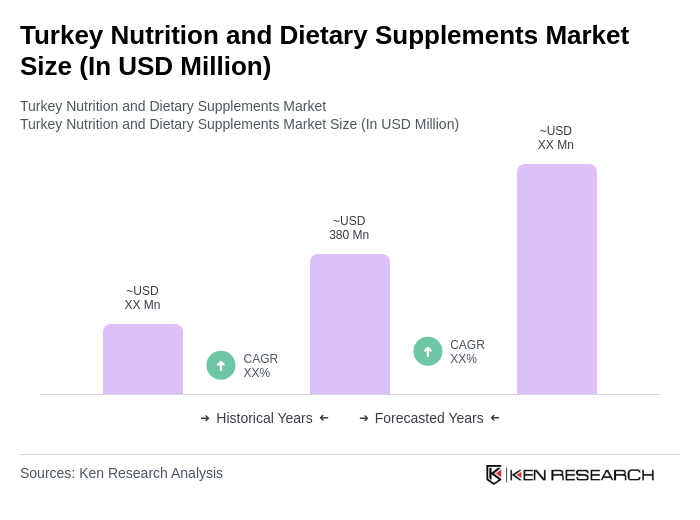

- The Turkey Nutrition and Dietary Supplements Market is valued at USD 380 million, based on a five-year historical analysis. This growth is primarily driven by increasing health awareness among consumers, a rise in lifestyle-related health issues, and a growing trend towards preventive healthcare. The market has seen a significant uptick in demand for dietary supplements, particularly vitamins and minerals, as consumers seek to enhance their overall well-being.

- The Marmara Region, particularly Istanbul, dominates the Turkey Nutrition and Dietary Supplements Market, accounting for the largest market share. Istanbul leads due to its large population and concentration of health-conscious consumers with higher disposable incomes, while other major urban centers follow closely with their growing populations and increasing purchasing power. The urbanization trend and economic dominance of the Marmara Region has contributed significantly to the rising demand for dietary supplements.

- The Turkish Food Codex Regulation on Food Supplements, issued by the Ministry of Agriculture and Forestry in 2013, mandates that all dietary supplements must undergo rigorous safety and efficacy testing before being marketed. This regulation establishes comprehensive requirements for product registration, labeling standards, health claims substantiation, and manufacturing quality controls, with mandatory compliance for all supplement manufacturers and importers operating in Turkey.

Turkey Nutrition and Dietary Supplements Market Segmentation

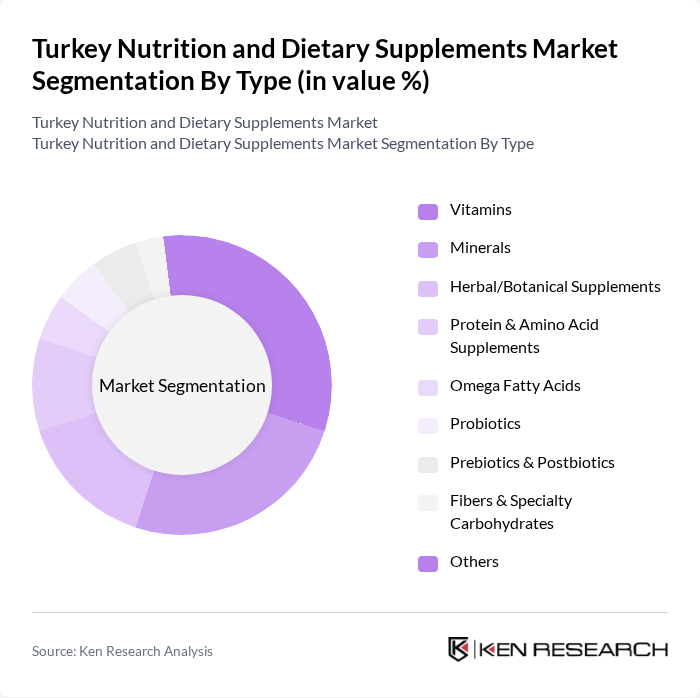

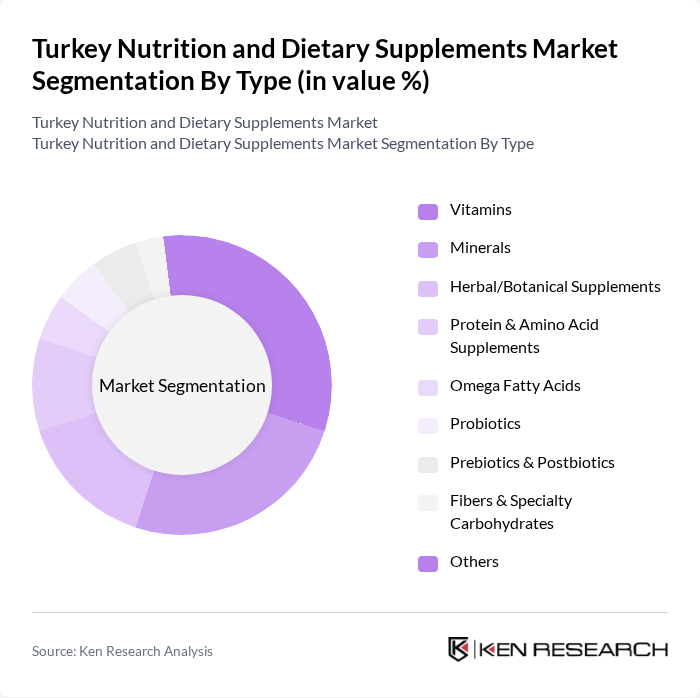

By Type:The market is segmented into various types of dietary supplements, including vitamins, botanicals, minerals, protein & amino acid supplements, omega fatty acids, probiotics, prebiotics & postbiotics, fibers & specialty carbohydrates, and others. Among these, vitamins and botanicals are the most popular due to their essential role in maintaining health and preventing deficiencies. The increasing awareness of the benefits of these supplements, particularly herbal and natural alternatives, has led to a surge in consumer demand driven by preferences for plant-based wellness solutions.

By End-User:The end-user segmentation includes infants, children, adults, pregnant women, geriatric (elderly), athletes, and others. Adults represent the largest segment, driven by a growing focus on health and wellness, as well as the increasing prevalence of lifestyle diseases. The demand for dietary supplements among adults is further fueled by the rising trend of self-medication and preventive healthcare, with particular emphasis on immunity support, digestive health, joint health, and overall vitality following increased health consciousness post-pandemic.

Turkey Nutrition and Dietary Supplements Market Competitive Landscape

The Turkey Nutrition and Dietary Supplements Market is characterized by a dynamic mix of regional and international players. Leading participants such as Abdi ?brahim Pharmaceuticals, Orzaks ?laç ve Kimya Sanayi, Zade Ya?lar?, Pharmanatura, Amway Turkey, Herbalife Nutrition Turkey, GNC Turkey, Solgar Turkey, Eczac?ba??, Y?ld?z Holding, Nature's Supreme, Voonka, New Life, Nutraxin, TakviyeEdiciGida.com contribute to innovation, geographic expansion, and service delivery in this space.

Turkey Nutrition and Dietary Supplements Market Industry Analysis

Growth Drivers

- Increasing Health Awareness:The Turkish population is becoming increasingly health-conscious, with 65% of adults actively seeking dietary supplements to enhance their well-being. This trend is supported by a rise in health-related social media content, with over 75% of users engaging with health and wellness topics online. The Turkish government has also initiated campaigns promoting healthy lifestyles, contributing to a projected increase in supplement consumption, which is expected to reach 1.6 million tons in future.

- Rising Demand for Preventive Healthcare:Preventive healthcare is gaining traction in Turkey, with healthcare expenditure projected to reach $55 billion in future. This shift is driven by an aging population, with approximately 13% of the population over 65 years old, leading to increased demand for supplements that support immune health and chronic disease prevention. Consequently, the dietary supplement market is expected to see a significant uptick in products aimed at preventive health solutions, with a focus on vitamins and minerals.

- Growth of E-commerce Platforms:E-commerce in Turkey is projected to grow by 30% annually, reaching $39 billion in future. This growth is facilitating easier access to dietary supplements, particularly among younger consumers who prefer online shopping. Major platforms like Hepsiburada and Trendyol are expanding their health and wellness categories, which is expected to increase the availability of diverse supplement options, thereby driving market growth and consumer engagement in the nutrition sector.

Market Challenges

- Stringent Regulatory Framework:The Turkish Food Codex imposes strict regulations on dietary supplements, requiring compliance with safety and efficacy standards. In future, the Turkish Ministry of Health is expected to increase inspections by 25%, which may challenge smaller brands that struggle to meet these regulations. This regulatory environment can hinder market entry and innovation, particularly for new players aiming to introduce novel products in the competitive landscape.

- Consumer Skepticism Towards Supplements:Despite the growing market, consumer skepticism remains a significant challenge, with 45% of Turkish consumers expressing doubts about the efficacy of dietary supplements. This skepticism is fueled by misinformation and a lack of understanding of product benefits. To combat this, brands must invest in educational marketing strategies to build trust and credibility, which may require substantial financial resources and time to change consumer perceptions effectively.

Turkey Nutrition and Dietary Supplements Market Future Outlook

The Turkey Nutrition and Dietary Supplements Market is poised for significant transformation, driven by evolving consumer preferences and technological advancements. As health awareness continues to rise, the demand for innovative, science-backed products will likely increase. Additionally, the integration of digital platforms for personalized nutrition solutions is expected to reshape consumer engagement. Companies that adapt to these trends and invest in research and development will be well-positioned to capture market share and meet the diverse needs of health-conscious consumers in Turkey.

Market Opportunities

- Growth in Organic and Natural Products:The demand for organic and natural dietary supplements is on the rise, with the market expected to grow by 20% annually. This trend is driven by consumer preferences for clean-label products, with 75% of consumers willing to pay a premium for organic certifications. Companies can capitalize on this opportunity by developing products that align with these values, enhancing brand loyalty and market penetration.

- Increasing Investment in R&D:Investment in research and development is projected to increase by 35% in the next five years, focusing on innovative formulations and delivery methods. This investment will enable companies to create targeted supplements that address specific health concerns, such as gut health and mental wellness. By prioritizing R&D, brands can differentiate themselves in a crowded market and meet the evolving demands of health-conscious consumers.