Turkey Online Classifieds & Market Overview

- The Turkey Online Classifieds & Market is valued at USD 1.2 billion, based on a five-year historical analysis. This growth is primarily driven by the increasing penetration of the internet and smartphones, as well as a pronounced shift in consumer behavior toward digital-first shopping and selling experiences. The convenience of accessing a broad spectrum of products and services through online platforms, coupled with the proliferation of user-friendly mobile apps, has significantly accelerated market expansion. Enhanced digital connectivity and the widespread adoption of mobile devices have made these platforms accessible to a wider demographic, including users in both urban and rural areas .

- Istanbul, Ankara, and Izmir remain the dominant cities in the Turkey Online Classifieds & Market. Istanbul, as the largest city and commercial center, hosts a high concentration of users and businesses, making it a focal point for online transactions. Ankara, the capital, has a rapidly growing tech-savvy population, while Izmir leverages its strategic economic position and vibrant local economy to contribute significantly to market activity. These urban centers benefit from higher internet penetration rates and greater digital literacy, reinforcing their leadership in the online classifieds ecosystem .

- The Regulation on Distance Contracts (Mesafeli Sözle?meler Yönetmeli?i), issued by the Ministry of Trade in 2022, governs online transactions in Turkey. This regulation mandates enhanced consumer protection measures, including mandatory seller verification, clear disclosure of product and service information, and the right of withdrawal for consumers. The regulation also stipulates stricter guidelines on advertising practices and requires platforms to implement transparent dispute resolution mechanisms, thereby fostering a safer and more trustworthy online marketplace environment .

Turkey Online Classifieds & Market Segmentation

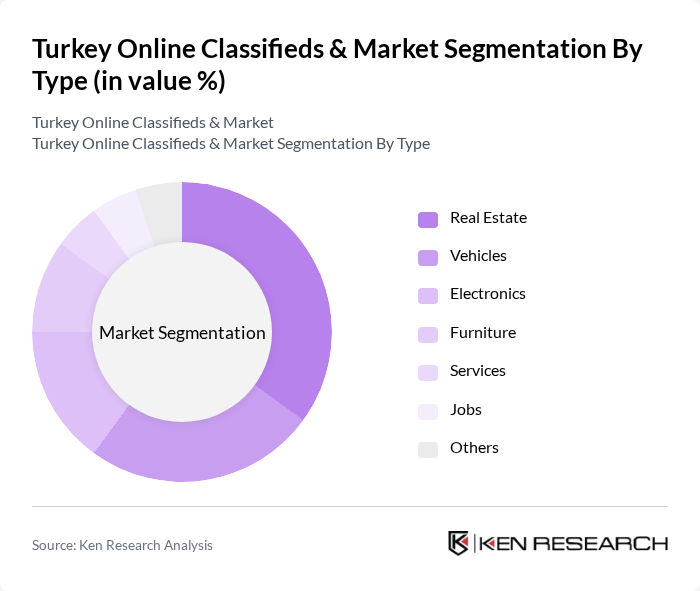

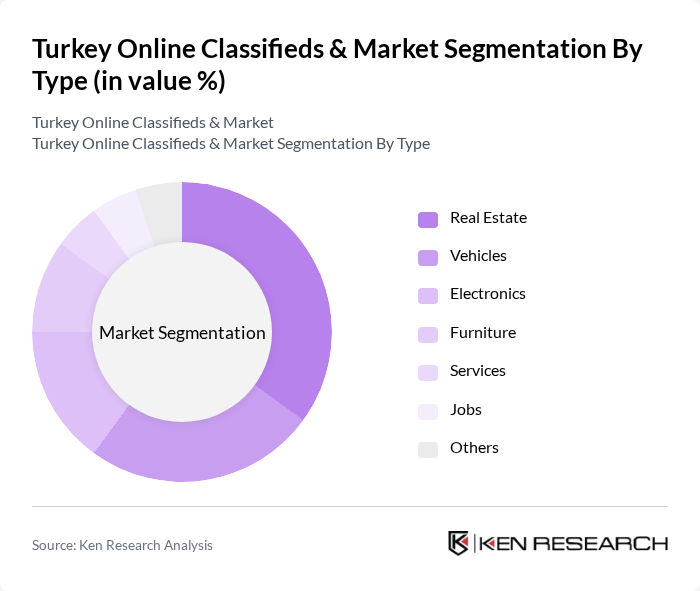

By Type:The market is segmented into Real Estate, Vehicles, Electronics, Furniture, Clothing, Services, and Others.Real EstateandVehiclesare the leading segments, driven by sustained demand for property and vehicle transactions in urban centers. The increasing reliance on digital channels for major purchases, coupled with the convenience of detailed listings and virtual tours, has reinforced the dominance of these segments. TheElectronicsandFurnituresegments are also experiencing robust growth, as consumers increasingly prefer online channels for purchasing high-value and lifestyle products. The rise of integrated payment solutions and enhanced delivery logistics further supports this trend .

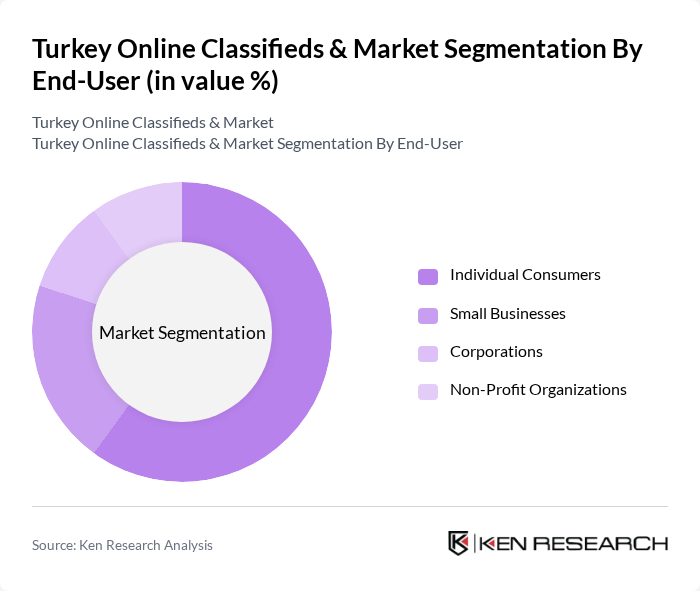

By End-User:The market is segmented into Individual Consumers, Small Businesses, and Corporates.Individual Consumersare the primary users, utilizing online classifieds for buying and selling goods and services, reflecting the peer-to-peer nature of these platforms.Small Businessesleverage classifieds to reach targeted local audiences and promote their offerings cost-effectively.Corporatesincreasingly use these platforms for recruitment, B2B transactions, and specialized services, reflecting the growing professionalization and diversification of online classifieds usage .

Turkey Online Classifieds & Market Competitive Landscape

The Turkey Online Classifieds & Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sahibinden.com, Letgo, GittiGidiyor, N11.com, Hepsiburada, Trendyol, Araba.com, Emlakjet, Zingat, Hürriyet Emlak, VavaCars, Modanisa, Çiçeksepeti, Pazarama, Toptan.com contribute to innovation, geographic expansion, and service delivery in this space.

Turkey Online Classifieds & Market Industry Analysis

Growth Drivers

- Increasing Internet Penetration:Turkey's internet penetration rate reached 85% in future, with over 72 million users accessing online platforms. This growth is driven by affordable mobile data plans and government initiatives to enhance digital infrastructure. The Turkish Statistical Institute reported that the number of internet users increased by approximately 4 million in the most recent period, indicating a strong trend towards online engagement, which directly benefits online classifieds and marketplaces.

- Rise of Mobile Commerce:Mobile commerce in Turkey is projected to account for over 50% of total e-commerce sales in future, reflecting a significant shift towards mobile platforms. The number of smartphone users is expected to exceed 65 million, facilitating easier access to online classifieds. According to the Turkish Informatics Industry Association, mobile transactions grew by approximately 30% year-on-year, highlighting the increasing reliance on mobile devices for purchasing second-hand goods and services.

- Growing Urbanization:Urbanization in Turkey is accelerating, with over 77% of the population expected to live in urban areas in future. This demographic shift creates a larger market for online classifieds, as urban residents often seek convenient platforms for buying and selling goods. The World Bank reported that urban areas contribute approximately 80% of Turkey's GDP, indicating a robust economic environment that supports the growth of online marketplaces.

Market Challenges

- Intense Competition:The Turkish online classifieds market is highly competitive, with over 50 active platforms vying for market share. Major players like Sahibinden and Letgo dominate, making it challenging for new entrants to establish themselves. According to industry reports, the competition has led to aggressive pricing strategies, which can erode profit margins and make it difficult for smaller platforms to sustain operations in this crowded marketplace.

- Trust and Safety Concerns:Trust issues remain a significant barrier in Turkey's online classifieds sector, with approximately 40% of users expressing concerns about fraud and scams. The Turkish Consumer Protection Agency reported an increase in complaints related to online transactions. This lack of trust can deter potential users from engaging with online platforms, impacting overall market growth and user retention rates.

Turkey Online Classifieds & Market Future Outlook

The future of Turkey's online classifieds market appears promising, driven by technological advancements and changing consumer behaviors. As mobile commerce continues to rise, platforms that prioritize user experience and security will likely thrive. Additionally, the integration of AI and machine learning can enhance personalization, making it easier for users to find relevant listings. With urbanization trends and increasing internet access, the market is poised for significant growth, provided that trust and safety measures are effectively addressed.

Market Opportunities

- Expansion of Niche Markets:There is a growing opportunity for online classifieds to cater to niche markets, such as eco-friendly products and local artisans. With increasing consumer interest in sustainability, platforms that focus on these segments can attract a dedicated user base, potentially increasing transaction volumes and brand loyalty.

- Integration of AI and Machine Learning:The adoption of AI and machine learning technologies can significantly enhance user experience by providing personalized recommendations and improving search functionalities. This technological integration can lead to higher user engagement and satisfaction, ultimately driving sales and increasing the overall market share for online classifieds in Turkey.