Region:Middle East

Author(s):Shubham

Product Code:KRAE0337

Pages:81

Published On:December 2025

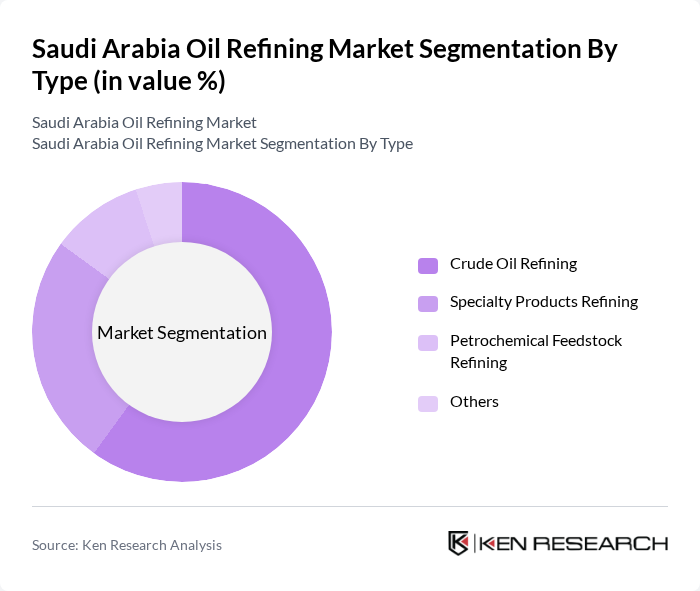

By Type:The segmentation by type includes various refining processes that cater to different market needs. Crude oil refining is the most significant segment, as it forms the backbone of the refining industry, converting raw crude into usable products. Specialty products refining is gaining traction due to the increasing demand for high-value products. Petrochemical feedstock refining is also crucial, as it supports the growing petrochemical industry, which is vital for economic diversification.

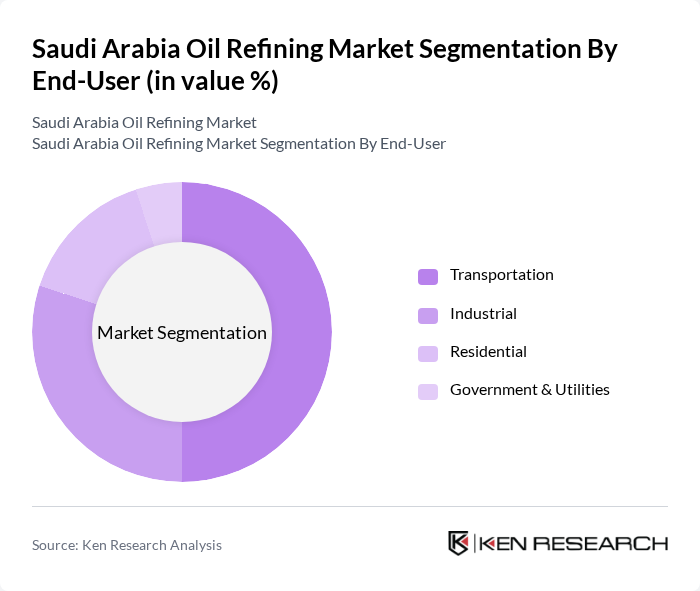

By End-User:The end-user segmentation highlights the primary consumers of refined products. The transportation sector is the largest consumer, driven by the high demand for gasoline and diesel fuels. The industrial sector follows closely, utilizing refined products for manufacturing processes. Residential usage is also significant, particularly for heating and cooking, while government and utilities represent a smaller but essential segment, focusing on energy supply and infrastructure development.

The Saudi Arabia Oil Refining Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Aramco, SABIC, Petro Rabigh, Yanbu National Petrochemicals Company (Yansab), Jazan Integrated Gas Project, Saudi International Petrochemical Company (Sipchem), National Petrochemical Company (NPC), Alujain Corporation, Tasnee, Gulf Oil and Gas, Arabian Oil Company, Al-Fanar Company, Al-Mansoori Specialized Engineering, Al-Jubail Petrochemical Company (KEMYA), Saudi Kayan Petrochemical Company contribute to innovation, geographic expansion, and service delivery in this space.

The Saudi oil refining market is poised for transformation as it embraces cleaner technologies and sustainability initiatives. In the future, the integration of digital solutions is expected to enhance operational efficiency, while investments in renewable energy will reshape the energy landscape. The focus on specialty products will cater to evolving consumer preferences, driving innovation. As the government continues to support diversification efforts, the refining sector will likely adapt, ensuring resilience against market fluctuations and environmental challenges.

| Segment | Sub-Segments |

|---|---|

| By Type | Crude Oil Refining Specialty Products Refining Petrochemical Feedstock Refining Others |

| By End-User | Transportation Industrial Residential Government & Utilities |

| By Product Type | Gasoline Diesel Jet Fuel Others |

| By Refining Complexity | Simple Refineries Complex Refineries Integrated Refineries Others |

| By Capacity | Small Scale Refineries Medium Scale Refineries Large Scale Refineries Others |

| By Geographic Distribution | Eastern Province Western Province Central Province Others |

| By Policy Support | Subsidies Tax Exemptions Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Refinery Operations | 100 | Refinery Managers, Operations Directors |

| Supply Chain Management | 80 | Supply Chain Managers, Logistics Coordinators |

| Regulatory Compliance | 60 | Compliance Officers, Environmental Managers |

| Market Trends Analysis | 75 | Market Analysts, Industry Consultants |

| Investment and Financing | 50 | Financial Analysts, Investment Managers |

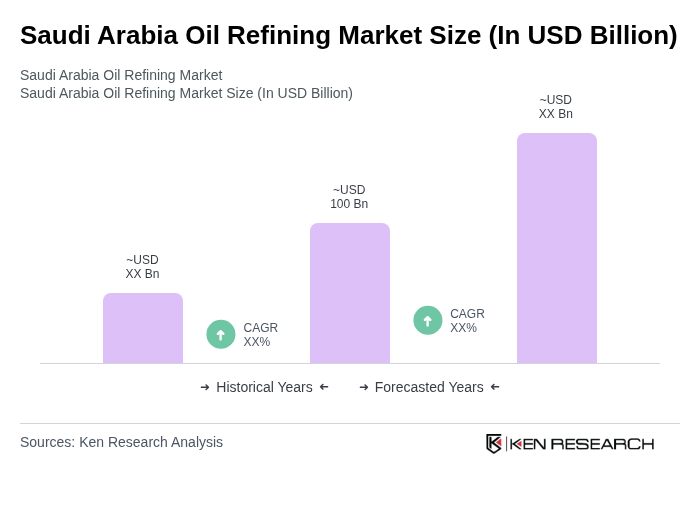

The Saudi Arabia Oil Refining Market is valued at approximately USD 100 billion, driven by the country's extensive oil reserves and increasing domestic demand for refined products, alongside government initiatives aimed at economic diversification.